Qantas 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Financial Statements continued

for the year ended 30 June 2004

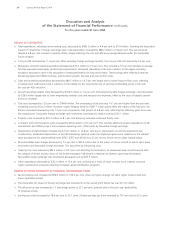

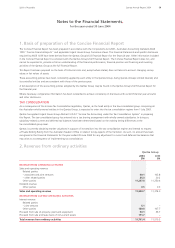

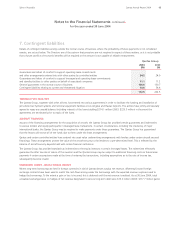

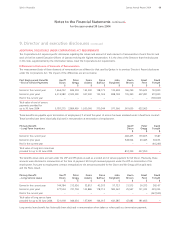

7. Contingent liabilities

Details of contingent liabilities arising outside the normal course of business, where the probability of future payments is not considered

remote, are set out below. The Directors are of the opinion that provisions are not required in respect of these matters, as it is not probable

that a future sacrifice of economic benefits will be required or the amount is not capable of reliable measurement.

Qantas Group

2004 2003

$M $M

Guarantees and letters of comfort to support operating lease commitments

and other arrangements entered into with other parties by controlled entities 24.2 24.0

Guarantees and letters of comfort to support leveraged and operating lease commitments

and standby facilities to other parties on behalf of associated companies 11.1 11.2

General guarantees in the normal course of business 126.6 130.7

Contingent liabilities relating to current and threatened litigation 10.6 56.6

172.5 222.5

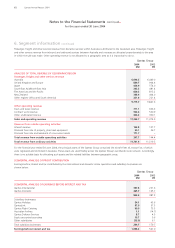

TERMINAL FUEL FACILITIES

The Qantas Group, together with other airlines, has entered into various agreements in order to facilitate the funding and installation of

jet turbine fuel hydrant systems and terminal equipment facilities at Los Angeles and Hawaii Airports. The airlines have jointly and severally

agreed to repay any unpaid balance (including interest) of the loans totalling $214.1 million (2003: $225.3 million) in the event the

agreements are terminated prior to expiry of the loans.

AIRCRAFT FINANCING

As part of the financing arrangements for the acquisition of aircraft, the Qantas Group has provided certain guarantees and indemnities

to various lenders and equity participants in leveraged lease transactions. In certain circumstances, including the insolvency of major

international banks, the Qantas Group may be required to make payments under these guarantees. The Qantas Group has guaranteed

that the lessors will receive all of the funds due to them under the lease arrangements.

Qantas and certain controlled entities have entered into asset value underwriting arrangements with lenders under certain aircraft secured

financings. These arrangements protect the value of the aircraft security to the lenders to a pre-determined level. This is reflected by the

balance of aircraft security deposits held with certain financial institutions.

The Qantas Group has provided standard tax indemnities to the equity investors in certain leveraged leases. The indemnities effectively

guarantee the after tax rate of return of the investors and the Qantas Group may be subject to additional financing costs on future lease

payments if certain assumptions made at the time of entering the transactions, including assumptions as to the rate of income tax,

subsequently become invalid.

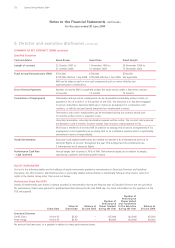

UNREALISED LOSSES – BACK-TO-BACK HEDGES

Where long-term borrowings are held in foreign currencies in which Qantas derives surplus net revenue, offsetting forward foreign

exchange contracts have been used to match the cash flows arising under the borrowings with the expected revenue surpluses used to

hedge the borrowings. To the extent a gain or loss is incurred, this is deferred until the net revenue is realised. As at 30 June 2004, total

unrealised exchange losses on hedges of net revenue designated to service long-term debt were $19.2 million (2003: $117.7 million gains).

Qantas Annual Report 2004 63Spirit of Australia