Lululemon 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

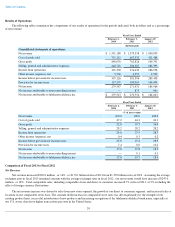

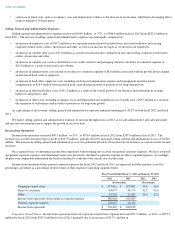

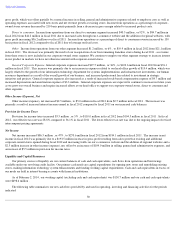

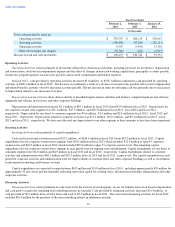

Results of Operations

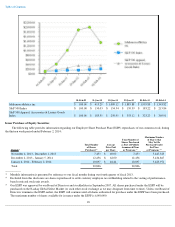

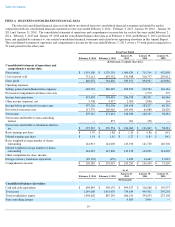

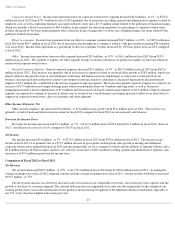

The following tables summarize key components of our results of operations for the periods indicated, both in dollars and as a percentage

of net revenue:

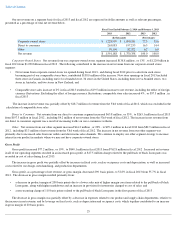

Comparison of Fiscal 2013 to Fiscal 2012

Net Revenue

Net revenue increased $220.8 million , or 16% , to $1.591 billion in fiscal 2013 from $1.370 billion in fiscal 2012 . Assuming the average

exchange rates in fiscal 2013 remained constant with the average exchange rates in fiscal 2012 , our net revenue would have increase d $247.0

million , or 18% . Total comparable sales, including comparable stores and direct to consumer, increased 7% in fiscal 2013, or 9% excluding the

effect of foreign currency fluctuations.

The net revenue increase

was driven by sales from new stores opened, the growth of our direct to consumer segment, and increased sales at

locations in our comparable stores base. The constant dollar increase in comparable store sales was driven primarily by the strength of our

existing product lines, successful introduction of new products and increasing recognition of the lululemon athletica brand name, especially at

our U.S. stores, that drove higher transactions per store in the United States.

24

Fiscal Year Ended

February 2,

2014

February 3,

2013

January 29,

2012

(In thousands)

Consolidated statements of operations:

Net revenue

$

1,591,188

$

1,370,358

$

1,000,839

Cost of goods sold

751,112

607,532

431,488

Gross profit

840,076

762,826

569,351

Selling, general and administrative expenses

448,718

386,387

282,393

Income from operations

391,358

376,439

286,958

Other income (expense), net

5,768

4,957

2,500

Income before provision for income taxes

397,126

381,396

289,458

Provision for income taxes

117,579

109,965

104,494

Net income

279,547

271,431

184,964

Net income attributable to non-controlling interest

—

875

901

Net income attributable to lululemon athletica inc.

$

279,547

$

270,556

$

184,063

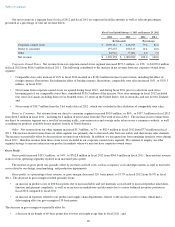

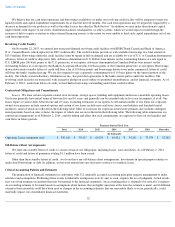

Fiscal Year Ended

February 2,

2014

February 3,

2013

January 29,

2012

(% of net revenue)

Net revenue

100.0

100.0

100.0

Cost of goods sold

47.2

44.3

43.1

Gross profit

52.8

55.7

56.9

Selling, general and administrative expenses

28.2

28.2

28.2

Income from operations

24.6

27.5

28.7

Other income (expense), net

0.4

0.3

0.2

Income before provision for income taxes

25.0

27.8

28.9

Provision for income taxes

7.4

8.0

10.4

Net income

17.6

19.8

18.5

Net income attributable to non-controlling interest

—

0.1

0.1

Net income attributable to lululemon athletica inc.

17.6

19.7

18.4