Memorex 2010 Annual Report Download - page 77

Download and view the complete annual report

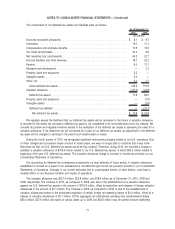

Please find page 77 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•up to the lesser of 65 percent of eligible inventory or 85 percent of the appraised net orderly liquidation value of

eligible inventory; plus

•up to 60 percent of the appraised fair market value of eligible real estate (the Original Real Estate Value), such

Original Real Estate Value to be reduced each calendar month by 1/84th, provided, that the Original Real Estate

Value shall not exceed $40,000,000; plus

•such other classes of collateral as may be mutually agreed upon and at advance rates as may be determined by

the Agent; minus

•such reserves as the Agent may establish in good faith.

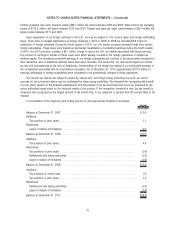

Our European obligations under the Credit Agreement are secured by a first priority lien on substantially all of the

material personal property of the European Borrower. Advances under the European portion of the Credit Facility are

limited to the lesser of (a) $50,000,000 and (b) the “European borrowing base.” The European borrowing base calculation

is fundamentally the same as the U.S. borrowing base, subject to certain differences to account for European law and

other similar issues.

The Amended Credit Agreement expires on March 29, 2013 and contains covenants which are customary for similar

credit arrangements, including covenants relating to financial reporting and notification; payment of indebtedness, taxes and

other obligations; compliance with applicable laws; and limitations regarding additional liens, indebtedness, certain

acquisitions, investments and dispositions of assets. We were in compliance with all covenants as of December 31, 2010.

The Amended Credit Agreement also contains a conditional financial covenant that requires us to have a Consolidated

Fixed Charge Coverage Ratio (as defined in the Amended Credit Agreement) of not less than 1.20 to 1.00 during certain

periods described in the Amended Credit Agreement. At December 31, 2010 the condition did not arise such that the

Consolidated Fixed Charge Coverage Ratio was required as a covenant. As of December 31, 2010, our total availability

under the credit facility was $149.4 million.

As of December 31, 2010, we had no other credit facilities available outside the United States.

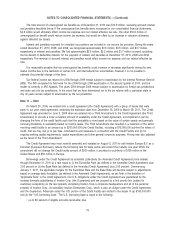

As of December 31, 2010 and 2009, we had outstanding standby and import letters of credit of $3.4 million and

$9.5 million, respectively. When circumstances allow, we are using standardized payment terms and are no longer actively

using trade letters of credit as payments to certain foreign suppliers, which has resulted in a decrease in our outstanding

letters of credit as of December 31, 2010.

Our interest expense, which includes letter of credit fees, facility fees and commitment fees under the Credit

Agreement, for 2010, 2009, and 2008 was $4.2 million, $2.9 million, and $1.5 million, respectively. Interest expense also

includes amortization of debt issuance costs which are being amortized through March 2013. Cash paid for interest in

these periods, relating to both continuing and discontinued operations, was $2.7 million, $1.4 million and $1.9 million,

respectively.

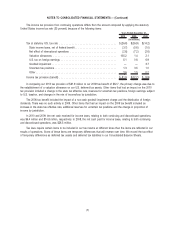

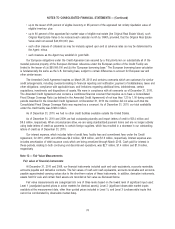

Note 12 — Fair Value Measurements

Fair value of financial instruments

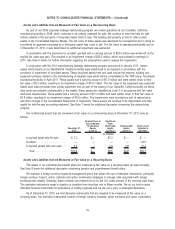

At December 31, 2010 and 2009, our financial instruments included cash and cash equivalents, accounts receivable,

accounts payable and derivative contracts. The fair values of cash and cash equivalents, accounts receivable and accounts

payable approximated carrying values due to the short-term nature of these instruments. In addition, derivative instruments,

assets held for sale and certain fixed assets are recorded at fair value as discussed below.

Fair value measurements are categorized into one of three levels based on the lowest level of significant input used:

Level 1 (unadjusted quoted prices in active markets for identical assets); Level 2 (significant observable market inputs

available at the measurement date, other than quoted prices included in Level 1); and Level 3 (unobservable inputs that

cannot be corroborated by observable market data).

74

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)