Qantas 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Qantas Annual Report 2004 59Spirit of Australia

Notes to the Financial Statements

for the year ended 30 June 2004

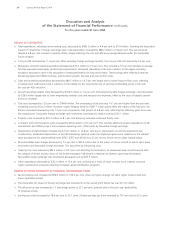

1. Basis of preparation of the Concise Financial Report

The Concise Financial Report has been prepared in accordance with the Corporations Act 2001, Australian Accounting Standard AASB

1039 “Concise Financial Reports” and applicable Urgent Issues Group Consensus Views. The Financial Statements and specific disclosures

required by AASB 1039 have been derived from the Qantas Group’s full Financial Report for the financial year. Other information included

in the Concise Financial Report is consistent with the Qantas Group’s full Financial Report. The Concise Financial Report does not, and

cannot be expected to, provide as full an understanding of the financial performance, financial position and financing and investing

activities of the Qantas Group as the full Financial Report.

This Report has been prepared on the basis of historical costs and, except where stated, does not take into account changing money

values or fair values of assets.

These accounting policies have been consistently applied by each entity in the Qantas Group, being Qantas Airways Limited (Qantas) and

its controlled entities and are consistent with those of the previous year.

A full description of the accounting policies adopted by the Qantas Group may be found in the Qantas Group’s full Financial Report for

the financial year.

Where necessary, comparative information has been reclassified to achieve consistency in disclosure with current financial year amounts

and other disclosures.

TAX CONSOLIDATION

As a consequence of the Income Tax Consolidation legislation, Qantas, as the head entity in the tax-consolidated group comprising all

the Australian wholly-owned entities in the Qantas Group, is expected to enter into the tax consolidation regime from 1 July 2003.

Qantas has applied Urgent Issues Group Abstract UIG 52 “Income Tax Accounting under the Tax Consolidation System” in preparing

this Report. The tax-consolidated group has entered into a tax sharing arrangement with wholly-owned subsidiaries. In doing so,

subsidiary-related current and deferred tax balances have been determined based on the existing timing differences at the

tax-consolidated group level.

Qantas is currently obtaining market valuations in support of its transition into the tax consolidation regime and intends to request

a Private Binding Ruling from the Australian Taxation Office in relation to key aspects of the transition. As such, no amount has been

recognised in the Financial Statements for the year ended 30 June 2004 for any adjustment to current and deferred tax balances that

may arise as a consequence of implementing tax consolidation.

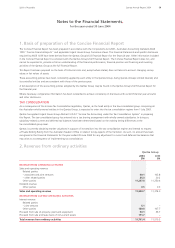

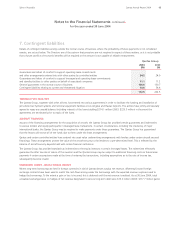

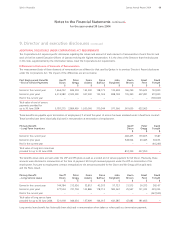

2. Revenue from ordinary activities

Qantas Group

2004 2003

$M $M

REVENUE FROM OPERATING ACTIVITIES

Sales and operating revenue

Related parties

– associates and joint ventures 90.1 103.8

– other related parties 25.3 20.2

Other parties 11,237.8 11,250.6

Dividend revenue

Other parties 0.5 0.3

Sales and operating revenue 11,353.7 11,374.9

REVENUE FROM OUTSIDE OPERATING ACTIVITIES

Interest revenue

Related parties

– joint ventures 5.1 –

Other parties 120.8 107.7

Proceeds from sale of property, plant and equipment 50.1 36.7

Proceeds from sale and lease back of non-current assets 171.7 –

Total revenue from ordinary activities 11,701.4 11,519.3