Mondelez 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Mondelez annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MONDELEZ INTERNATIONAL, INC.

FORM 10-K

(Annual Report)

Filed 02/20/15 for the Period Ending 12/31/14

Address THREE PARKWAY NORTH

DEERFIELD, IL 60015

Telephone 847-943-4000

CIK 0001103982

Symbol MDLZ

SIC Code 2000 - Food and kindred products

Industry Food Processing

Sector Consumer/Non-Cyclical

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2015, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

MONDELEZ INTERNATIONAL, INC. FORM 10-K (Annual Report) Filed 02/20/15 for the Period Ending 12/31/14 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year THREE PARKWAY NORTH DEERFIELD, IL 60015 847-943-4000 0001103982 MDLZ 2000 - Food and kindred products Food Processing Consumer/Non-... -

Page 2

... telephone number, including area code: 847-943-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, no par value The NASDAQ Global Select Market Floating Rate Notes due 2015 New York Stock Exchange LLC... -

Page 3

... December 31, 2014, 2013 and 2012 Notes to Consolidated Financial Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership... -

Page 4

... to statements about: our future performance, including our future revenue growth and margins; our strategy, including our goals to deliver top-tier financial performance and be a great place to work; price volatility and pricing actions; the cost environment and measures to address increased costs... -

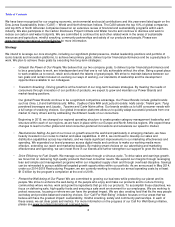

Page 5

... global presence, market leadership positions and portfolio of iconic brands and innovation platforms, to achieve two primary goals: deliver top-tier financial performance and be a great place to work. We plan to achieve these goals by executing five long-term strategies: • Unleash the Power... -

Page 6

...beverages) Cheese & grocery During 2014, our segments contributed to our net revenues in these product categories as follows: Percentage of 2014 Net Revenues by Product Category Gum & Cheese & Chocolate Candy Beverages Grocery Segment Biscuits Total Latin America Asia Pacific EEMEA Europe North... -

Page 7

... pre-tax earnings as well as other information on our segments, see Note 17, Segment Reporting . Our segment operating income for each of the last three years was: For the Years Ended December 31, 2014 2013 2012 (in millions) Segment operating income: Latin America Asia Pacific EEMEA Europe North... -

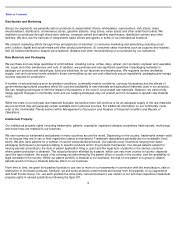

Page 8

... retail food outlets. We distribute our products through direct store delivery, company-owned and satellite warehouses, distribution centers and other facilities. We also use the services of independent sales offices and agents in some of our international locations. We conduct marketing efforts... -

Page 9

... in research and development: product safety and quality, growth through new products, superior consumer satisfaction and reduced costs. At December 31, 2014, we had approximately 2,650 food scientists, chemists and engineers working primarily in 11 key technology centers: East Hanover, New Jersey... -

Page 10

... and Chief Growth Officer and Executive Vice President and President, North America Executive Vice President and President, Asia Pacific and EEMEA Executive Vice President and President, EEMEA Executive Vice President, Human Resources Executive Vice President, Integrated Supply Chain Executive Vice... -

Page 11

... a financial services provider. Mr. Myers became Executive Vice President, Integrated Supply Chain in September 2011. Prior to that, he worked for Procter & Gamble, a consumer products company, for 33 years in a variety of leadership positions, most recently serving as Vice President, Product Supply... -

Page 12

..., advertising and new product innovation to protect or increase market share. These expenditures might not result in trade and consumer acceptance of our efforts. If we reduce prices or our costs increase but we cannot increase sales volumes to offset those changes, then our financial condition and... -

Page 13

... brands, product sales, financial condition and results of operations could be materially and adversely affected. We are subject to risks from operating globally. We are a global company and generated 82.1% of our 2014 net revenues, 83.1% of our 2013 net revenues and 82.9% of our 2012 net revenues... -

Page 14

... their production capacities. Our success in emerging markets is critical to our growth strategy. If we cannot successfully increase our business in emerging markets and manage associated political, economic and regulatory risks, our product sales, financial condition and results of operations could... -

Page 15

... pricing, increased promotional programs, longer payment terms or specifically tailored products. In addition, larger retail customers have the scale to develop supply chains that permit them to operate with reduced inventories or to develop and market their own retailer and other economy brands... -

Page 16

... customers will continue to purchase our products in the same mix or quantities or on the same terms as in the past, particularly as increasingly powerful retailers continue to demand lower pricing and develop their own brands. The loss of or disruptions related to significant customers, such as the... -

Page 17

..., product sales, financial condition and results of operations. Failure to maintain effective internal control over financial reporting could adversely affect us, and we have not maintained effective internal controls over our accounting for income taxes. The accuracy of our financial reporting... -

Page 18

... material weakness, we may not timely or accurately report our financial condition or results of operations. This could adversely affect our stock price and the confidence of investors, business partners and others in our financial reports. We are increasingly dependent on information technology. We... -

Page 19

...plan funding, cause volatility in the net periodic pension cost and increase our future funding requirements. Legislative and other governmental regulatory actions may also increase funding requirements for our pension plans' benefits obligation. Volatility in the global capital markets may increase... -

Page 20

... our plants and other facilities in good condition. We believe we have or will add sufficient capacity to meet our planned operating needs. As of December 31, 2014 Number of Number of Manufacturing Distribution Facilities Facilities Latin America Asia Pacific EEMEA Europe North America Total Owned... -

Page 21

... Kraft Foods Group, Inc. shares distributed in the SpinOff). The vertical line below indicates the October 1, 2012 Spin-Off date and is intended to facilitate comparisons of performance against peers listed below and the stock market before and following the Spin-Off. Date MondelÄ"z International... -

Page 22

... and extended the expiration date to December 31, 2016. On December 3, 2013, our Board of Directors approved an increase of $1.7 billion to the program related to a new accelerated share repurchase program, which concluded in May 2014. See Note 13, Capital Stock , for additional information. 19 -

Page 23

... Note 13, Capital Stock , for additional information on our share repurchase program in 2014 and 2013. (5) Per Share and Other Data includes Kraft Foods Group, Inc. data for periods prior to the October 1, 2012 Spin-Off date. Refer to Note 2, Divestitures and Acquisitions , related to the resolution... -

Page 24

...the Company We manufacture and market primarily snack food and beverage products, including biscuits (cookies, crackers and salted snacks), chocolate, gum & candy, coffee & powdered beverages and various cheese & grocery products. We have operations in more than 80 countries and sell our products in... -

Page 25

... we use or monitor include product quality measures, category growth, market share performance, pricing net of commodity costs, net commodity inflation, volume growth, Power Brand Organic Net Revenue growth, gross and net productivity savings, brand support and related investments, capital spending... -

Page 26

... work on various programs to expand our profitability and margins, such as our 2014-2018 Restructuring Program designed to bring about significant reductions in our operating cost structure in both our supply chain and overhead costs. Currency - As a global company with over 80% of our net revenues... -

