Memorex 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

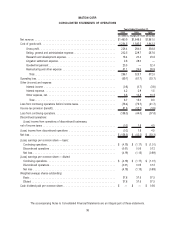

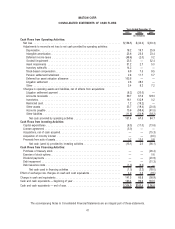

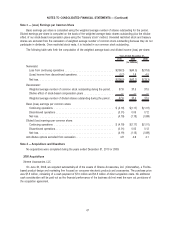

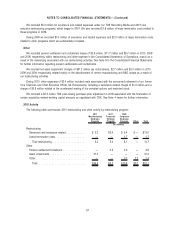

Note 3 — (Loss) Earnings per Common Share

Basic earnings per share is calculated using the weighted average number of shares outstanding for the period.

Diluted earnings per share is computed on the basis of the weighted average basic shares outstanding plus the dilutive

effect of our stock-based compensation plans using the “treasury stock” method. Unvested restricted stock and treasury

shares are excluded from the calculation of weighted average number of common stock outstanding because they do not

participate in dividends. Once restricted stock vests, it is included in our common stock outstanding.

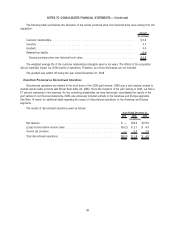

The following table sets forth the computation of the weighted average basic and diluted income (loss) per share:

2010 2009 2008

Years Ended December 31,

(In millions)

Numerator:

Loss from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(158.3) $(44.0) $(37.8)

(Loss) income from discontinued operations . . . . . . . . . . . . . . . . . . . . . . . (0.2) 1.8 4.5

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(158.5) $(42.2) $(33.3)

Denominator:

Weighted average number of common stock outstanding during the period . . 37.8 37.5 37.5

Dilutive effect of stock-based compensation plans . . . . . . . . . . . . . . . . . . . — — —

Weighted average number of diluted shares outstanding during the period . . 37.8 37.5 37.5

Basic (loss) earnings per common share:

Continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (4.19) $(1.17) $(1.01)

Discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.01) 0.05 0.12

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.19) (1.13) (0.89)

Diluted (loss) earnings per common share:

Continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (4.19) $(1.17) $(1.01)

Discontinued operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.01) 0.05 0.12

Net loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.19) (1.13) (0.89)

Anti-dilutive options excluded from calculation . . . . . . . . . . . . . . . . . . . . . . . . 4.9 4.6 4.1

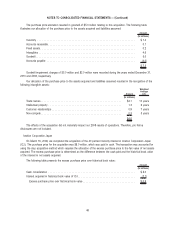

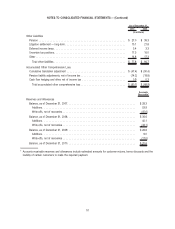

Note 4 — Acquisitions and Divestiture

No acquisitions were completed during the years ended December 31, 2010 or 2009.

2008 Acquisitions

Xtreme Accessories, LLC

On June 30, 2008, we acquired substantially all of the assets of Xtreme Accessories, LLC (XtremeMac), a Florida-

based product design and marketing firm focused on consumer electronic products and accessories. The purchase price

was $7.3 million, consisting of a cash payment of $7.0 million and $0.3 million of direct acquisition costs. No additional

cash consideration will be paid out as the financial performance of the business did not meet the earn out provisions of

the acquisition agreement.

47

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)