Lululemon 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We believe that our cash from operations and borrowings available to us under our revolving credit facility will be adequate to meet our

liquidity needs and capital expenditure requirements for at least the next 24 months. Our cash from operations may be negatively impacted by a

decrease in demand for our products as well as the other factors described in "Risk Factors." In addition, we may make discretionary capital

improvements with respect to our stores, distribution facilities, headquarters, or other systems, which we would expect to fund through the

issuance of debt or equity securities or other external financing sources to the extent we were unable to fund such capital expenditures out of our

cash from operations.

Revolving Credit Facility

On November 22, 2013, we entered into unsecured demand revolving credit facilities with HSBC Bank Canada and Bank of America,

N.A., Canada Branch, which replaced our 2007 credit facility. The credit facilities provide us with available borrowings in a total amount of

$15.0 million. Borrowings under the credit facilities must be repaid in full on demand and are available by way of U.S. or Canadian denominated

advances, letters of credit or depository bills. Advances denominate in U.S. Dollars bear interest on the outstanding balance at a rate equal to

U.S. LIBOR plus 100 basis points or the U.S. prime rate, at our option. Advances denominated in Canadian Dollars bear interest on the

outstanding balance at a rate equal to the Bankers Acceptance Rate plus 100 basis points or the Canadian prime rate, at our option. Borrowings

drawn down under standby letters of credit will bear a fee of 100 basis points and borrowings drawn down under commercial letters of credit

will bear the banks' standard pricing. We are also required to pay a quarterly commitment fee of 10 basis points on the unused portion of the

facility. Our wholly-owned subsidiary, lululemon usa inc., has provided a guarantee to the bank counter-parties under the facilities. The

revolving credit facilities are unsecured, with a negative pledge on assets subject to permitted encumbrances, and no financial covenants. As of

February 2, 2014 , aside from letters of credit, we had $nil in borrowings outstanding under these credit facilities.

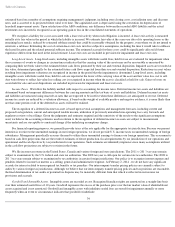

Contractual Obligations and Commitments

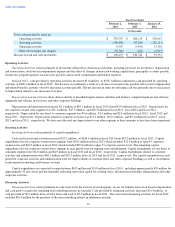

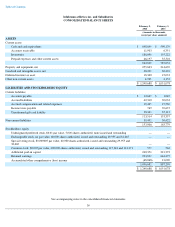

Leases. We lease certain corporate-owned store locations, storage spaces, building and equipment under non-cancelable operating leases.

Our leases generally have initial terms of between five and 10 years, and generally can be extended only in five-year increments, if at all. Our

leases expire at various dates between one and 10 years, excluding extensions at our option. A substantial number of our leases for corporate-

owned store premises include renewal options and certain of our leases include rent escalation clauses, rent holidays and leasehold rental

incentives, none of which are reflected in the following table. Most of our leases for corporate-owned store premises also include contingent

rental payments based on sales volume, the impact of which also are not reflected in the following table. The following table summarizes our

contractual arrangements as of February 2, 2014 , and the timing and effect that such commitments are expected to have on our liquidity and

cash flows in future periods:

Off-Balance Sheet Arrangements

We enter into standby letters of credit t o secure certain of our obligations, including leases, taxes and duties. As of February 2, 2014 ,

letters of credit and letters of guarantee totaling $1.1 million have been issued.

Other than these standby letters of credit , we do not have any off-balance sheet arrangements, investments in special purpose entities or

undisclosed borrowings or debt. In addition, we have not entered into any derivative contracts or synthetic leases.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make

estimates and assumptions. Predicting future events is inherently an imprecise activity and, as such, requires the use of judgment. Actual results

may vary from estimates in amounts that may be material to the financial statements. An accounting policy is deemed to be critical if it requires

an accounting estimate to be made based on assumptions about matters that are highly uncertain at the time the estimate is made, and if different

estimates that reasonably could have been used or changes in the accounting estimates that are reasonably likely to occur periodically, could

materially impact our consolidated financial statements.

32

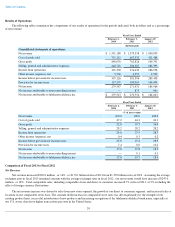

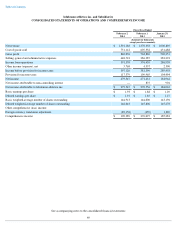

Payments Due by Fiscal Year

Total

2014

2015

2016

2017

2018

Thereafter

(In thousands)

Operating Leases (minimum rent)

$

350,168

$

70,913

$

69,209

$

65,421

$

54,261

$

37,979

$

52,385