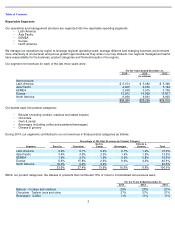

Page 27

... International table for the per share impacts of these items. See Note 2014 For the Years Ended December 31, 2013 2012 (in millions of U.S. dollars) Planned coffee business transactions: Incremental costs for readying the businesses Unrealized gain on currency hedge 2014-2018 Restructuring Program... -

Page 28

... business in South Africa and a chocolate business in Spain. The accounting calendar change made in Europe in 2013 resulted in a year-overyear decrease in net revenues of $38 million. The acquisition of a biscuit operation in Morocco on February 22, 2013 added $14 million in incremental net revenues... -

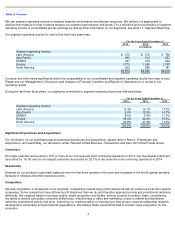

Page 29

...Spin-Off Costs 2012-2014 Restructuring Program costs Integration Program and other acquisition integration costs Benefit from indemnification resolution Remeasurement of net monetary assets in Venezuela Gains on acquisition and divestitures, net Operating income from divestitures Acquisition-related... -

Page 30

... Program costs, value-added tax ("VAT")-related settlements in 2014, lower Spin-Off Costs, 2013 business divestitures and a gain on a sale of property in 2014. Items that increased selling, general and administrative expenses included a 2013 benefit received related to the resolution of a Cadbury... -

Page 31

... December 31, 2013 Discontinued operations Diluted EPS Attributable to MondelÄ"z International from Continuing Operations for the Year Ended December 31, 2013 Spin-Off Costs (2) 2012-2014 Restructuring Program costs (3) Integration Program and other acquisition integration costs (4) Net benefit from... -

Page 32

...our 2012-2014 Restructuring Program. (4) Refer to Note 7, Integration Program and Cost Savings Initiatives , for information on our Cadbury acquisition integration program and Note 2, Divestitures and Acquisitions , for other integration charges associated with our acquisition of a biscuit operation... -

Page 33

... except Asia Pacific. Higher net pricing in Latin America, primarily related to Venezuela, Argentina and Brazil, and in North America was partially offset by lower net pricing in Europe, Asia Pacific and EEMEA, primarily due to lower coffee prices. Unfavorable currency decreased net revenues by... -

Page 34

...estimated annual benefit plan expense associated with certain benefit plan obligations transferred to Kraft Foods Group, Inc. in the Spin-Off. Favorable volume/mix was driven primarily by volume gains across all segments except Asia Pacific. Higher net pricing in Latin America and North America was... -

Page 35

... in 2013. The increase in operating income margin was driven primarily by lower Spin-Off Costs and the benefit from the resolution of the Cadbury acquisition-related indemnification, partially offset by higher costs for the 2012-2014 Restructuring Program, lower Integration Program costs, a negative... -

Page 36

... Adjusted EPS (1) for the Year Ended December 31, 2013 Spin-Off Costs (2) 2012-2014 Restructuring Program costs (3) Integration Program and other acquisition integration costs (4) Loss on debt extinguishment and related expenses (11) Net benefit from indemnification resolution (12) Remeasurement of... -

Page 37

... the estimated annual benefit plan expense associated with certain benefit plan obligations transferred to Kraft Foods Group, Inc. in the Spin-Off. (7) In 2012, we recorded $52 million of impairment charges related to a trademark on a Japanese chewing gum product within our Asia Pacific segment... -

Page 38

... income taxes: Operating income: Latin America Asia Pacific EEMEA Europe North America Unrealized gains / (losses) on hedging activities General corporate expenses Amortization of intangibles Benefit from indemnification resolution Gains on acquisition and divestitures, net Acquisition-related costs... -

Page 39

... pricing, lower manufacturing costs, the absence of Integration Program costs in 2014, lower other selling, general and administrative expenses (including $84 million related primarily to VAT-related settlements) and lower 20122014 Restructuring Program costs. 2013 compared with 2012: Net revenues... -

Page 40

... charge related to a biscuit trademark, higher 2012-2014 Restructuring Program costs, 2014-2018 Restructuring Program costs and unfavorable currency. These unfavorable items were partially offset by higher net pricing, lower manufacturing costs, lower advertising and consumer promotion costs, the... -

Page 41

...partially offset by higher net pricing, lower manufacturing costs, lower Integration Program and other acquisition integration costs, favorable volume/mix, the impact of 2013 divestitures and lower advertising and consumer promotion costs. 2013 compared with 2012: Net revenues increased $180 million... -

Page 42

... volume mix, higher 2012-2014 Restructuring Program costs, costs associated with the JDE coffee transactions, an intangible asset impairment charge related to a candy trademark and the year-over-year impact from last year's accounting calendar change. 2013 compared with 2012: Net revenues increased... -

Page 43

... net pricing in chocolate. Segment operating income increased $33 million (3.7%), due primarily to lower raw material costs, lower other selling, general and administrative expenses, favorable volume/mix, lower 2012-2014 Restructuring Program costs, lower advertising and consumer promotion costs... -

Page 44

.... This year, for reporting units in our Europe and North America segments, we used a market-based, weighted-average cost of capital of 6.9% to discount the projected cash flows of those operations. For our Latin America, Asia Pacific and EEMEA reporting units, we used a risk-rated discount rate of... -

Page 45

... advertising, marketing, sales incentives and trade promotions. These programs include, but are not limited to, cooperative advertising, in-store displays, consumer promotions, new product introduction fees, discounts, coupons, rebates and volume-based incentives. We expense advertising costs either... -

Page 46

...to fully hedge against commodity cost changes, and our hedging strategies may not protect us from increases in specific raw material costs. We generally also price to protect gross profit dollars. Due to competitive or market conditions, planned trade or promotional incentives, or other factors, our... -

Page 47

... decrease in net cash used in investing activities in 2013 relative to 2012 related to payments made to Kraft Foods Group, Inc. in 2012 in connection with the Spin-Off, partially offset by cash we paid for the acquisition in Morocco and lower proceeds from divestitures in 2013. Capital expenditures... -

Page 48

... delay or discontinue our share repurchase program at any time, without notice. Dividends: We paid dividends of $964 million in 2014, $943 million in 2013 and $2,058 million in 2012. Immediately following the Spin-Off of Kraft Foods Group, Inc. on October 1, 2012, our annual dividend rate changed to... -

Page 49

... that our net pension cost will increase to approximately $321 million in 2015. The increase is primarily due to lower discount rates offset by favorable beginning of the year asset levels and planned contributions. As of December 31, 2014, our total liability for income taxes, including uncertain... -

Page 50

...Ä"z International from continuing operations excluding the impact of Spin-Off Costs, pension costs related to the obligations transferred in the Spin-Off, the 2012-2014 Restructuring Program, the 2014-2018 Restructuring Program, the Integration Program and other acquisition integration costs, the... -

Page 51

... to "net revenues" (the most comparable U.S. GAAP financial measure) were to exclude the impact of currency, divestitures, an accounting calendar change in 2013 and acquisitions. We believe that Organic Net Revenue better reflects the underlying growth from the ongoing activities of our business and... -

Page 52

... transferred in the Spin-Off, 2012-2014 Restructuring Program costs, 2014-2018 Restructuring Program costs, the Integration Program and other acquisition integration costs, the benefit from the Cadbury acquisition-related indemnification resolution, the remeasurement of net monetary assets in... -

