Porsche 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

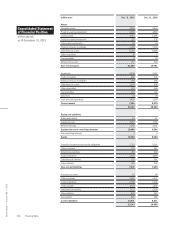

Deferred tax assets amounted to 727 million euro

compared with 562 million euro in the prior year.

As a percentage of total assets, current assets

amount to 26 percent compared to 24 percent

inthe prior year. Inventories increased from

2,157 million euro in the prior year to 2,509 million

euro at the end of the reporting period. In com-

parison to the prior reporting date, there was

anincrease of approximately 5,400 units in new

vehicle inventories.

Non-current and current financial services

receiv ables rose from 1,696 million euro to

1,887 million euro. These items mainly contain

receivables from finance leases and receivables

from customer and dealer financing.

Current other financial assets increased slightly

by 42 million euro to 1,000 million euro. The

decrease in current derivative financial instru-

ments was countered by a slightly higher balance

on the clearing account with Porsche Holding

Stuttgart GmbH.

Cash and cash equivalents increased significantly

year on year, climbing by 925 million euro to

2,485 million euro.

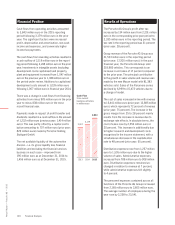

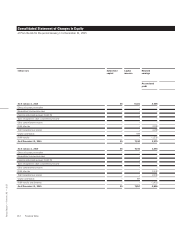

The equity of the Porsche AG Group increased

by1,101 million euro to 10,700 million euro

compared with the prior-year reporting date. The

profit after tax, profit transfer and dividends of

430 million euro together with currency translation

differences, revaluations from pension plans and

acapital contribution by Porsche Holding Stuttgart

GmbH amounting to 707 million euro generated

increases in equity. By contrast, the changes

inthe cash flow hedge reserve in the amount of

307 million euro after tax represented reductions

in equity.

Non-current liabilities mainly relate to financial

liabilities, pension provisions, deferred tax

liabilities, other financial liabilities and other

provisions. They declined by 478 million euro

to7,472 million euro in comparison with the

prior year. Non-current liabilities expressed as

a percentage of total capital decreased from

30 percent in the prior year to 26 percent at the

end of the financial year. At the same time, non-

current financial liabilities fell by 920 million

euro. This decrease primarily reflects the change

in the remaining maturity of a bond in the amount

of 1,000 million euro classified as non-current

in the prior year.

Provisions for pensions and similar obligations

remained unchanged as against the prior year,

at 2,361 million euro.

Non-current other financial liabilities recorded

growth of 395 million euro. The increase mainly

relates to marking derivative financial instru-

ments to market.

Current liabilities increased significantly from

8,511 million euro to 10,971 million euro. Current

liabilities expressed as a percentage of total

capital rose from 33 percent in the prior year to

37 percent as of December 31, 2015. Current

financial liabilities grew by 884 million euro. This

increase primarily reflects the change in the

maturity of a bond in the amount of 1,000 million

euro.

Deferred tax liabilities amounted to 749 million

euro compared with 684 million euro in the

prior year.

Trade payables increased to 2,214 million euro

after 1,856 million euro in the previous year.

This increase is attributable to higher volumes

of investments and business.

Current other financial liabilities amounted to

3,127 million euro (prior year: 2,058 million

euro). The increase mainly relates to marking

derivative financial instruments to market.

125