Lululemon 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

useful live intangible assets might be impaired. We use our best estimates and judgment based on available evidence in conducting the

impairment testing. When the carrying amount exceeds the fair value, an impairment loss is recognized in an amount equal to the excess of the

carrying value over its fair market value.

Stock-Based Compensation. We account for stock-based compensation using the fair value method. The fair value of awards granted is

estimated at the date of grant and recognized as employee compensation expense on a straight-line basis over the requisite service period with

the offsetting credit to additional paid-in capital. Our calculation of stock-based compensation requires us to make a number of complex and

subjective estimates and assumptions, including future forfeitures, stock price volatility, expected life of the options and related tax effects. The

estimation of stock awards that will ultimately vest requires judgment, and to the extent actual results differ from our estimates, such amounts

will be recorded as a cumulative adjustment in the period estimates are revised. We consider several factors when estimating expected

forfeitures, such as types of awards, size of option holder group and anticipated employee retention. Actual results may differ substantially from

these estimates. Expected volatility of the stock is based on our review of companies we believe of similar growth and maturity and our peer

group in the industry in which we do business because we do not have sufficient historical volatility data for our own stock. The expected term

of options granted is derived from the output of the option valuation model and represents the period of time that options granted are expected to

be outstanding. In the future, as we gain historical data for volatility in our own stock and the actual term employees hold our options, expected

volatility and expected term may change which could substantially change the grant-date fair value of future awards of stock options and,

ultimately, the expense we record. For awards with service and/or performance conditions, the total amount of compensation expense to be

recognized is based on the number of awards that are expected to vest and is adjusted to reflect those awards that do ultimately vest. For awards

with performance conditions, we recognize the compensation expense over the requisite service period as determined by a range of probability

weighted outcomes. For awards with market and or performance conditions, all compensation expense is recognized if it is probable that the

underlying market or performance conditions will be fulfilled.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Market risk represents the risk of loss that may impact our financial position due to adverse changes in financial market prices and rates.

Our market risk exposure is primarily a result of fluctuations in interest rates and foreign currency exchange rates. We do not hold or issue

financial instruments for trading purposes.

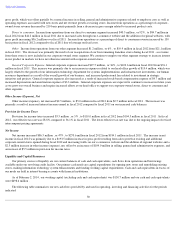

Foreign Currency Exchange Risk. We currently generate a significant portion of our net revenue in Canada. The reporting currency for

our consolidated financial statements is the U.S. dollar. Historically, our operations were based largely in Canada. As of February 2, 2014 , we

operated 54 stores in Canada. As a result, we have been impacted by changes in exchange rates and may be impacted materially for the

foreseeable future. As we recognize net revenue from sales in Canada in Canadian dollars, and the U.S. dollar has strengthened during fiscal

2013 , it has had a negative impact on our Canadian operating results upon translation of those results into U.S. dollars for the purposes of

consolidation. However, the loss in net revenue was partially offset by lower cost of sales and lower selling, general and administrative expenses

that are generated in Canadian dollars. A 10% depreciation in the relative value of the Canadian dollar compared to the U.S. dollar would have

resulted in lost income from operations of approximately $0.8 million in fiscal 2013 and approximately $5.5 million in fiscal 2012 . To the

extent the ratio between our net revenue generated in Canadian dollars increases as compared to our expenses generated in Canadian dollars, we

expect that our results of operations will be further impacted by changes in exchange rates. A portion of our net revenue is generated in

Australia. A 10% depreciation in the relative value of the Australian dollar compared to the U.S. dollar would have resulted in lost income from

operations of approximately $0.3 million in fiscal 2013 and approximately $0.9 million in fiscal 2012 . We do not currently hedge foreign

currency fluctuations. However, in the future, in an effort to mitigate losses associated with these risks, we may at times enter into derivative

financial instruments, although we have not historically done so. We do not, and do not intend to, engage in the practice of trading derivative

securities for profit.

Interest Rate Risk.

In November 2013, we entered into unsecured demand revolving credit facilities with HSBC Bank Canada and Bank of

America, N.A., Canada Branch. The revolving credit facilities provide us with available borrowings in amount up to $15.0 million total. Because

our revolving credit facilities bear interest at a variable rate, we will be exposed to market risks relating to changes in interest rates, if we have a

meaningful outstanding balance. As of February 2, 2014 we had no outstanding balances under our revolving facilities. We currently do not

engage in any interest rate hedging activity and currently have no intention to do so in the foreseeable future. However, in the future, if we have

a meaningful outstanding balance under our revolving facility, in an effort to mitigate losses associated with these risks, we may at times enter

into derivative financial instruments, although we have not historically done so. These may take the form of forward contracts, option contracts,

or interest rate swaps. We do not, and do not intend to, engage in the practice of trading derivative securities for profit.

35