Page 53

... transferred in the Spin-Off, 2012-2014 Restructuring Program costs, 2014-2018 Restructuring Program costs, the Integration Program and other acquisition integration costs, the net benefit from the Cadbury acquisition-related indemnification resolution, the residual tax benefit impact from the... -

Page 54

... currency Adjusted EPS Spin-Off Costs Spin-Off pension expense adjustment Spin-Off interest expense adjustment 2012-2014 Restructuring Program Integration Program and other acquisition integration costs Net benefit from indemnification resolution Residual tax benefit associated with Starbucks... -

Page 55

... fixed rate debt based on current and projected market conditions. In addition to using interest rate derivatives to manage future interest payments, earlier this year and in the fourth quarter of 2013, we also retired $5 billion of our long-term debt and issued $6.3 billion of lower borrowing cost... -

Page 56

... movements in interest rates, currency exchange rates and commodity prices. The computation does not represent actual losses in fair value or earnings we will incur, nor does it consider the effect of favorable changes in market rates. We cannot predict actual future movements in market rates and do... -

Page 57

...of America. Also in our opinion, the Company did not maintain, in all material respects, effective internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of... -

Page 58

Table of Contents MondelÄ"z International, Inc. and Subsidiaries Consolidated Statements of Earnings For the Years Ended December 31 (in millions of U.S. dollars, except per share data) 2014 2013 2012 Net revenues Cost of sales Gross profit Selling, general and administrative expenses Asset ... -

Page 59

... International, Inc. and Subsidiaries Consolidated Statements of Comprehensive Earnings For the Years Ended December 31 (in millions of U.S. dollars) 2014 2013 2012 Net earnings Other comprehensive earnings / (losses): Currency translation adjustment: Translation adjustment Tax (expense) / benefit... -

Page 60

...pension costs Accrued postretirement health care costs Other liabilities TOTAL LIABILITIES Commitments and Contingencies (Note 11) EQUITY Common Stock, no par value (5,000,000,000 shares authorized and 1,996,537,778 shares issued at December 31, 2014 and December 31, 2013) Additional paid-in capital... -

Page 61

... Stock Balances at January 1, 2012 Comprehensive earnings / (losses): Net earnings Other comprehensive earnings / (losses), net of income taxes Exercise of stock options and issuance of other stock awards Cash dividends declared ($1.00 per share) Spin-Off of Kraft Foods Group, Inc. Dividends paid... -

Page 62

... BY / (USED IN) INVESTING ACTIVITIES Capital expenditures Acquisition, net of cash received Proceeds from divestitures, net of disbursements Cash received from / (transferred to) Kraft Foods Group related to the Spin-Off Proceeds from sale of property, plant and equipment and other Net cash used in... -

Page 63

... "our"), sells food and beverage products to consumers in approximately 165 countries. Discontinued Operation: On October 1, 2012 (the "Distribution Date"), we completed the spin-off of our former North American grocery business, Kraft Foods Group, Inc. ("Kraft Foods Group"), by distributing 100% of... -

Page 64

... Our Venezuelan operations produce a wide range of biscuit, cheese & grocery, confectionery and beverage products. Based on the currency exchange developments this year, we reviewed our domestic and international sourcing of goods and services and the exchange rates we believe will be applicable. We... -

Page 65

...the economy, the SICAD II exchange rate is expected to be replaced with a new market-based SIMADI rate. We will continue to monitor developments related to this currency structure. At this time, we continue to expect to use the SICAD I rate to remeasure our net monetary assets in Venezuela. A change... -

Page 66

.... This year, for reporting units in our Europe and North America segments, we used a market-based, weightedaverage cost of capital of 6.9% to discount the projected cash flows of those operations. For our Latin America, Asia Pacific and EEMEA reporting units, we used a risk-rated discount rate of... -

Page 67

...to lower-cost, digital media outlets and currency, while we increased our spending on our global Power Brands and maintained working media spending. In 2013, advertising and consumer promotion costs were higher than in 2012. We expense product research and development costs as incurred. Research and... -

Page 68

... rates. We manage derivative market risk by limiting the types of derivative instruments and derivative strategies we use and the degree of market risk that we plan to hedge through the use of derivative instruments. Commodity cash flow hedges - We are exposed to price risk related to forecasted... -

Page 69

...1, 2016 and the standard is not expected to have a material impact on our consolidated financial statements. In May 2014, the FASB issued an ASU on revenue recognition from contracts with customers. The new ASU outlines a new, single comprehensive model for companies to use in accounting for revenue... -

Page 70

... tax purposes. Following the Spin-Off, Kraft Foods Group is an independent public company and we do not beneficially own any shares of Kraft Foods Group common stock. The divested Kraft Foods Group business is presented as a discontinued operation on the consolidated statements of earnings in 2012... -

Page 71

... of workers' compensation liabilities for claims incurred by Kraft Foods Group employees prior to the Spin-Off. In November 2012, we paid Kraft Foods Group $95 million to cash settle the net trade payables and receivables. In March 2013, we collected $55 million from Kraft Foods Group related to the... -

Page 72

... ($1.6 billion net of tax) was recorded in earnings from discontinued operations during the fourth quarter of 2013. Acquisitions, Other Divestitures and Sales of Property: On November 11, 2014, we announced the pending acquisition of a biscuit operation in Vietnam. The biscuit operation will become... -

Page 73

...of earnings within asset impairment and exit costs as follows and arose from restructuring activities further described in Note 6, Restructuring Programs . For the Years Ended December 31, 2014 2013 (in millions) Latin America Asia Pacific EEMEA Europe North America Total non-cash asset write-downs... -

Page 74

...of brand names purchased through our acquisitions of Nabisco Holdings Corp., the Spanish and Portuguese operations of United Biscuits, the global LU biscuit business of Groupe Danone S.A. and Cadbury Limited. Amortizable intangible assets consist primarily of trademarks, customer-related intangibles... -

Page 75

... on a global basis and were recorded within asset impairment and exit costs. We primarily use a relief of royalty valuation method, which utilizes estimates of future sales, growth rates, royalty rates and discount rates in determining a brand's global fair value. During our 2014 intangible asset... -

Page 76

... other manufacturing-related one-time costs. The primary objective of the 2012-2014 Restructuring Program was to ensure that MondelÄ"z International and Kraft Foods Group were each set up to operate efficiently and execute on our respective business strategies upon separation and in the future. Of... -

Page 77

... costs related to the 2012-2014 Restructuring Program within operating income as follows: Latin For the Years Ended December 31, America Asia Pacific EEMEA Europe (in millions) North Corporate America (1) Total 2014 Restructuring Costs Implementation Costs Total 2013 Restructuring Costs... -

Page 78

... the Integration Program charges of $8 million in 2014 related to accruals no longer required. We recorded Integration Program charges of $216 million in 2013 and $185 million in 2012 in cost of sales and selling, general and administrative expenses within our Europe, Asia Pacific, Latin America and... -

Page 79

...unamortized discounts and deferred financing costs in earnings at the time of the debt extinguishment. The loss on extinguishment is included in long-term debt repayments in the 2014 consolidated statement of cash flows. We also recognized $2 million in interest expense related to interest rate cash... -

