Memorex 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

measuring the fair value of the reporting unit’s assets and liabilities (both recognized and unrecognized) at the time of the

impairment test. The difference between the reporting unit’s fair value and the fair values assigned to the reporting unit’s

individual assets and liabilities is the implied fair value of the reporting unit’s goodwill. Based on this step of the impairment

test, we determined that the full amount of remaining goodwill, $23.5 million, was impaired.

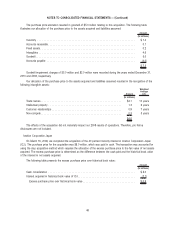

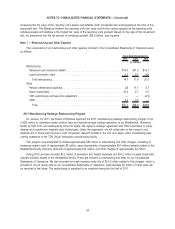

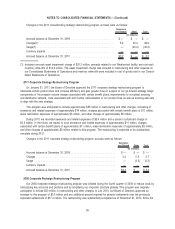

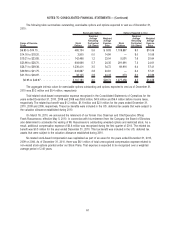

Note 7 — Restructuring and Other Expense

The components of our restructuring and other expense included in the Consolidated Statements of Operations were

as follows:

2010 2009 2008

Years Ended December 31,

(In millions)

Restructuring

Severance and severance related . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13.0 $11.2 $15.7

Lease termination costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.7 0.7 4.8

Total restructuring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.7 11.9 20.5

Other

Pension settlement/curtailment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.8 11.7 5.7

Asset impairments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.2 2.7 5.0

TDK post-closing purchase price adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (2.3)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.4 0.3 —

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $51.1 $26.6 $28.9

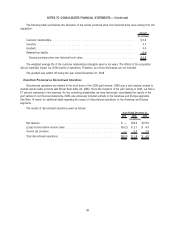

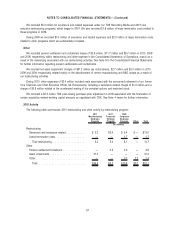

2011 Manufacturing Redesign Restructuring Program

On January 13, 2011, the Board of Directors approved the 2011 manufacturing redesign restructuring program of up

to $55 million to rationalize certain product lines and discontinue tape coating operations at our Weatherford, Oklahoma

facility by April 2011 and subsequently close the facility. We signed a strategic agreement with TDK Corporation to jointly

develop and manufacture magnetic tape technologies. Under the agreement, we will collaborate on the research and

development of future tape formats in both companies’ research centers in the U.S. and Japan, while consolidating tape

coating operations to the TDK Group Yamanashi manufacturing facility.

This program was anticipated to include approximately $50 million in restructuring and other charges, consisting of

severance related costs of approximately $3 million, asset impairments of approximately $31 million primarily related to the

Weatherford facility, inventory write-offs of approximately $14 million, and other charges of approximately $2 million.

During 2010 we have recorded $3.2 million of severance and related expenses and $31.2 million of asset impairment

charges primarily related to the Weatherford facility. These are included in restructuring and other on our Consolidated

Statements of Operations. We also recorded non-cash inventory write-offs of $14.2 million related to this program, which is

included in cost of goods sold on our Consolidated Statements of Operations. Approximately $2 million of other costs will

be recorded in the future. The restructuring is expected to be complete during the first half of 2011.

54

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)