Mondelez 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Mondelez annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We seek to maintain, extend and expand our brand image through marketing investments, including advertising and consumer

promotions, and product innovation. Continuing global focus on health and wellness, including weight management, and increasing

attention from the media, shareholders, consumers, activists and other stakeholders on the role of food marketing could adversely

affect our brand image. It could also lead to stricter regulations and increased focus on food and snacking marketing practices.

Increased legal or regulatory restrictions on our advertising, consumer promotions and marketing, or our response to those

restrictions, could limit our efforts to maintain, extend and expand our brands. Moreover, adverse publicity about regulatory or legal

action against us, product quality and safety, or environmental and human rights risks in our supply chain could damage our

reputation and brand image, undermine our customers’ confidence and reduce demand for our products, even if the regulatory or

legal action is unfounded or these matters are immaterial to our operations.

In addition, our success in maintaining, extending and expanding our brand image depends on our ability to adapt to a rapidly

changing marketing and media environment, including our increasing reliance on social media and online dissemination of

marketing and advertising campaigns. We are subject to a variety of legal and regulatory restrictions on how and to whom we

market our products. These restrictions may limit our ability to maintain, extend and expand our brand image, particularly as social

media and the communications environment continue to evolve. Negative posts or comments about us on social networking web

sites (whether factual or not) or security breaches related to use of our social media and failure to respond effectively to these

posts, comments or activities could seriously damage our reputation and brand image across the various regions in which we

operate. In addition, we might fail to invest sufficiently in maintaining, extending and expanding our brand image. As a result, we

might be required to recognize impairment charges on our intangible assets or goodwill. If we do not successfully maintain, extend

and expand our reputation and brand image, then our brands, product sales, financial condition and results of operations could be

materially and adversely affected.

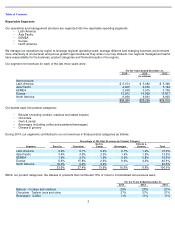

We are subject to risks from operating globally.

We are a global company and generated 82.1% of our 2014 net revenues, 83.1% of our 2013 net revenues and 82.9% of our 2012

net revenues outside the United States. We manufacture and market our products in approximately 165 countries and have

operations in more than 80 countries, so we are subject to risks inherent in multinational operations. Those risks include:

In addition, political and economic changes or volatility, geopolitical regional conflicts, terrorist activity, political unrest, civil strife,

acts of war, public corruption, expropriation and other economic or political uncertainties could interrupt and negatively affect our

business operations or customer demand. The slowdown in economic growth or high unemployment in some emerging markets

could constrain consumer spending, and declining consumer purchasing power could adversely impact our profitability. Continued

instability in the banking and governmental sectors of certain countries in the European Union or the dynamics associated with the

federal and state debt and budget challenges in the United States could adversely affect us. All of these factors could result in

increased costs or decreased revenues, and could materially and adversely affect our product sales, financial condition and results

of operations.

10

• compliance with U.S. laws affecting operations outside of the United States, including anti-bribery laws such as the

Foreign Corrupt Practices Act (“FCPA”);

• compliance with antitrust and competition laws, data privacy laws, and a variety of other local, national and multi-

national

regulations and laws in multiple regimes;

• changes in tax laws, interpretation of tax laws and tax audit outcomes;

• currency devaluations or fluctuations in currency values, including in developing markets such as Venezuela, Argentina

and Russia as well as in developed markets such as countries within the European Union;

• changes in capital controls, including currency exchange controls, government currency policies or other limits on our

ability to import raw materials or finished product or repatriate cash from outside the United States;

•

discriminatory or conflicting fiscal policies;

•

increased sovereign risk, such as default by or deterioration in the economies and credit ratings of governments;

• changes in local regulations and laws, the uncertainty of enforcement of remedies in foreign jurisdictions, and foreign

ownership restrictions and the potential for nationalization or expropriation of property or other resources;

•

varying abilities to enforce intellectual property and contractual rights;

• greater risk of uncollectible accounts and longer collection cycles;

• design, implementation and use of effective control environment processes across our diverse operations and employee

base; and

• the imposition of increased or new tariffs, quotas, trade barriers or similar restrictions on our sales or regulations, taxes

or policies that might negatively affect our sales.