Page 80

... used to fund the February 2014 tender offer, pay down commercial paper borrowings and for other general corporate purposes. We recorded approximately $18 million of discounts and deferred financing costs, which will be amortized into interest expense over the life of the notes. On December 18, 2013... -

Page 81

... forward contracts associated with the planned coffee business transactions. See Note 11, Commitments and Contingencies, for information on the benefit from the resolution of the Cadbury acquisition-related indemnification. See Note 9, Financial Instruments , on the Spin-Off related financing fees... -

Page 82

... consist of exchange-traded commodity futures and listed options. The fair value of these instruments is determined based on quoted market prices on commodity exchanges. Our exchange-traded derivatives are generally subject to master netting arrangements that permit net settlement of transactions... -

Page 83

..., net of taxes, within accumulated other comprehensive earnings / (losses) included: 2014 For the Years Ended December 31, 2013 (in millions) 2012 Accumulated gain / (loss) at January 1 Transfer of realized (gains) / losses to earnings Unrealized gain / (loss) Discontinued operations Impact of Spin... -

Page 84

... in 2012 within interest and other expense, net related to certain forwardstarting interest rate swaps for which the planned timing of the related forecasted debt was changed in connection with our Spin-Off plans and related debt capitalization plans. We record pre-tax and after-tax (i) gains... -

Page 85

... and Acquisitions-Planned Coffee Business Transactions , for additional information on the monetization of the currency exchange forward contracts in the first quarter of 2015. Hedges of Net Investments in International Operations: After-tax gains / (losses) related to hedges of net investments... -

Page 86

...10. Benefit Plans Pension Plans Obligations and Funded Status: The projected benefit obligations, plan assets and funded status of our pension plans were: U.S. Plans 2014 2013 (in millions) 2014 Non-U.S. Plans 2013 Benefit obligation at January 1 Service cost Interest cost Benefits paid Settlements... -

Page 87

... Restructuring Program and cost saving initiatives and retired employees who elected lump-sum payments resulted in net settlement losses for our U.S. plans of $28 million in 2014, $1 million in 2013, and $113 million in 2012 (2012 includes amounts related to the discontinued operation of Kraft Foods... -

Page 88

... service cost. We used the following weighted-average assumptions to determine our net pension cost: U.S. Plans For the Years Ended December 31, 2014 2013 2012 Non-U.S. Plans For the Years Ended December 31, 2014 2013 2012 Discount rate Expected rate of return on plan assets Rate of compensation... -

Page 89

...investment managers using the net asset value per share of the investment as reported by the money managers of the underlying funds. • Fair value estimates for certain fixed-income securities such as insurance contracts are calculated based on the future stream of benefit payments discounted using... -

Page 90

... increases in Level 3 pension plan investments during 2014 were primarily due to unrealized gains across most of the Level 3 asset categories and net transfers into pooled funds-fixed income securities offset by the effects of currency. The increases in Level 3 pension plan investments during 2013... -

Page 91

... increases and reduction to benefit provisions. Our contributions to other multiemployer pension plans that were not individually significant were $7 million in 2014, $6 million in 2013 and $5 million in 2012. These contributions include contributions related to Kraft Foods Group employees... -

Page 92

...2012. Postretirement Benefit Plans Obligations: Our postretirement health care plans are not funded. The changes in and the amount of the accrued benefit obligation were: As of December 31, 2014 (in millions) 2013 Accrued benefit obligation at January 1 Service cost Interest cost Benefits paid Plan... -

Page 93

... service credit. We used the following weighted-average assumptions to determine our net postretirement cost: U.S. Plans For the Years Ended December 31, 2014 2013 2012 Non-U.S. Plans For the Years Ended December 31, 2014 2013 2012 Discount rate Health care cost trend rate Future Benefit Payments... -

Page 94

... assumed weighted-average ultimate annual turnover rate of 0.3% in 2014 and 2013, assumed compensation cost increases of 4.0% in 2014 and 2013 and assumed benefits as defined in the respective plans. Postemployment costs arising from actions that offer employees benefits in excess of those specified... -

Page 95

... the excise tax benefit is valid and we are contesting the show cause notice through the administrative and judicial process. In April 2013, the staff of the Commodity Futures Trading Commission ("CFTC") advised us and Kraft Foods Group that it was investigating activities related to the trading of... -

Page 96

... stock options at the date of grant is amortized to expense over the vesting period. We recorded compensation expense related to stock options held by our employees of $47 million in 2014, $39 million in 2013 and $39 million in 2012 in our results from continuing operations. The deferred tax benefit... -

Page 97

...stock units at the date of grant is amortized to earnings over the restriction period. We recorded compensation expense related to restricted stock and deferred stock units of $94 million in 2014, $94 million in 2013 and $90 million in 2012 in our results from continuing operations. The deferred tax... -

Page 98

... restricted and deferred stock activity is reflected below: Number of Shares Weighted-Average Fair Value Per Share Weighted-Average Aggregate Fair Value Grant Date Balance at January 1, 2012 LTIP shares granted Annual grant to eligible employees Additional shares issued Total shares granted Vested... -

Page 99

...program. On December 3, 2013, we paid $1.7 billion and received an initial delivery of 44.8 million shares of Common Stock valued at $1.5 billion. We increased treasury stock by $1.5 billion, and the remaining $0.2 billion was recorded against additional paid in capital. In May 2014, the ASR program... -

Page 100

... financial statements were as follows: Location of Gain / (Loss) Recognized in Net Earnings For the Years Ended December 31, 2014 2013 (in millions) Pension and other benefits: Reclassification of losses / (gains) into net earnings: Amortization of experience losses and prior service costs... -

Page 101

...Acquisitions , for information on taxes presented as part of discontinued operations related to the resolution of the Starbucks arbitration and the Spin-Off of Kraft Foods Group. During 2014, we recorded out-of-period adjustments of $31 million net expense that had an immaterial impact on the annual... -

Page 102

...of December 31, 2014 2013 (in millions) Deferred income tax assets: Accrued postretirement and postemployment benefits Accrued pension costs Other employee benefits Accrued expenses Loss carryforwards Other Total deferred income tax assets Valuation allowance Net deferred income tax assets Deferred... -

Page 103

... and discontinued operations were calculated using the following: 2014 For the Years Ended December 31, 2013 (in millions, except per share data) 2012 Earnings from continuing operations Earnings from discontinued operations, net of income taxes Net earnings Noncontrolling interest Net earnings... -

Page 104

... market primarily snack food and beverage products, including biscuits (cookies, crackers and salted snacks), chocolate, gum & candy, coffee & powdered beverages and various cheese & grocery products. We manage our global business and report operating results through geographic units. Our operations... -

Page 105

... income taxes: Operating income: Latin America Asia Pacific EEMEA Europe North America Unrealized gains / (losses) on hedging activities General corporate expenses Amortization of intangibles Benefit from indemnification resolution Gains on acquisition and divestitures, net Acquisition-related costs... -

Page 106

...property, plant and equipment, prepaid pension assets and derivative financial instrument balances. For the Years Ended December 31, 2013 (in millions) 2014 2012 Depreciation expense: Latin America Asia Pacific EEMEA Europe North America Total - continuing operations Discontinued operations Total... -

