Memorex 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

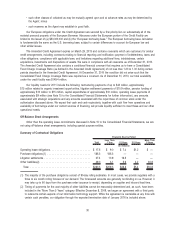

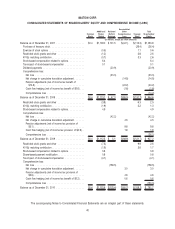

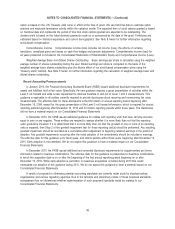

IMATION CORP.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY AND COMPREHENSIVE INCOME (LOSS)

Common

Stock

Additional

Paid-in

Capital

Retained

(Deficit)

Earnings

Accumulated

Other

Comprehensive

Loss

Treasury

Stock

Total

Shareholders’

Equity

(In millions, except per share amounts)

Balance as of December 31, 2007 ................... $0.4 $1,109.0 $ 101.5 $(44.1) $(113.0) $1,053.8

Purchase of treasury stock. . ..................... (26.4) (26.4)

Exercise of stock options . . . ..................... (0.5) 1.1 0.6

Restricted stock grants and other .................. (1.2) 3.8 2.6

401(k) matching contribution . ..................... (0.7) 3.3 2.6

Stock-based compensation related to options........... 6.4 6.4

Tax impact of stock-based compensation . ............ 0.1 0.1

Dividend payments ............................ (20.9) (20.9)

Comprehensive loss:

Net loss . . . .............................. (33.3) (33.3)

Net change in cumulative translation adjustment ....... (14.9) (14.9)

Pension adjustments (net of income tax benefit of

$14.8) . . . .............................. (24.2) (24.2)

Cash flow hedging (net of income tax benefit of $0.6) . . . (1.8) (1.8)

Comprehensive loss ......................... (74.2)

Balance as of December 31, 2008 ................... $0.4 $1,113.1 $ 47.3 $(85.0) $(131.2) $ 944.6

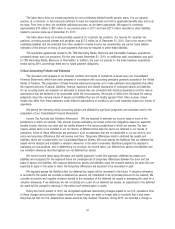

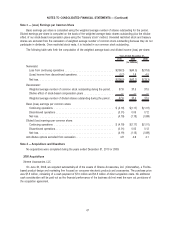

Restricted stock grants and other .................. (3.8) 6.3 2.5

401(k) matching contribution . ..................... (1.9) 3.2 1.3

Stock-based compensation related to options........... 4.9 4.9

Comprehensive loss:

Net loss . . . .............................. (42.2) (42.2)

Net change in cumulative translation adjustment ....... 4.5 4.5

Pension adjustments (net of income tax provision of

$5.1).................................. 9.8 9.8

Cash flow hedging (net of income tax provision of $0.9). . 1.8 1.8

Comprehensive loss ......................... (26.1)

Balance as of December 31, 2009 ................... $0.4 $1,112.3 $ 5.1 $(68.9) $(121.7) $ 927.2

Restricted stock grants and other .................. (7.3) 9.9 2.6

401(k) matching contribution . ..................... (1.9) 3.6 1.7

Stock-based compensation related to options........... 3.8 3.8

Share-based payment modification.................. 0.8 0.8

Tax impact of stock-based compensation . ............ (4.1) (4.1)

Comprehensive loss:

Net loss . . . .............................. (158.5) (158.5)

Net change in cumulative translation adjustment ....... 3.0 3.0

Pension adjustments (net of income tax provision of

$3.6).................................. 4.6 4.6

Cash flow hedging (net of income tax benefit of $0.2) . . . 0.6 0.6

Comprehensive loss ......................... (150.3)

Balance as of December 31, 2010 ................... $0.4 $1,103.6 $(153.4) $(60.7) $(108.2) $ 781.7

The accompanying Notes to Consolidated Financial Satements are an integral part of these statements.

40