Memorex 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

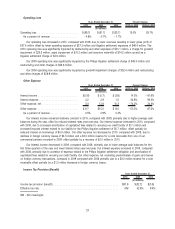

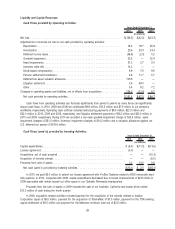

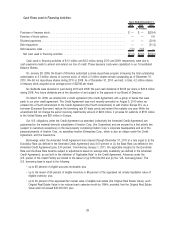

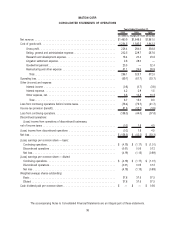

Cash Flows used in Financing Activities:

2010 2009 2008

Years Ended December 31,

(In millions)

Purchase of treasury stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $(26.4)

Exercise of stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 0.6

Dividend payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (20.9)

Debt repayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (31.3)

Debt issuance costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.0) (3.2) —

Net cash used in financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1.0) $(3.2) $(78.0)

Cash used in financing activities of $1.0 million and $3.2 million during 2010 and 2009, respectively, were due to

cash payments made to amend and extend our line of credit. These issuance costs were capitalized in our Consolidated

Balance Sheets.

On January 28, 2008, the Board of Directors authorized a share repurchase program increasing the total outstanding

authorization to 3.0 million shares of common stock, of which 2.3 million shares remain outstanding as of December 31,

2010. We did not repurchase shares during 2010 or 2009. As of December 31, 2010, we held, in total, 4.2 million shares

of treasury stock acquired at an average price of $25.68 per share.

No dividends were declared or paid during 2010 and 2009. We paid cash dividends of $0.56 per share or $20.9 million

during 2008. Any future dividends are at the discretion of and subject to the approval of our Board of Directors.

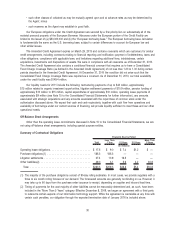

On March 30, 2006, we entered into a credit agreement (the Credit Agreement) with a group of banks that were

party to our prior credit agreement. The Credit Agreement was most recently amended on August 3, 2010 when we

entered into a Fourth Amendment to the Credit Agreement (the Fourth Amendment) to add Imation Europe B.V. as a

borrower (European Borrower), reduce the borrowing rate 50 basis points and extend the maturity one year. While the

amendment did not change the senior revolving credit facility amount of $200 million, it provides for sublimits of $150 million

in the United States and $50 million in Europe.

Our U.S. obligations under the Credit Agreement as amended (collectively the Amended Credit Agreement) are

guaranteed by the material domestic subsidiaries of Imation Corp. (the Guarantors) and are secured by a first priority lien

(subject to customary exceptions) on the real property comprising Imation Corp.’s corporate headquarters and all of the

personal property of Imation Corp., its subsidiary Imation Enterprises Corp., which is also an obligor under the Credit

Agreement, and the Guarantors.

Borrowings under the Amended Credit Agreement bore interest through December 31, 2010 at a rate equal to (i) the

Eurodollar Rate (as defined in the Amended Credit Agreement) plus 3.00 percent or (ii) the Base Rate (as defined in the

Amended Credit Agreement) plus 2.00 percent. Commencing January 1, 2011, the applicable margins for the Eurodollar

Rate and the Base Rate became subject to adjustments based on average daily Availability (as defined in the Amended

Credit Agreement), as set forth in the definition of “Applicable Rate” in the Credit Agreement. Advances under the

U.S. portion of the Credit Facility are limited to the lesser of (a) $150,000,000 and (b) the “U.S. borrowing base.” The

U.S. borrowing base is equal to the following:

• up to 85 percent of eligible accounts receivable; plus

• up to the lesser of 65 percent of eligible inventory or 85 percent of the appraised net orderly liquidation value of

eligible inventory; plus

• up to 60 percent of the appraised fair market value of eligible real estate (the Original Real Estate Value), such

Original Real Estate Value to be reduced each calendar month by 1/84th, provided, that the Original Real Estate

Value shall not exceed $40,000,000; plus

29