Page 107

...2013 and 2012 product category net revenues below on a consistent basis. Net revenues by product category were: For the Year Ended December 31, 2014 Latin America Asia Pacific EEMEA Europe (in millions) North America Total Biscuits Chocolate Gum & Candy Beverages Cheese & Grocery Total net revenues... -

Page 108

... Net revenues Gross profit (Benefit) / provision for income taxes (1) Net earnings Noncontrolling interest Net earnings attributable to MondelÄ"z International Weighted-average shares for basic EPS Plus incremental shares from assumed conversions of stock options and long-term incentive plan shares... -

Page 109

... Contents 2013 Quarters Second Third (in millions, except per share data) First Fourth Net revenues Gross profit Provision / (benefit) for income taxes Earnings from continuing operations Earnings from discontinued operations, net of income taxes Net earnings Noncontrolling interest Net earnings... -

Page 110

Table of Contents During 2014 and 2013, we recorded the following pre-tax charges / (gains) in earnings from continuing operations: 2014 Quarters First Second (in millions) Third Fourth Asset impairment and exit costs Unrealized (gain) / loss on planned coffee business transactions currency hedge ... -

Page 111

...due to a continued material weakness in our internal control over financial reporting related to the accounting for income taxes, our disclosure controls and procedures were not effective as of December 31, 2014. In light of this material weakness, prior to filing this Annual Report on Form 10-K, we... -

Page 112

... tax accounting constituted a material weakness. PricewaterhouseCoopers LLP, an independent registered public accounting firm, has audited the effectiveness of our internal control over financial reporting as of December 31, 2014, as stated in their report that appears herein. February 20, 2015... -

Page 113

...Compensation Committee Report for the Year Ended December 31, 2014" in our 2015 Proxy Statement. All of this information is incorporated by reference into this Annual Report. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. The number of shares... -

Page 114

... 31, 2014 and 2013 Consolidated Statements of Equity for the Years Ended December 31, 2014, 2013 and 2012 Consolidated Statements of Cash Flows for the Years Ended December 31, 2014, 2013 and 2012 Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm on... -

Page 115

...'s Annual Report on Form 10-K filed with the SEC on February 25, 2013).* Master Ownership and License Agreement Regarding Patents, Trade Secrets and Related Intellectual Property, among Kraft Foods Global Brands LLC, Kraft Foods Group Brands LLC, Kraft Foods UK Ltd. and Kraft Foods R&D Inc., dated... -

Page 116

...the Registrant's Annual Report on Form 10-K filed with the SEC on February 25, 2013).+ MondelÄ"z International, Inc. Change in Control Plan for Key Executives, amended as of February 4, 2015.+ MondelÄ"z Global LLC Executive Deferred Compensation Plan, effective as of October 1, 2012 (incorporated by... -

Page 117

... and Irene B. Rosenfeld, effective as of December 19, 2012 (incorporated by reference to Exhibit 10.22 to the Registrant's Annual Report on Form 10-K filed with the SEC on February 25, 2013).+ Offer of Employment Letter, between the Registrant and Daniel P. Myers, dated June 20, 2011 (incorporated... -

Page 118

... the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. MONDELÄ'Z INTERNATIONAL, INC. By: /s/ BRIAN T. GLADDEN (Brian T. Gladden Executive Vice President and Chief Financial Officer) Date: February 20, 2015 Pursuant to the requirements of... -

Page 119

... REGISTERED PUBLIC ACCOUNTING FIRM ON FINANCIAL STATEMENT SCHEDULE To the Board of Directors and Shareholders of MondelÄ"z International, Inc.: Our audits of the consolidated financial statements and of the effectiveness of internal control over financial reporting referred to in our report dated... -

Page 120

... (b) 2014: Allowance for trade receivables Allowance for other current receivables Allowance for long-term receivables Allowance for deferred taxes 2013: Allowance for trade receivables Allowance for other current receivables Allowance for long-term receivables Allowance for deferred taxes 2012... -

Page 121

... PERFORMANCE INCENTIVE PLAN (Amended and Restated as of May 21, 2014) RESTRICTED STOCK AGREEMENT FOR MONDELÄ'Z INTERNATIONAL COMMON STOCK MONDELÄ'Z INTERNATIONAL, INC., a Virginia corporation (the " Company "), hereby grants to the employee (the " Employee ") named in the award statement provided to... -

Page 122

... this purpose (on the Employee's behalf and at the Employee's direction pursuant to this authorization) to sell the Restricted Shares to meet the Tax-Related Items withholding obligation and any theoretical taxes, except to the extent that such a sale would violate any U.S. federal securities law or... -

Page 123

... engaged in the business of production, sale or marketing of snack foods (including, but not limited to gum, chocolate, confectionary products, biscuits or any other product or service Employee has reason to know has been under development by the MondelÄ"z Group during Employee's employment with the... -

Page 124

2. to protect the MondelÄ"z Group's investment in its employees and to ensure the long-term success of the business, Employee, without the express written permission of the Executive Vice President of Human Resources of the Company, will not directly or indirectly solicit, hire, recruit, attempt to... -

Page 125

... or any other applicable law, including the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act, or any securities exchange on which the Common Stock is listed or traded, as may be in effect from time to time. 11. Original Issue or Transfer Taxes . The Company shall pay all... -

Page 126

... any action related to the Plan and that the Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Employee's participation in the Plan, or the Employee's acquisition or sale of the underlying shares of Common Stock; and (j) unless... -

Page 127

... determined under procedures established by the Company for purposes of the Plan, and (b) the term " Normal Retirement " means retirement from active employment under a pension plan of the MondelÄ"z Group, an employment contract with any member of the MondelÄ"z Group or a local labor contract, on or... -

Page 128

...Market Abuse Laws . The Employee acknowledges that the Employee is subject to insider trading and/or market abuse laws, which affect the Employee's ability to acquire or sell shares of Common Stock under the Plan during such times as the Employee is considered to have "material nonpublic information... -

Page 129

... and this Agreement shall be administered, and the Grant is made, only in such a manner as to conform to such laws, rules and regulations. To the extent permitted by applicable law, the Award Statement, the Plan and this Agreement shall be deemed amended to the extent necessary to conform to such... -

Page 130

... The Employee agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, the Award Statement or this Agreement. IN WITNESS WHEREOF, this Agreement has been duly executed as of the Grant Date. MONDELÄ'Z INTERNATIONAL... -

Page 131

...PLAN (Amended and Restated as of May 21, 2014) GLOBAL DEFERRED STOCK UNIT AGREEMENT MONDELÄ'Z INTERNATIONAL, INC., a Virginia corporation (the " Company "), hereby grants to the employee (the " Employee ") named in the award statement provided to the Employee (the " Award Statement ") as of the date... -

Page 132

... taxes from the Employee's wages or other cash compensation paid by the Company and/or the Employer or from proceeds of the sale of the shares of Common Stock issued upon vesting of the Deferred Stock Units. Alternatively, or in addition, the Company may (i) deduct the number of Deferred Stock Units... -

Page 133

... the full number of shares of Common Stock underlying the Grant, notwithstanding that a number of Deferred Stock Units are held back solely for the purpose of paying the Tax-Related Items and/or any theoretical taxes due as a result of any aspect of the Employee's participation in the Plan. 6. Death... -

