Qantas 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

for the year ended 30 June 2004

2004 EXECUTIVE REMUNERATION PHILOSOPHY AND OBJECTIVES continued

Performance Share Plan continued

Assessment of the performance of individuals against their specific annual goals and a further assessment of the relative contribution

of Executives, results in a differentiated distribution in the number of deferred shares.

Shares issued under this Plan are purchased on-market and are locked for 10 years. Participants may “call” for the shares prior to the

expiration of the holding lock but not before end of the financial year in relation to half of the shares and the end of the following

financial year in relation to the remaining shares. Any shares still under lock are forfeited on termination.

Performance Rights Plan

The aims of the Performance Rights Plan as the long-term incentive component are to:

align the interests of eligible Executives and shareholders;

provide targeted but competitive remuneration and a long-term incentive for the retention of key Executives; and

support a culture of employee share ownership.

As a retention tool, the program is specifically targeted to Senior Executives in key roles or identified as high potential developing Executives.

Rights issued under this Plan are subject to a performance hurdle, being Total Shareholder Return (TSR) in comparison to a basket of global

airline companies and the largest 100 Australian listed public companies. The TSR will be tested three years after the rights are granted,

and re-tested at regular intervals over the subsequent two years.

Incentive Plan Operation

Under all of the Executive Incentive Plans operating within Qantas, the Chief Executive Officer may recommend changes to the Board,

which has discretion to amend the operation of the plan as appropriate given changes in business circumstances. Any such changes would

be disclosed in the relevant Annual Report.

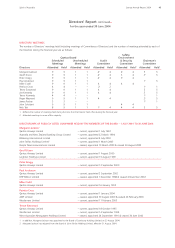

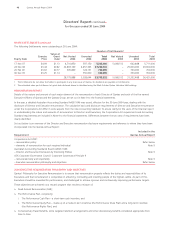

Total Reward Mix

Consistent with market practice, the proportion of Remuneration attributable to each component of the Performance Plan is dependent

on the level of seniority of the Executive. For the Executives detailed in the Directors Remuneration disclosure note, the total reward mix

is as follows:

% of Total Reward Opportunity (at target)

FAR Performance Cash Plan Performance Equity Plan

%%%

Chief Executive Officer 50 30 20

Chief Financial Officer 55 25 20

Executive General Managers 65 20 15

Other Executives depending on level of seniority 70 to 90 5 to 15 5 to 15

For those Executives eligible to participate in the Performance Rights Plan, the Performance Equity Plan at target is split 50:50 between

the Performance Share Plan and the Performance Rights Plan.

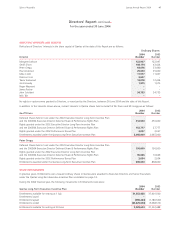

Concessionary Travel Entitlements, Service Payments and Retention Arrangements

Travel entitlements are provided to all Executives within Qantas, consistent with practice in the airline industry. Travel at concessionary

prices, is on a sub-load (standby) basis, i.e. subject to considerable restrictions and limits on availability and includes specified direct family

members or parties. There is also a post retirement element of this benefit for all staff who qualify through retirement or redundancy.

In addition to this and consistent with practice in the airline industry, a small number of Senior Executives are entitled to a number of

free trips, for personal purposes and includes specified direct family members or parties. The value of these entitlements is accrued over

the expected service of the individual. Eligibility for new participants is now restricted to members of the Qantas Executive Committee.

The primary elements of retention within Qantas are the provision of appropriate development opportunities for high performing

Executives and the recognition of performance on an ongoing basis through the remuneration programs detailed above. In addition, it is

occasionally appropriate to establish specific milestone reward programs which link agreed performance outcomes to an opportunity for

award either in the form of cash, or by way of special allocations under the Performance Share Plan or Performance Rights Plan.

For Executives appointed to Executive General Manager, fixed term contracts of up to five years are agreed on appointment as a further

element of retention. A limited number of these are eligible for a payment on termination provided they have completed five years service.

Continuous Improvement

Qantas continually reviews all elements of its Executive Remuneration Philosophy and Objectives to ensure that they are appropriate from

the perspectives of governance, disclosure and reward.

50 Qantas Annual Report 2004