Memorex 2010 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

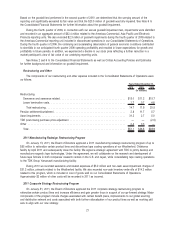

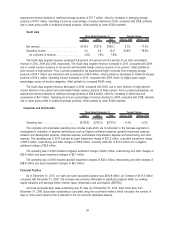

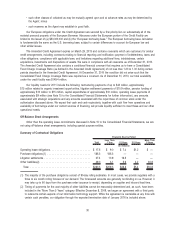

Research and Development (R&D)

2010 2009 2008 2010 vs. 2009 2009 vs. 2008

Years Ended December 31, Percent Change

(In millions)

Research and development . . . . . . . . . . . . . . . . . . . . . . . . . . $16.4 $20.4 $23.6 ⫺19.6% ⫺13.6%

As a percent of revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . 1.1% 1.2% 1.2%

The decrease in our 2010 and 2009 R&D expense was due to continued cost savings from restructuring activities

and cost control actions. R&D expense as a percent of revenue remained relatively flat compared with 2009 and 2008.

During 2011 we plan to invest in additional R&D activities in four core product technology areas: secure storage, scalable

storage, wireless/connectivity and magnetic tape. These investments will result in an increase of more than 30 percent in

R&D annually.

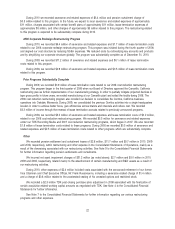

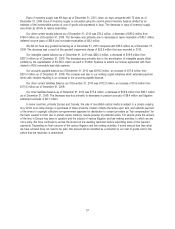

Litigation Settlement

2010 2009 2008

Years Ended December 31,

(In millions)

Litigation settlement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2.6 $49.0 $—

A charge of $2.6 million was recognized in the fourth quarter of 2010 and is included in litigation settlement expense.

On January 11, 2011, we signed a patent cross-license agreement with SanDisk to settle the two patent cases filed by

SanDisk in Federal District Court against our flash memory products, including USB drives and solid state disk (SSD)

drives. Under the terms of the cross-license, we will pay SanDisk royalties on certain flash memory products that were

previously not licensed. The specific terms of the cross-license are confidential. The cross-license agreement requires us

to make a one time payment of $2.6 million. The one time payment was recognized in the fourth quarter of 2010 and

recorded as litigation settlement expense in the Consolidated Statements of Operations. See Note 15 in the Consolidated

Financial Statements for further information about this litigation settlement.

A litigation settlement charge of $49.0 million was recorded in 2009. We entered into a confidential settlement

agreement ending all legal disputes with Philips Electronics N.V., U.S. Philips Corporation and North American Philips

Corporation (collectively, Philips). We had been involved in a complex series of disputes in multiple jurisdictions regarding

cross-licensing and patent infringement related to recordable optical media. The settlement provided resolution of all claims

and counterclaims filed by the parties without any finding or admission of liability or wrongdoing by any party. As a term of

the settlement, we agreed to pay Philips $53.0 million over a period of three years. Based on the present value of these

settlement payments, we recorded a charge of $49.0 million in the second quarter of 2009. We made payments of

$8.2 million and $20.0 million in 2010 and 2009, respectively. Interest accretion of $1.5 million and $0.8 million was

recorded in 2010 and 2009, respectively. The interest accretion is included in the interest expense on our Consolidated

Statements of Operations.

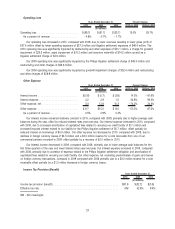

Goodwill Impairment

2010 2009 2008

Years Ended December 31,

(In millions)

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $23.5 $— $32.4

We made certain changes to our business segments effective in the second quarter of 2010. Our reporting units for

goodwill are our operating segments with the exception of the Americas segment which is further divided between the

Americas-Consumer and Americas-Commercial reporting units as determined by sales channel. As a result of the segment

change in the second quarter of 2010, the $23.5 million of goodwill which was previously allocated to the Electronics

Products segment was merged into the Americas-Consumer reporting unit. See Note 14 to the Consolidated Financial

Statements for further information about the changes of our segments. The Americas-Consumer reporting unit had a fair

value that was significantly less than its carrying amount prior to the combination, which is a triggering event for an interim

goodwill impairment test. Goodwill is considered impaired when its carrying amount exceeds its implied fair value. A two-

step impairment test was performed to identify a potential impairment and measure an impairment loss to be recognized.

20