Page 134

... engaged in the business of production, sale or marketing of snack foods (including, but not limited to gum, chocolate, confectionary products, biscuits or any other product or service Employee has reason to know has been under development by the MondelÄ"z Group during Employee's employment with the... -

Page 135

... not inconsistent with Section 409A of the Code or other applicable law. For purposes of this paragraph, net proceeds shall mean the fair market value of the shares of Common Stock less any Tax-Related Items; and the MondelÄ"z Group shall be entitled to seek, in addition to other available remedies... -

Page 136

... or any other applicable law, including the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act, or any securities exchange on which the Common Stock is listed or traded, as may be in effect from time to time. 11. Original Issue or Transfer Taxes . The Company shall pay all... -

Page 137

...exclusive purpose of implementing, administering and managing Employee's participation in the Plan. The Employee understands that the MondelÄ"z Group may hold certain personal information about him or her, including, but not limited to, the Employee's name, home address and telephone number, date of... -

Page 138

... the Employee's local human resources representative . 15. Notices . Any notice required or permitted hereunder shall be (i) given in writing and shall be deemed effectively given upon personal delivery, upon deposit for delivery by an internationally recognized express mail courier service or... -

Page 139

... by the Company for purposes of the Plan, and (b) the term " Normal Retirement " means retirement from active employment, in circumstances that constitute a "separation from service" for purposes of Section 409A of the Code, under a pension plan of the MondelÄ"z Group, an employment contract with... -

Page 140

...Market Abuse Laws . The Employee acknowledges that the Employee is subject to insider trading and/or market abuse laws, which affect the Employee's ability to acquire or sell shares of Common Stock under the Plan during such times as the Employee is considered to have "material nonpublic information... -

Page 141

... Stock Units shall be subject to any special terms set forth in the Appendix to this Agreement for Employee's country. Moreover, if Employee relocates to one of the countries included in the Appendix, the special terms for such country will apply to Employee, to the extent the Company determines... -

Page 142

.... The Employee agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, the Award Statement or this Agreement. IN WITNESS WHEREOF, this Agreement has been duly executed as of the Grant Date. MONDELÄ'Z INTERNATIONAL... -

Page 143

... Statement (the " Option Shares ") of the Company's Common Stock, at the price per share set forth in the Award Statement (the " Grant Price "). Capitalized terms not otherwise defined in this Non-Qualified U.S. Stock Option Agreement (the " Agreement ") shall have the meaning set forth in the Plan... -

Page 144

...garden leave payments, or other comparable benefits under the MondelÄ"z Global LLC Severance Pay Plan for Salaried Exempt Employees, or any similar plan maintained by the MondelÄ"z Group or through other such arrangements that may be entered into that give rise to separation or notice pay, except in... -

Page 145

...intern or any other similar capacity to a competitor or to an entity engaged in the same or similar business as the MondelÄ"z Group, including those engaged in the business of production, sale or marketing of snack foods (including, but not limited to gum, chocolate, confectionary products, biscuits... -

Page 146

...Ä"z Group, to the extent that such set-off is not inconsistent with Section 409A of the Code or other applicable law. For purposes of this paragraph, net proceeds shall mean the difference between the fair market value of the shares of Common Stock and the Grant Price less any Tax-Related Items... -

Page 147

... by the Commission or any other applicable law, including the requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act, or any securities exchange on which the Common Stock is listed or traded, as may be in effect from time to time. 8. Transfer Restrictions . Unless otherwise... -

Page 148

... compensation or salary for purposes of calculating any severance, resignation, termination, redundancy, dismissal, end-of-service payments, bonuses, long-service awards, pension, retirement or welfare benefits or similar payments; (g) the future value of the underlying shares of Common Stock... -

Page 149

... to the Plan and that the Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Optionee's participation in the Plan, or the Optionee's acquisition or sale of the underlying shares of Common Stock; (l) the Option is designated as not... -

Page 150

... laws applicable to the issuance of shares of Common Stock. 16. Notices . Any notice required or permitted hereunder shall be (i) given in writing and shall be deemed effectively given upon personal delivery, upon deposit for delivery by an internationally recognized express mail courier service... -

Page 151

...and this Agreement shall be administered, and the Option is granted, only in such a manner as to conform to such laws, rules and regulations. To the extent permitted by applicable law, the Award Statement, the Plan and this Agreement shall be deemed amended to the extent necessary to conform to such... -

Page 152

..., conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, the Award Statement or this Agreement. IN WITNESS WHEREOF, this Agreement has been executed as of the Grant Date. MONDELÄ'Z INTERNATIONAL, INC. /s/ Carol J. Ward Carol J. Ward Vice... -

Page 153

...RESTATED 2005 PERFORMANCE INCENTIVE PLAN (Amended and Restated as of May 21, 2014) NON-QUALIFIED NON-U.S. STOCK OPTION AGREEMENT MONDELÄ'Z INTERNATIONAL, INC., a Virginia corporation (the " Company "), hereby grants to the employee (the " Optionee ") identified in the award statement provided to the... -

Page 154

...the ultimate liability for all income tax, social insurance, payroll tax, fringe benefits tax, payment on account or other tax-related items related to the Optionee's participation in the Plan and legally applicable to the Optionee or deemed by the Company or the Employer, in their discretion, to be... -

Page 155

...deliver the Option Shares upon any exercise of this Option unless it has received payment in a form acceptable to the Company for all applicable Tax-Related Items, as well as amounts due to the Company as "theoretical taxes" pursuant to the then-current international assignment and tax and/or social... -

Page 156

... proprietary information and/or trade secrets; 2. to protect the MondelÄ"z Group's investment in its employees and to ensure the long-term success of the business, Optionee, without the express written permission of the Executive Vice President of Human Resources of the Company, will not directly or... -

Page 157

... with Section 409A of the Code or other applicable law. For purposes of this paragraph, net proceeds shall mean the difference between the fair market value of the shares of Common Stock and the Grant Price less any Tax-Related Items; and the MondelÄ"z Group shall be entitled to seek, in addition to... -

Page 158

... of any successors or assigns of the Company and any person or persons who shall acquire any rights hereunder in accordance with this Agreement, the Award Statement or the Plan. 11. Entire Agreement; Governing Law . The Award Statement, the Plan and this Agreement constitute the entire agreement... -

Page 159

... to the Plan and that the Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Optionee's participation in the Plan, or the Optionee's acquisition or sale of the underlying shares of Common Stock; (l) the Option is designated as not... -

Page 160

... purpose of implementing, administering and managing the Optionee's participation in the Plan. The Optionee understands that the MondelÄ"z Group may hold certain personal information about the Optionee, including, but not limited to, the Optionee's name, home address and telephone number, date... -

Page 161

... laws applicable to the issuance of shares of Common Stock. 18. Notices . Any notice required or permitted hereunder shall be (i) given in writing and shall be deemed effectively given upon personal delivery, upon deposit for delivery by an internationally recognized express mail courier service... -

Page 162

... subject to insider trading and/or market abuse laws, which affect the Optionee's ability to acquire or sell shares of Common Stock under the Plan during such times as the Optionee is considered to have "material nonpublic information" or "inside information" (as defined by the laws in the Optionee... -

