Memorex 2010 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PRODUCT STRATEGIES

We intend to retain Imation’s strong leadership in Traditional

Storage, including magnetic and optical products, optimizing

profitability, asset returns and cash in a declining market.

Imation’s strategic alliance with TDK to jointly develop and

manufacture advanced tape products is just one example

of improving return on assets in this category. In Emerging

Storage, including flash and removable hard disk drives, we

intend to grow through focused investment in our Defender™

data security and protection offerings, scalable storage for

small and medium businesses (SMBs), and connectivity

solutions for home and businesses. And in Electronics and

Accessories, our strategy is to launch differentiated higher-

margin products, leveraging our portfolio of brands, including

Imation, Memorex, TDK Life on Record, and XtremeMac.

TECHNOLOGY AND INVESTMENT STRATEGIES

We plan to invest in four core technology areas: Secure

Storage, Scalable Storage, Wireless Connectivity, and

Magnetic Tape. These investments include organic initiatives

already under way in our own RD&E (research, development,

and engineering) function, as well as investing in deeper

sales and marketing coverage for VAR (value-added reseller)

and OEM channels and international expansion. We also plan

to grow through acquisitions, with the potential for several

transactions ranging from a few million dollars to $50 million,

focused on data protection, storage hardware, removable

hard drive systems, and related software.

MOVING FORWARD

Imation has made good progress on the Company’s

operational foundation, and we are dedicated to achieving

our goals. We go forward with a strong balance sheet, a clear

vision for our future and actionable strategies to return to

growth in 2012 and beyond.

We will share our progress with you in the quarters ahead

as we implement our direction as a technology company

dedicated to helping people and organizations store, protect,

and connect their digital world.

Sincerely,

In 2010, Imation made progress with operational

improvements needed to establish a stronger foundation

for future growth. With renewed discipline across our global

organization, we delivered sustainable operational efficiencies,

including improved working capital management. This was

evident in our strong cash flows as we finished the year with

almost $305 million in cash, up over $140 million in just one

year. Also in 2010, we implemented an end-to-end product life

cycle process that has enabled us to more closely manage our

product portfolios from concept through end-of-life.

Imation’s 2010 revenues were $1.46 billion, reflecting the

expected continuing decline in Traditional Storage formats

and our more selective participation in Consumer Electronics

and Accessories. Despite our operational strides, we know

that we still have considerable work ahead to return Imation to

sustained growth and profitability. We are confident that the

plan we are implementing will yield that result over time.

A PATH TO GROWTH

Imation’s vision is to be a technology company dedicated to

helping people and organizations store, protect, and connect

their digital world.

With the increase in newly created data dramatically

outpacing the world’s available storage capacity, data storage

remains an attractive market, especially in the growing

Emerging Storage formats. Likewise, as the amount of

sensitive data rises, businesses and government agencies are

facing a critical and largely unmet need to protect their data

with highly secure storage solutions. And as we generate and

use more and more digital content in homes and businesses,

connectivity among digital devices and with the cloud is

becoming increasingly important.

These growing data-driven applications — storage, protection,

and connectivity — form the basis of our strategic direction.

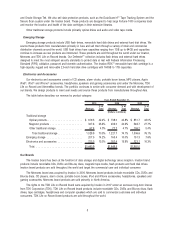

FINANCIAL GOALS

In 2011, Imation will maintain its focus on cash and continued

margin improvement. We do not expect revenues in 2011 to

rise, due to declines in Traditional Storage and rationalization

of low-margin products. We also expect that earnings,

excluding charges, will decline in 2011 due to organic

investments we need to drive long-term growth. But looking

forward, we are well positioned, and plan to invest to capitalize

on opportunities in targeted, growing markets. We will strive

to create lasting value with our goals of returning to top-line

growth by the end of 2012, improving our product gross

margins toward 20 percent, and driving increasing operating

margins to the 4-5 percent level.

DEAR FELLOW IMATION SHAREHOLDER,

Linda W. Hart

Non-Executive

Chairman of the Board

Mark E. Lucas

President and

Chief Executive Officer