Lululemon 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

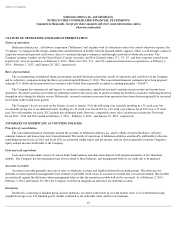

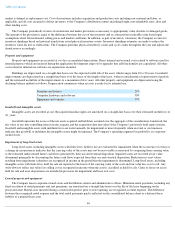

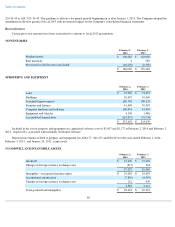

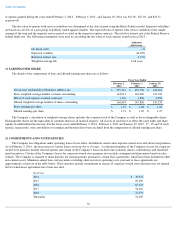

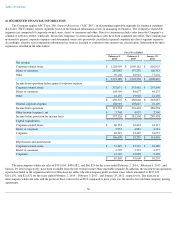

Amortization expense related to intangible assets was $891 , $1,329 , and $1,314 for the years ended February 2, 2014 , February 3, 2013

,

and January 29, 2012 , respectively. The estimated aggregate amortization expense is as follows:

Reacquired franchise rights are amortized on a straight-line basis over their estimated useful lives. The weighted-average remaining useful

lives of the reacquired franchise rights was 2.49 years as at February 2, 2014 and 3.26 years years as at February 3, 2013 . Goodwill is reviewed

for impairment annually, or as events occur or circumstances arise which may reduce the fair value of goodwill below carrying value.

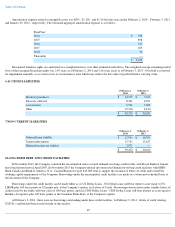

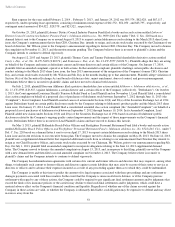

6 ACCRUED LIABILITIES

7 NON-CURRENT LIABILITIES

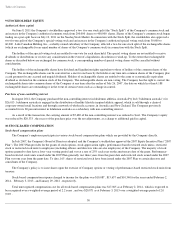

8 LONG-TERM DEBT AND CREDIT FACILITIES

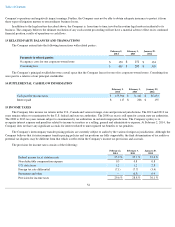

In November 2013, the Company canceled the uncommitted senior secured demand revolving credit facility with Royal Bank of Canada

that it had entered into in April 2007. In November 2013 the Company entered into unsecured demand revolving credit facilities with HSBC

Bank Canada and Bank of America, N.A., Canada Branch for up to $15,000 total to support the issuance of letters of credit and to fund the

working capital requirements of the Company. Borrowings under the uncommitted credit facilities are made on a when-and-as-needed basis at

the discretion of the Company.

Borrowings under the credit facility can be made either as (i) US Dollar Loans - US Dollar Loans will bear interest a rate equal to US

LIBOR plus 100 basis points or US prime rate, at the Company's option; (ii) Letters of Credit - Borrowings drawn down under standby letters of

credit issued by the banks will bear a fee of 100 basis points; and (iii) CDN Dollar Loans - CDN Dollar Loans will bear interest at a rate equal to

Bankers Acceptance plus 100 basis points or the Canadian Prime Rate, at the Company's option.

At February 2, 2014 , there were no borrowings outstanding under these credit facilities. At February 2, 2014 , letters of credit totaling

USD $1.1 million had been issued outside of this facility.

49

Fiscal Year

2014

$

938

2015

898

2016

747

2017

265

2018

74

Thereafter

—

$

2,922

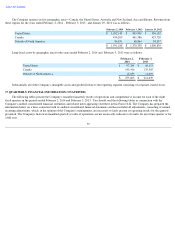

February 2,

2014

February 3,

2013

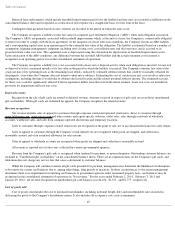

Inventory purchases

$

12,715

$

7,633

Sales tax collected

8,341

8,501

Accrued rent

5,936

5,688

Other

15,318

8,210

$

42,310

$

30,032

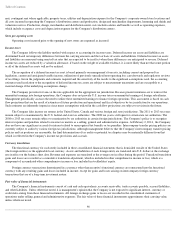

February 2,

2014

February 3,

2013

Deferred lease liability

$

17,994

$

16,785

Tenant inducements

17,521

13,637

Deferred income tax liability

3,977

—

$

39,492

$

30,422