Page 163

..., conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, the Award Statement or this Agreement. IN WITNESS WHEREOF, this Agreement has been executed as of the Grant Date. MONDELÄ'Z INTERNATIONAL, INC. /s/ Carol J. Ward Carol J. Ward Vice... -

Page 164

... so indicates. All capitalized terms used in this Agreement without definition shall have the meanings ascribed in the Plan and the Notice. (a) Affiliate . "Affiliate" means any entity that directly or indirectly through one or more intermediaries controls or is controlled by the Company, in each... -

Page 165

... the target number of shares of Common Stock or amount set forth in the Notice. (f) Maximum Goal Factor . "Maximum Goal Factor" means the maximum percentage set forth in the Notice. (g) Normal Retirement . "Normal Retirement" means retirement from active employment under (a) a pension plan of the... -

Page 166

..., then the Company will not apply such favorable treatment, and the Participant shall forfeit as of the date of the termination any rights under the LTI Grant. 4. Payment . (a) Form and Time of Payment . (i) Form of Payment . Subject to the terms of the Plan, the Notice and this Agreement... -

Page 167

... Company shall not be required to issue or deliver any certificate or certificates (whether in electronic or other form) for any shares of Common Stock in payment of the Award prior to the fulfillment of all of the following conditions: (A) the admission of the Common Stock to listing on all stock... -

Page 168

... these for the exclusive knowledge and use of the MondelÄ"z Group, which is of great competitive importance and commercial value to the MondelÄ"z Group, the Participant, without the express written permission of the Executive Vice President of Human Resources of the Company, will not engage in any... -

Page 169

... proprietary information and/or trade secrets; 2. to protect the MondelÄ"z Group's investment in its employees and to ensure the long-term success of the business, Participant, without the express written permission of the Executive Vice President of Human Resources of the Company, will not directly... -

Page 170

...setoff is not inconsistent with Section 409A of the Code or other applicable law. For purposes of this Section, net proceeds shall mean the fair market value of the shares of Common Stock less any Tax-Related Items; and 4. the MondelÄ"z Group shall be entitled to seek, in addition to other available... -

Page 171

... that a number of shares of Common Stock is held back solely for the purpose of such Tax-Related Items withholding. The Company is also authorized to satisfy the actual Tax-Related Items withholding arising from the vesting or payment of any Award relating to the LTI Grant, the sale of shares of... -

Page 172

...expected compensation or salary for purposes of calculating any severance, resignation, termination, redundancy, dismissal, end-ofservice payments, bonuses, long-service awards, pension, retirement or welfare benefits or similar payments; (g) the future value of the underlying shares of Common Stock... -

Page 173

... purpose of implementing, administering and managing the Participant's participation in the Plan. The Participant understands that the MondelÄ"z Group may hold certain personal information about the Participant, including, but not limited to, the Participant's name, home address and telephone number... -

Page 174

...WITHOUT CAUSE AND IN ACCORDANCE WITH APPLICABLE EMPLOYMENT LAWS OF THE COUNTRY WHERE THE PARTICIPANT RESIDES OR BE INTERPRETED AS FORMING AN EMPLOYMENT OR SERVICE CONTRACT WITH THE EMPLOYER. 15. Entire Agreement; Governing Law . The Notice, the Plan and this Agreement constitute the entire agreement... -

Page 175

... Corporate Secretary, MondelÄ"z International, Inc., Three Parkway North, Deerfield, Illinois 60015) are incorporated herein by reference. To the extent any provision in the Notice or this Agreement is inconsistent or in conflict with any term or provision of the Plan, the Plan shall govern except... -

Page 176

... Regarding LTI Grant . The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Participant's participation in the Plan or the Participant's acquisition or sale of any shares of Common Stock issued in payment of the LTI Grant. The... -

Page 177

29. Waiver . The Participant acknowledges that a waiver by the Company of a breach of any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement or of any subsequent breach by the Participant or any other participant of the Plan. 14 -

Page 178

... conclusive and final all decisions or interpretations of the Committee upon any questions arising under the Plan, the Notice or this Agreement. IN WITNESS WHEREOF, this Agreement has been duly executed as of the date of the Notice. MONDELÄ'Z INTERNATIONAL, INC. /s/ Carol J. Ward Carol J. Ward Vice... -

Page 179

Exhibit 10.19 M ONDELÄ'Z I NTERNATIONAL , I NC . C HANGE IN C ONTROL P LAN FOR K EY E XECUTIVES ADOPTED : APRIL 24, 2007 AMENDED : D ECEMBER 31, 2009 AMENDED : O CTOBER 2, 2012 AMENDED : M AY 21, 2014 A MENDED : D ECEMBER 4, 2014 A MENDED : F EBRUARY 4, 2015 -

Page 180

...purposes of the Change in Control Plan for Key Executives, the following terms are defined as set forth below (unless the context clearly indicates otherwise): 2005 Plan The MondelÄ"z International, Inc. Amended and Restated 2005 Performance Incentive Plan, as amended from time to time. Twelve times... -

Page 181

... Code Committee The U.S. Internal Revenue Code. The Board's Human Resources and Compensation Committee, any successor thereto or such other committee or subcommittee as may be designated by the Board to administer the Plan. MondelÄ"z International, Inc., a corporation organized under the laws of the... -

Page 182

... is serving in an executive position that reports directly to the Company's Chairman and/or Chief Executive Officer, (iii) is serving as a Regional President of the Company or (iv) is otherwise designated by the Committee as eligible to participate in this Plan. Employer Excise Tax Good Reason Key... -

Page 183

... of this Plan. A Participant whose designated home country, for purposes of the Employer's personnel and benefits programs and policies, is the United States. Non-U.S. Executive Participant Payment Plan Plan Administrator Separation Benefits Separation Pay U.S. Executive For purposes of these... -

Page 184

... the Plan effective as of the date of the employee's promotion or hire as a Key Executive or designation by the Committee as a Participant. 2.2. Duration of Participation . A Participant shall cease to be a Participant in the Plan if (i) the Participant terminates employment with the Employer under... -

Page 185

... in Control; (iii) the MondelÄ"z Group's requiring the Participant to be based at any office or location other than any other location that does not extend the Participant's home to work commute as of the time of the Change in Control by more than 50 miles; or (iv) any failure by the Company to... -

Page 186

... party. For purposes of this Plan, a "Notice of Termination" means a written notice that: (i) (ii) indicates the specific termination provision in this Plan relied upon, to the extent applicable, sets forth in reasonable detail the facts and circumstances claimed to provide a basis for termination... -

Page 187

... to the product of (i) the target number of shares under the Participant's Long-Term Incentive Grant Target multiplied by (ii) the closing share price of the Common Stock (as defined in the 2005 Plan) on the last trading day immediately preceding the closing date of the Change in Control; provided... -

Page 188

... the Participant's costs under any such retiree benefits plans, practices, programs or policies shall be based upon actual service with the MondelÄ"z Group. (d) The Employer shall, at its sole expense, provide the Participant with outplacement services through the provider of the Company's choice... -

Page 189

... purposes under the applicable Company non-qualified defined benefit pension plan, the Company shall credit the Participant with two (or in the case of a Participant who served as Chairman and/or Chief Executive Officer immediately prior to the Change in Control, three) additional years of service... -

