Memorex 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.account is recovered, it is recorded as an increase to revenue or reduction of bad debt expense, as appropriate, in the

Consolidated Statements of Operations at the time cash is received.

Inventories. Inventories are valued at the lower of cost or market, with cost generally determined on a first-in, first-

out basis. We provide estimated inventory write-downs for excess, slow-moving and obsolete inventory as well as inventory

with a carrying value in excess of net realizable value.

Derivative Financial Instruments. We recognize all derivatives, including foreign currency exchange contracts on the

balance sheet at fair value. Derivatives that are not hedges are recorded at fair value through operations. If a derivative is

a hedge, depending on the nature of the hedge, changes in the fair value of the derivative are either offset against the

change in fair value of the underlying assets or liabilities through operations or recognized in accumulated other

comprehensive loss in shareholders’ equity until the underlying hedged item is recognized in operations. These gains and

losses are generally recognized as an adjustment to cost of goods sold for inventory-related hedge transactions, or as

adjustments to foreign currency transaction gains or losses included in non-operating expenses for foreign denominated

payables and receivables-related hedge transactions. Cash flows attributable to these financial instruments are included

with cash flows of the associated hedged items. The ineffective portion of a derivative’s change in fair value is immediately

recognized in operations.

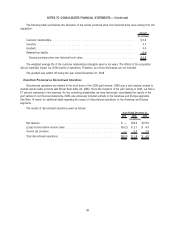

Property, Plant and Equipment. Property, plant and equipment, including leasehold and other improvements that

extend an asset’s useful life or productive capabilities, are recorded at cost. Maintenance and repairs are expensed as

incurred. The cost and related accumulated depreciation of assets sold or otherwise disposed are removed from the

related accounts and the gains or losses are reflected in the results of operations.

Property, plant and equipment are generally depreciated on a straight-line basis over their estimated useful lives. The

estimated depreciable lives range from 10 to 20 years for buildings and 5 to 10 years for machinery and equipment.

Leasehold and other improvements are amortized over the lesser of the remaining life of the lease or the estimated useful

life of the improvement.

Intangible Assets. Intangible assets include trade names, customer relationships and other intangible assets

acquired in business combinations. Intangible assets are amortized using methods that approximate the benefit provided

by utilization of the assets.

We record all assets and liabilities acquired in purchase acquisitions, including intangibles, at fair value. The initial

recognition of intangible assets, the determination of useful lives and subsequent impairment analyses require management

to make subjective judgments concerning estimates of how the acquired assets will perform in the future using valuation

methods including discounted cash flow analysis. As of December 31, 2010, we had $320.4 million of definite-lived

intangible assets subject to amortization. While we believe that the current carrying value of these assets is not impaired,

materially different assumptions regarding future performance of our businesses could result in significant impairment

losses.

We capitalize costs of software developed or obtained for internal use, once the preliminary project stage has been

completed, management commits to funding the project and it is probable that the project will be completed and the

software will be used to perform the function intended. Capitalized costs include only (1) external direct costs of materials

and services consumed in developing or obtaining internal-use software, (2) payroll and payroll-related costs for employees

who are directly associated with and who devote time to the internal-use software project and (3) interest costs incurred,

when material, while developing internal-use software. Capitalization of costs ceases when the project is substantially

complete and ready for its intended use.

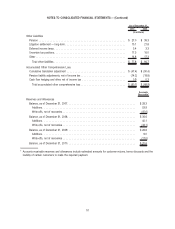

Goodwill. Goodwill is the excess of the cost of an acquired entity over the amounts assigned to assets acquired

and liabilities assumed in a business combination. Goodwill is not amortized. Goodwill is considered impaired when its

carrying amount exceeds its implied fair value. A two-step impairment test was performed to identify a potential impairment

and measure an impairment loss to be recognized. Based on the goodwill test performed, we determined that the carrying

amount of the reporting unit significantly exceeded its fair value and that the goodwill was fully impaired. See Note 6

herein for additional information.

43

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)