Qantas 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

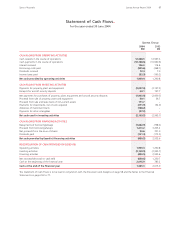

Discussion and Analysis

of the Statement of Cash Flows

for the year ended 30 June 2004

For the purposes of the Statement of Cash Flows, cash includes cash at bank and on hand, bank overdrafts, cash at call, short-term money

market securities and term deposits.

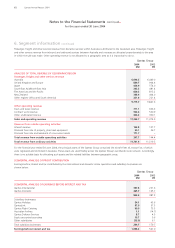

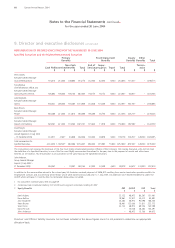

REVIEW OF CASH FLOWS FROM OPERATING ACTIVITIES

Cash flows provided by operations increased by 54.9 per cent to $1,999.4 million primarily due to lower cash payments in the course

of operations resulting from operating expenditure efficiencies and favourable exchange movements.

Income taxes paid were lower in the current year due to a refund received from the Australian Taxation Office relating to prior year

realised foreign exchange losses on the hedging of aircraft acquisitions and the impact of accelerated tax depreciation on new aircraft.

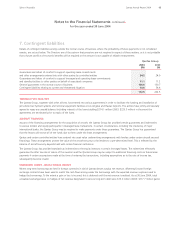

REVIEW OF CASH FLOWS FROM INVESTING ACTIVITIES

Cash flows used in investing activities decreased by $826.2 million to $2,169.5 million.

Total capital expenditure of $2,007.0 million for the year predominantly related to the acquisition of aircraft under the aircraft fleet

plan, aircraft progress payments, reconfigurations, product investment, engine modifications and spares.

Payments for investments made during the year of $271.9 million mainly comprised the investments in Star Track Express Holdings

Pty Limited, AVBA Pte Ltd and Jet Turbine Services Pty Limited.

Proceeds from the sale and leaseback of non-current assets of $171.7 million relates to the sale and subsequent leaseback of

two B747-400 aircraft.

Advances of investment loans of $128.2 million relate to a loan advanced to Star Track Express Holdings Pty Limited as part of

the acquisition of 50 per cent of the share capital of that company.

Payments for other intangibles of $47.3 million relate to the purchase of additional landing slots at London Heathrow Airport.

REVIEW OF CASH FLOWS FROM FINANCING ACTIVITIES

Cash flows provided by/(used in) financing activities decreased by $3,416.1 million to $(480.5) million.

Repayments of borrowings/swaps of $1,822.9 million comprised repayments of short-term borrowings, swaps, loans and leases.

Proceeds from borrowings/swaps of $1,413.2 million included secured loans required to purchase new aircraft under the fleet plan.

Proceeds from the issue of shares of $90.6 million reflected the proceeds received from the underwriting of the October 2003 dividend.

Dividend payments of $161.4 million represent total dividends paid and is net of $146.5 million which was converted directly to shares

via the Dividend Reinvestment Plan.

Qantas held cash of $1,365 million and had access to additional funding of $1,700 million as at 30 June 2004. This comprised a

$700 million standby facility, a $769 million revolving facility under a syndicated loan and $231 million in undrawn secured borrowings

on two A330-300 aircraft delivered and paid for in June 2004.

58 Qantas Annual Report 2004