Page 190

... subsequent claim by the Internal Revenue Service or otherwise. For purposes of determining the Reduced Amount under this Section 3.5(a), amounts otherwise payable to the Participant under the Plan shall be reduced, to the extent necessary, in the following order: first, Separation Pay under Section... -

Page 191

... the MondelÄ"z Group or its officers, directors and employees. 3.9 General Release of Claims. Upon a Change in Control and termination of employment under the circumstances described in Section 3.2(a), the obligations of the MondelÄ"z Group to pay or provide the Separation Benefits are contingent on... -

Page 192

... Group's obligations under this Plan, in the same manner and to the same extent that the Company would be required to perform if no such succession had taken place. The term "Company," as used in this Plan, shall mean the Company as hereinbefore defined and any successor or assignee to the business... -

Page 193

... an "at will" employee, or to change the MondelÄ"z Group's policies regarding termination of employment. 6.3. Tax Withholding . The Employer may withhold from any amounts payable under this Plan such taxes as shall be required to be withheld pursuant to any applicable law or regulation as determined... -

Page 194

... the applicable U.S. Department of Labor regulations. 6.8. Unfunded Plan Status . This Plan is unfunded and is intended to qualify as a severance pay plan within the meaning of Labor Department Regulations Section 2510.3-2(b). All payments pursuant to the Plan shall be made from the general funds of... -

Page 195

... be executed by its duly authorized officer effective as of the Effective Date set forth above. MONDELÄ'Z INTERNATIONAL, INC. By: /s/ Karen May Karen May Executive Vice President, Global Human Resources [Signature Page to the MondelÄ"z International, Inc. Change in Control Plan for Key Executives as... -

Page 196

EXHIBIT 12.1 MondelÄ"z International, Inc. and Subsidiaries Computation of Ratios of Earnings to Fixed Charges (in millions of dollars) 2014 Years Ended December 31, 2013 2012 2011 2010 Earnings from continuing operations before income taxes Add / (Deduct): Equity in net earnings of less than 50% ... -

Page 197

... Fulmer Corporation Limited Mondelez Bahrain Biscuits WLL Mondelez Bahrain W.L.L. LLC Jacobs Bel OOO Mondelez International Bel Cadbury Belgium BVBA Confibel SPRL Kraft Foods Belgium Intellectual Property Kraft Foods Belgium Production Holdings BVBA Kraft Foods Production Holdings Maatschap Mondelez... -

Page 198

... China Cadbury Marketing Services Co Ltd Shanghai Kraft Tianmei Food (Tianjin) Co. Ltd. Mondelez Beijing Food Co., Ltd. Mondelez China Co., Ltd Mondelez Guangzhou Food Company Limited Mondelez Jiangmen Food Co., Ltd. Mondelez Shanghai Food Co., Ltd. Mondelez Shanghai Foods Corporate Management Co... -

Page 199

MondelÄ"z International, Inc. Subsidiaries - 2014 Entity Name Country Mondelez Costa Rica Limitada Mondelez Zagreb d.o.o. Gum Management Services Ltd Mondelez CR Biscuit Production s.r.o. Mondelez CR Coffee Production s.r.o. Mondelez Czech Republic s.r.o. Opavia Lu s.r.o. Kraft Foods Danmark ... -

Page 200

... de R.L. Cadbury Trading Hong Kong Ltd. Mondelez Hong Kong Limited Gyori Keksz Kft SARL Mondelez Hungaria IP Kft Mondelez Hungaria Kft C S Business Services (India) Pvt. Limited Georges Beverages India Private Limited Induri Farm Limited KJS India Private Limited Mondelez India Foods Private Limited... -

Page 201

... Suh Foods Corporation Migabang Limited Company SIA Mondelez Latvija Cadbury Adams Middle East Offshore S.A.L. Cadbury Adams Middle East S.A.L. AB Kraft Foods Lietuva UAB Mondelez Baltic UAB Mondelez Lietuva Production Kraft Foods Biscuit Financing Luxembourg Sarl Kraft Foods Financing Luxembourg... -

Page 202

... Cadbury Enterprises Holdings B.V. Cadbury Holdings B.V. Cadbury Netherlands International Holdings B.V. CS Americas Holdings B.V. Gernika, B.V. Kraft Foods Central & Eastern Europe Service B.V. Kraft Foods Cesko Holdings BV Kraft Foods Entity Holdings B.V. Kraft Foods Holland Holding BV Kraft Foods... -

Page 203

... Cadbury Enterprises Pte. Ltd. Kraft Foods Holdings Singapore Pte. Ltd. Kraft Foods Trading Singapore Pte. Ltd. Kraft Helix Singapore Pte. Ltd. Kuan Enterprises Pte. Ltd. Mondelez Asia Pacific Pte. Ltd. Mondelez Business Services AP Pte Ltd Mondelez Singapore Pte. Ltd. Symphony Biscuits Holdings... -

Page 204

...AG Kraft Foods Biscuits Holding GmbH Kraft Foods Holding (Europa) GmbH Kraft Foods Intercontinental Schweiz GmbH Kraft Foods Schweiz Holding GmbH Lambras Holdings AG Mondelez Europe GmbH Mondelez Europe Procurement GmbH Mondelez Europe Services GmbH Mondelez International Finance AG Mondelez Schweiz... -

Page 205

.... Mondelez International (Thailand) Co., Ltd Kraft Foods (Trinidad) Unlimited Kent Gida Maddeleri Sanayii ve Ticaret Anonim Sirketi Cadbury South Africa (Holdings) Dirol Cadbury Ukraine SFE LLC Chipsy LYUKS Private Joint Stock Company "Mondelez Ukrania" Mondelez Eastern Europe Middle East & Africe... -

Page 206

... Kraft Foods Middle East & Africa Ltd. Kraft Foods UK Intellectual Property Limited Kraft Foods UK IP & Production Holdings Ltd. Kraft Russia Limited L. Rose & Co., Limited Mondelez UK Biscuit Financing Ltd Mondelez UK Confectionery Production Limited Mondelez UK Holdings & Services Limited Mondelez... -

Page 207

... LLC Kraft Foods Holdings LLC Kraft Foods International Beverages LLC Kraft Foods International Biscuit Holdings LLC Kraft Foods International Europe Holdings LLC Kraft Foods International Holdings Delaware LLC Kraft Foods International Services LLC Kraft Foods Latin America Holding LLC Kraft Foods... -

Page 208

... and 333-71266) of MondelÄ"z International, Inc. of our reports dated February 20, 2015 relating to the consolidated financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appear in this Form 10-K. /s/ PricewaterhouseCoopers LLP... -

Page 209

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Date: February 20, 2015 / S / IRENE B. ROSENFELD Irene B. Rosenfeld Chairman and Chief Executive Officer -

Page 210

...financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. (b) Date: February 20, 2015 /s/ BRIAN T. GLADDEN Brian T. Gladden Executive Vice President and Chief... -

Page 211

... Annual Report on Form 10-K fairly presents in all material respects MondelÄ"z International's financial condition and results of operations. / S / BRIAN T. GLADDEN Brian T. Gladden Executive Vice President and Chief Financial Officer February 20, 2015 A signed original of these written statements...