Porsche 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

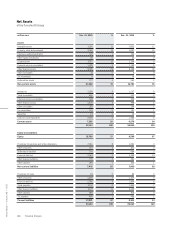

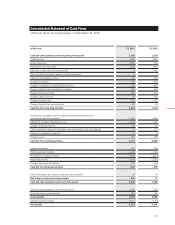

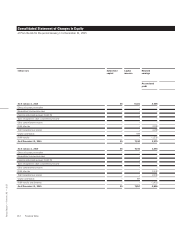

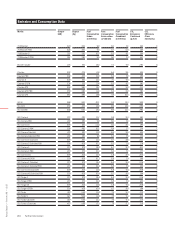

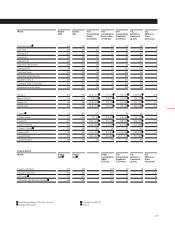

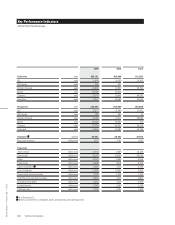

Consolidated Statement of Cash Flows

of Porsche AG for the period January 1 to December 31, 2015

million euro FY 2015 FY 2014

Cash and cash equivalents at the beginning of the period 1,560 1,570

Prot before tax 3,382 3,060

Income taxes paid – 1,148 – 784

Depreciation and amortization 2,124 1,878

Gain / loss on disposal of non-current assets 5– 281

Share of prots and losses of equity-accounted investments 3 1

Other non-cash expense / income 312 254

Change in inventories – 220 – 460

Change in receivables (excluding nancial services) – 542 – 586

Change in liabilities (excluding nancial liabilities) 602 608

Change in pension provisions 208 164

Change in other provisions 63 195

Change in leased assets – 827 – 775

Change in nancial services receivables – 119 – 95

Cash ow from operating activities 3,843 3,179

Investments in intangible assets (excluding capitalised development costs),

and property, plant and equipment – 1,388 – 1,047

Additions to capitalised development costs – 1,039 – 1,067

Change in equity investments – 26 – 50

Cash received from disposal of intangible assets and property, plant and equipment 77 170

Change in investments in securities – 4 14

Change in loans 261 – 268

Cash ow from investing activities – 2,119 – 2,248

Capital contributions 707 829

Prot transfer and dividends – 1,232 – 1,414

Proceeds from issuance of bonds 2,536 2,473

Repayment of bonds – 2,343 – 2,228

Change in other nancial liabilities – 506 – 638

Cash ow from financing activities – 838 – 978

Eect of exchange rate changes on cash and cash equivalents 39 – 47

Net change in cash and cash equivalents 886 37

Cash and cash equivalents at the end of the period 2,485 1,560

Cash and cash equivalents at the end of the period 2,485 1,560

Securities, loans and time deposits 267 526

Gross liquidity 2,752 2,086

Total third-party borrowings – 5,317 – 5,353

Net liquidity – 2,566 – 3,267

131