Porsche 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PFS Group continued its international expansion

in financial year 2015 with the formation of a

financial services subsidiary in South Korea.

In addition to the core products of leasing and

financing, the extensive product range includes

insurance products, the Porsche Card and dealer

financing. Under the brand names Bentley Financial

Services and Lamborghini Financial Services,

exclusive financial services are offered in relation

to the Group’s Bentley and Lamborghini brands,

including in Germany, Italy, Switzerland, France,

Russia, Singapore, the Middle East, the United

States and Canada. In addition, individual solutions

are developed for Bugatti customers. Demand

for financial services remained strong in financial

year 2015, with over 54,000 new agreements

signed around the world. The financial services

companies manage more than 114,000 leases

and financing agreements with a volume of just

over 4.4 billion euro. In addition, over 14,000

customers appreciate the comfort and exclusive

services offered by the Porsche Card and

approximately 20,000 customers have taken

advantage of the insurance offerings of the

Porsche Insurance Service. The companies of the

Porsche Financial Services Group have adapted

their processes and methods – including for risk

management – in their respective markets to

ensure compliance with the ever stricter statutory

requirements imposed on financial services.

Outlook

Further Growth Possible

The global economy is expected to see somewhat

stronger growth in 2016 than in the previous

year due to the anticipated economic recovery

inthe majority of industrialised nations. As was

the case in the previous year, however, growth

looks set to remain sluggish in a large number of

emerging economies. Western Europe’s economic

upturn should continue in 2016. The German

economy is showing signs of slightly higher growth

rates than in the reporting period. Provided that

there is no escalation in the conflict between

Russia and Ukraine, the situation in Eastern Europe

could stabilise.

Signs of robust growth continue to be observed

in North America. That said, the south of the

continent paints a different picture: Brazil will

probably see negative growth continue in 2016.

Economic growth is expected to remain high

inChina, although this will continue to lose

momentum as against the previous years. The

economic situation in Japan is expected to

seeonly a slight improvement.

Dampened Automotive Markets

Developments in the passenger car markets

inthe individual regions could be mixed in

2016. Overall, global demand for new vehicles

is expected to grow at a somewhat slower rate

than in the reporting period. Western Europe is

showing signs of a slight year-on-year decrease

in demand at the very least. In the German

sales market, too, volumes are expected to fall

just short of the prior-year figure after positive

growth in the past year. Spain and Italy are

expected to see the recovery continue at a

moderate pace. Demand for passenger cars in

Russia is likely to decrease further, despite

thesubstantial declines already seen in recent

years. In the United States, the market for

passenger cars and light commercial vehicles

could continue to benefit from the favourable

conditions in 2016, and the positive trend

observed in the prior-year period could continue

at a weakened pace. However, volumes in the

South American markets are expected to be

substantially below the prior-year figures in 2016.

Somewhat weaker momentum is becoming

apparent in the passenger car markets in the

Asia-Pacific region.

Anticipated Developments

Porsche AG will endeavour to further increase

new vehicle deliveries and revenue in financial

year 2016 as compared to the year under

review. This will primarily be driven by Porsche’s

attractive product range, which is reflected

inthe robust order situation. Although invest-

ments in vehicle projects and the expansion

and renewal of sites are high, continuous pro-

ductivity and process improvements and strict

cost management are intended to ensure that

Porsche AG’s high earnings objective continues

to be achieve

d.

---------------------------------------------------------------------------------------------------------------------------------------------------------

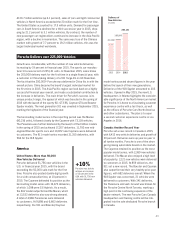

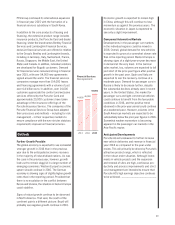

20152013 2014

54,000

44,000 46,000

Financial Services

New Agreements

49