Lululemon 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5.9 Forfeiture of Unvested Performance Shares.

Except as otherwise provided by this Section 5 or Section 8, on the

Performance Share Vesting Date, the Participant shall forfeit and the Company shall automatically reacquire all Performance Shares subject to

the Award which have not become Vested Performance Shares. The Participant shall not be entitled to any payment for such forfeited

Performance Shares.

6. SETTLEMENT OF THE AWARD .

6.1 Issuance of Common Shares .

Subject to the provisions of Section 6.3 below, the Company shall issue to the

Participant on the Settlement Date with respect to each Vested Performance Share one (1) Common Share. Common Shares issued in settlement

of Performance Shares shall be subject to any restrictions as may be required pursuant to Section 6.3, Section 7 or the Insider Trading Policy.

6.2 Beneficial Ownership of Common Shares; Certificate Registration .

The Participant hereby authorizes the Company,

in its sole discretion, to deposit for the benefit of the Participant with any broker with which the Participant has an account relationship of which

the Company has notice any or all Common Shares acquired by the Participant pursuant to the settlement of the Award. Except as otherwise

provided by this Section 6.2, a certificate for the Common Shares as to which the Award is settled shall be registered in the name of the

Participant, or, if applicable, in the names of the heirs of the Participant.

6.3 Restrictions on Grant of the Award and Issuance of Common Shares .

The grant of the Award and issuance of

Common Shares upon settlement of the Award shall be subject to compliance with all applicable requirements of federal, state law or foreign

law with respect to such securities. No Common Shares may be issued hereunder if the issuance of such shares would constitute a violation of

any applicable federal, state or foreign securities laws or other law or regulations or the requirements of any stock exchange or market system

upon which the Stock may then be listed. The inability of the Company to obtain from any regulatory body having jurisdiction the authority, if

any, deemed by the Company’

s legal counsel to be necessary to the lawful issuance of any Common Shares subject to the Award shall relieve

the Company of any liability in respect of the failure to issue such shares as to which such requisite authority shall not have been obtained. As a

condition to the settlement of the Award, the Company may require the Participant to satisfy any qualifications that may be necessary or

appropriate, to evidence compliance with any applicable law or regulation and to make any representation or warranty with respect thereto as

may be requested by the Company.

6.4 Fractional Shares .

The Company shall not be required to issue fractional Common Shares upon the settlement of the

Award. Any fractional share resulting from the determination of the number of Vested Performance Shares shall be rounded up to the nearest

whole number.

7. TAX MATTERS .

7.1 In General.

At the time the Grant Notice is executed, or at any time thereafter as requested by the Company, the

Participant hereby authorizes withholding from payroll and any other amounts payable to the Participant, and otherwise agrees to make adequate

provision for, any sums required to satisfy the federal, state, local and foreign tax withholding obligations of the Company, if any, which arise in

connection with the Award or the issuance of Common shares in settlement thereof. The Company shall have no obligation to process the

settlement of the Award or to deliver Common Shares until the tax withholding obligations as described in this Section have been satisfied by

the Participant.

7.2 Withholding in Common Shares.

Subject to applicable law, the Company shall require the Participant to satisfy its tax

withholding obligations by deducting from the Common Shares otherwise deliverable to the Participant in settlement of the Award a number of

whole Common Shares having a fair market value, as determined by the Company as of the date on which the tax withholding obligations arise,

not in excess of the amount of such tax withholding obligations determined by the applicable minimum statutory withholding rates.

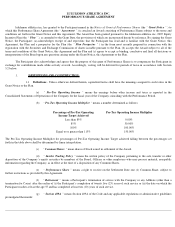

8. CHANGE IN CONTROL .

8.1 Acceleration of Vesting Upon a Change in Control

. In the event of the consummation of a Change in Control prior to

the Performance Share Vesting Date, the surviving, continuing, successor, or purchasing entity or parent thereof, as the case may be (the “

Acquiror

”), may assume or continue the Company’

s rights and obligations with respect to outstanding Awards or substitute for outstanding

Awards substantially equivalent rights with respect to the Acquiror’

s stock. For purposes of this Section 8.1, an Award shall be deemed assumed

if, following the Change in Control, the Award confers the right to receive, for each Performance Share subject to the Award immediately prior

to the Change in Control, the consideration (whether stock, cash, other securities or property or a combination thereof) to which a holder of a

share of stock of the Company on the effective date of the Change in Control was entitled for each Performance Share subject to an Award. In

the event that the Acquiror elects