Lululemon 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

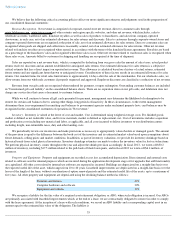

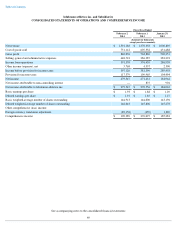

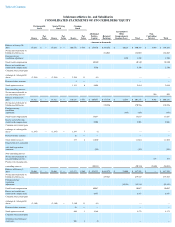

lululemon athletica inc. and Subsidiaries

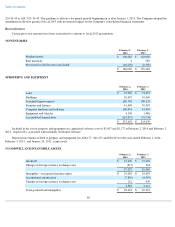

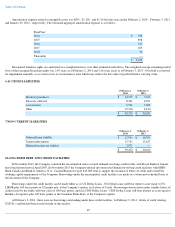

CONSOLIDATED STATEMENTS OF CASH FLOWS

See accompanying notes to the consolidated financial statements

42

Fiscal Year Ended

February 2,

2014

February 3,

2013

January 29,

2012

(Amounts in thousands)

Cash flows from operating activities

Net income

$

279,547

$

271,431

$

184,964

Items not affecting cash

Depreciation and amortization

49,068

43,000

30,259

Stock-based compensation

10,087

15,637

10,340

Derecognition of unredeemed gift card liability

(4,654

)

(1,351

)

(1,775

)

Deferred income taxes

820

(6,445

)

(693

)

Excess tax benefits from stock-based compensation

(6,457

)

(9,901

)

(5,750

)

Other, including net changes in other non-cash balances

Prepaid tax installments

3,067

(7,812

)

(4,030

)

Other prepaid expenses and other current assets

(14,408

)

(10,492

)

5,374

Inventories

(37,407

)

(51,022

)

(46,072

)

Accounts payable

11,627

(13,481

)

7,861

Accrued liabilities

13,722

(208

)

1,027

Sales tax collected

161

(4,232

)

8,232

Income taxes payable

(35,075

)

30,951

(3,951

)

Accrued compensation and related expenses

(6,282

)

4,695

5,976

Deferred gift card revenue

9,306

13,711

6,110

Other non-cash balances

5,217

5,632

5,743

Net cash provided by operating activities

278,339

280,113

203,615

Cash flows from investing activities

Purchase of property and equipment

(106,408

)

(93,229

)

(116,657

)

Acquisition of franchises

—

—

(

5,654

)

Net cash used in investing activities

(106,408

)

(93,229

)

(122,311

)

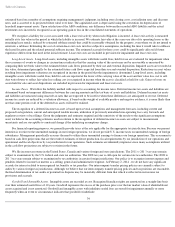

Cash flows from financing activities

Proceeds from exercise of stock options

8,171

11,014

9,614

Excess tax benefits from stock-based compensation

6,457

9,901

5,750

Registration fees associated with shelf registration statement

—

(

393

)

—

Purchase of non-controlling interest

—

(

26,013

)

—

Taxes paid related to net share settlement of equity awards

(5,721

)

—

—

Net cash provided by (used in) financing activities

8,907

(5,491

)

15,364

Effect of exchange rate changes on cash

(72,368

)

(651

)

(3,517

)

Increase in cash and cash equivalents

108,470

180,742

93,151

Cash and cash equivalents, beginning of period

$

590,179

$

409,437

$

316,286

Cash and cash equivalents, end of period

$

698,649

$

590,179

$

409,437