Lululemon 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We believe that the following critical accounting policies affect our more significant estimates and judgments used in the preparation of

our consolidated financial statements:

Revenue Recognition. Net revenue is comprised of corporate-owned store net revenue, direct to consumer sales through

www.lululemon.com , www.ivivva.com and other country and region specific websites, and other net revenue, which includes, sales to

wholesale accounts, warehouse sales, franchise royalties as well as sales of products to franchisees, and sales from company-operated

showrooms, in each case, net of an estimated allowance for sales returns and discounts. Sales to customers through corporate-owned stores and

company-operated showrooms are recognized at the point of sale, net of an estimated allowance for sales returns. Direct to consumer sales are

recognized when goods are shipped and collection is reasonably assured, net of an estimated allowance for sales returns. Other net revenue

related to franchise royalties are recognized when earned, in accordance with the terms of the franchise/license agreements. Royalties are based

on a percentage of the franchisees' sales and recognized when those sales occur. Other net revenue related to warehouse sales is recognized when

these sales occur. Amounts billed to customers for shipping and handling are recognized at the time of shipment.

Sales are reported on a net revenue basis, which is computed by deducting from our gross sales the amount of sales taxes, actual product

returns received, discounts and an amount established for anticipated sales returns. Our estimated allowance for sales returns is a subjective

critical estimate that has a direct impact on reported net revenue. This allowance is calculated based on a history of actual returns, estimated

future returns and any significant future known or anticipated events. Consideration of these factors results in an estimated allowance for sales

returns. Our standard terms for retail sales limit returns to approximately 14 days after the sale of the merchandise. For our wholesale sales, we

allow returns from our wholesale customers if properly requested and approved. Employee discounts are classified as a reduction of net revenue.

Revenue from our gift cards are recognized when tendered for payment, or upon redemption. Outstanding customer balances are included

in "Unredeemed gift card liability" on the consolidated balance sheets. There are no expiration dates on our gift cards, and lululemon does not

charge any service fees that cause a decrement to customer balances.

While we will continue to honor all gift cards presented for payment, management may determine the likelihood of redemption to be

remote for certain card balances due to, among other things, long periods of inactivity. In these circumstances, to the extent management

determines there is no requirement for remitting card balances to government agencies under unclaimed property laws, card balances may be

recognized in the consolidated statements of operations in "Net revenue."

Inventory. Inventory is valued at the lower of cost and market. Cost is determined using weighted-average costs. For finished goods,

market is defined as net realizable value, and for raw materials, market is defined as replacement cost. Cost of inventories includes acquisition

and production costs including raw material and labor, as applicable, and all costs incurred to deliver inventory to our distribution centers

including freight, non-refundable taxes, duty and other landing costs.

We periodically review our inventories and make provisions as necessary to appropriately value obsolete or damaged goods. The amount

of the provision is equal to the difference between the book cost of the inventory and its estimated market value based upon assumptions about

future demands, selling prices and market conditions. In addition, as part of inventory valuations, we provide for inventory shrinkage based on

historical trends from actual physical inventories. Inventory shrinkage estimates are made to reduce the inventory value for lost or stolen items.

We perform physical inventory counts throughout the year and adjust the shrink provision accordingly. In fiscal 2013 , we wrote-off $30.2

million of inventory, including $17.5 million related to the pull-back of black Luon pants, and in fiscal 2012 we wrote-off $6.4 million of

inventory.

Property and Equipment. Property and equipment are recorded at cost less accumulated depreciation. Direct internal and external costs

related to software used for internal purposes which are incurred during the application development stage or for upgrades that add functionality

are capitalized. All other costs related to internal use software are expensed as incurred. Buildings are depreciated on a straight-line basis over

the expected useful life of the asset, which ranges from 10 to 20 years. Leasehold improvements are depreciated on a straight-line basis over the

lesser of the length of the lease, without consideration of option renewal periods and the estimated useful life of the assets, up to a maximum of

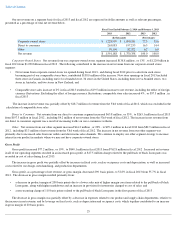

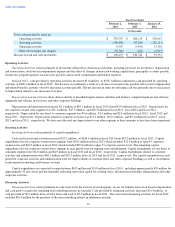

five years. All other property and equipment are depreciated using the declining balance method as follows:

We recognize a liability for the fair value of a required asset retirement obligation, or ARO, when such obligation is incurred. Our AROs

are primarily associated with leasehold improvements which, at the end of a lease, we are contractually obligated to remove in order to comply

with the lease agreement. At the inception of a lease with such conditions, we record an ARO liability and a corresponding capital asset in an

amount equal to the estimated fair value of the obligation. The liability is

33

Furniture and fixtures

20

%

Computer hardware and software

30

%

Equipment and vehicles

30

%