Qantas 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

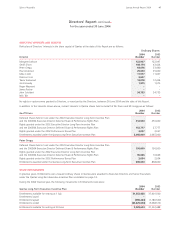

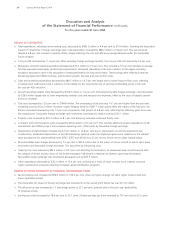

Discussion and Analysis

of the Statement of Financial Position

as at 30 June 2004

The net assets of the Qantas Group increased by 11.0 per cent to $5,840.3 million during the financial year. The major movements are

discussed below.

REVIEW OF ASSETS

Current receivables decreased by 26.2 per cent due to a decrease in short-term money market securities resulting from repayment

of borrowings during the year, partially offset by an increase in trade and sundry debtors resulting from stronger trading conditions

in June 2004 compared to the prior year.

Non-current receivables increased by 72.6 per cent due to a loan advanced to Star Track Express Holdings Pty Limited as part of the

acquisition of 50 per cent of the share capital of that company.

Investments accounted for using the equity method increased by $271.4 million due mainly to the acquisitions of Star Track Express

Holdings Pty Limited, AVBA Pte Ltd and Jet Turbine Services Pty Limited during the year.

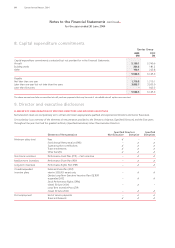

Property, plant and equipment increased by 7.2 per cent due to aircraft acquisitions under the aircraft fleet plan (15 aircraft entered

service during the financial year). Significant investment was also made in airline product and aircraft reconfigurations.

REVIEW OF LIABILITIES

Interest-bearing liabilities decreased by 7.2 per cent to $5,903.7 million due mainly to repayment of borrowings during the year,

partially offset by new borrowings to fund fleet acquisitions.

Provisions reduced by $76.7 million or 9.7 per cent primarily due to the payment of redundancies provided for at 30 June 2003.

Revenue received in advance increased by 28.9 per cent to $1,493.3 million, reflecting stronger trading conditions in June 2004

compared to the prior year.

REVIEW OF EQUITY

Contributed equity increased by $237.0 million due to the issue of 71.0 million shares as part of the Dividend Reinvestment Plan.

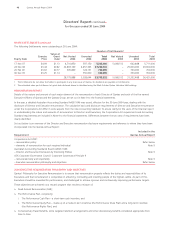

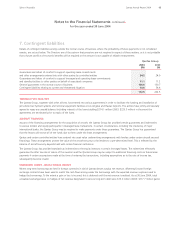

GEARING

Qantas Group gearing (including the notional capitalisation of non-cancellable operating leases) on a hedged basis at 30 June 2004

was 49:51 compared to 50:50 at 31 December 2003 and 51:49 at 30 June 2003. The decrease in gearing was principally a result of

the profit earned during the year, partially offset by capital investment in product and fleet.

Gearing is determined by dividing the book value of the Qantas Group’s net debt (short and long-term plus the present value of

non-cancellable operating leases less related hedge receivables and cash and cash equivalents) by the same amount plus the book

value of total equity.

56 Qantas Annual Report 2004