Memorex 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• such other classes of collateral as may be mutually agreed upon and at advance rates as may be determined by

the Agent; minus

• such reserves as the Agent may establish in good faith.

Our European obligations under the Credit Agreement are secured by a first priority lien on substantially all of the

material personal property of the European Borrower. Advances under the European portion of the Credit Facility are

limited to the lesser of (a) $50,000,000 and (b) the “European borrowing base.” The European borrowing base calculation

is fundamentally the same as the U.S. borrowing base, subject to certain differences to account for European law and

other similar issues.

The Amended Credit Agreement expires on March 29, 2013 and contains covenants which are customary for similar

credit arrangements, including covenants relating to financial reporting and notification; payment of indebtedness, taxes and

other obligations; compliance with applicable laws; and limitations regarding additional liens, indebtedness, certain

acquisitions, investments and dispositions of assets. We were in compliance with all covenants as of December 31, 2010.

The Amended Credit Agreement also contains a conditional financial covenant that requires us to have a Consolidated

Fixed Charge Coverage Ratio (as defined in the Amended Credit Agreement) of not less than 1.20 to 1.00 during certain

periods described in the Amended Credit Agreement. At December 31, 2010 the condition did not arise such that the

Consolidated Fixed Charge Coverage Ratio was required as a covenant. As of December 31, 2010, our total availability

under the credit facility was $149.4 million.

Our liquidity needs for 2011 include the following: restructuring payments of up to $40 million, approximately

$15 million related to organic investment opportunities, litigation settlement payments of $10.9 million, pension funding of

approximately $10 million to $15 million, capital expenditures of approximately $10 million, operating lease payments of

approximately $9 million (see Note 15 to the Consolidated Financial Statements for further information), any amounts

associated with strategic acquisitions and any amounts associated with the repurchase of common stock under the

authorization discussed above. We expect that cash and cash equivalents, together with cash flow from operations and

availability of borrowings under our current sources of financing, will provide liquidity sufficient to meet these and our other

operational needs.

Off-Balance Sheet Arrangements

Other than the operating lease commitments discussed in Note 15 to the Consolidated Financial Statements, we are

not using off-balance sheet arrangements, including special purpose entities.

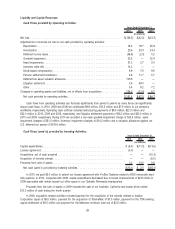

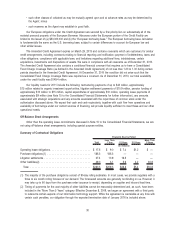

Summary of Contractual Obligations

Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

Payments Due by Period

(In millions)

Operating lease obligations . . . . . . . . . . . . . . . . . . . . . . . . . . $ 17.6 $ 9.0 $ 7.4 $1.2 $ —

Purchase obligations(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186.3 186.3 — — —

Litigation settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27.4 10.9 16.5 — —

Other liabilities(2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49.0 3.1 5.9 4.2 35.8

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $280.3 $209.3 $29.8 $5.4 $35.8

(1) The majority of the purchase obligations consist of 90-day rolling estimates. In most cases, we provide suppliers with a

three to six month rolling forecast of our demand. The forecasted amounts are generally not binding on us. However, it

may take up to 60 days from the purchase order issuance to receipt, depending on supplier and inbound lead time.

(2) Timing of payments for the vast majority of other liabilities cannot be reasonably determined and, as such, have been

included in the “More Than 5 Years” category. Effective December 8, 2009, we began an agreement with a third party

to outsource certain aspects of our information technology support. While the agreement is cancelable at any time with

certain cash penalties, our obligation through the expected termination date of January 2016 is included above.

30