Lululemon 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

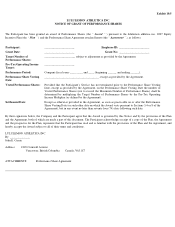

(h) “ Section 409A Deferred Compensation ”

means compensation payable pursuant to the Award granted to a

Participant subject to United States income taxation that constitutes nonqualified deferred compensation for purposes of Section 409A.

1.2 Construction .

Captions and titles contained herein are for convenience only and shall not affect the meaning or

interpretation of any provision of this Agreement. Except when otherwise indicated by the context, the singular shall include the plural and the

plural shall include the singular. Use of the term “or” is not intended to be exclusive, unless the context clearly requires otherwise.

2. ADMINISTRATION .

All questions of interpretation concerning the Grant Notice, this Agreement and the Plan shall be determined by the Board. All

determinations by the Board shall be final and binding upon all persons having an interest in the Award. Any executive officer of the Company

shall have the authority to act on behalf of the Company with respect to any matter, right, obligation, or election which is the responsibility of or

which is allocated to the Company herein, provided such executive officer has apparent authority with respect to such matter, right, obligation, or

election. The Company intends that the Award comply with Section 409A (including any amendments or replacements of such section), and the

provisions of this Agreement shall be construed and administered in a manner consistent with this intent.

3. THE AWARD .

3.1 Grant of Performance Shares.

On the Grant Date, the Participant shall acquire, subject to the provisions of this

Agreement, a right to receive a number of Performance Shares which shall not exceed the Maximum Number of Performance Shares set forth in

the Grant Notice, subject to adjustment as provided in Section 9. The number of Performance Shares, if any, ultimately earned by the Participant,

shall be that number of Performance Shares which become Vested Performance Shares.

3.2 No Monetary Payment Required.

The Participant is not required to make any monetary payment (other than applicable

tax withholding, if any) as a condition to receiving the Performance Shares or the Common Shares issued upon settlement of the Performance

Shares, the consideration for which shall be past services actually rendered and/or future services to be rendered to the Company (or any

Affiliate) or for its benefit. Notwithstanding the foregoing, if required by applicable state corporate law, the Participant shall furnish

consideration in the form of cash or past services rendered to the Company (or any Affiliate) or for its benefit having a value not less than the par

value of the Common Shares issued upon settlement of the Performance Shares.

4. CERTIFICATION OF THE BOARD .

4.1 Level of Pre-Tax Operating Income Attained.

As soon as practicable following completion of the Performance

Period, and in any event prior to the Performance Share Vesting Date, the Board shall certify in writing the level of attainment of Pre-

Tax

Operating Income during the Performance Period and the resulting number of Performance Shares which shall become Vested Performance

Shares on the Performance Share Vesting Date, subject to the Participant’

s continued Service until the Performance Share Vesting Date, except

as otherwise provided by Section 5. The Company shall promptly notify the Participant of the determination by the Board.

4.2 Adjustment to Pre-Tax Operating Income for Extraordinary Items. The Board shall adjust Pre-

Tax Operating

Income, as it deems appropriate, to exclude the effect (whether positive or negative) of any of the following occurring after the grant of the

Award: (a) a change in accounting standards required by generally accepted accounting principles or (b) any extraordinary, unusual or

nonrecurring item. Each such adjustment, if any, shall be made solely for the purpose of providing a consistent basis from period to period for

the calculation of Pre-Tax Operating Income in order to prevent the dilution or enlargement of the Participant’s rights with respect to the Award.

5. VESTING OF PERFORMANCE SHARES .

5.1 In General.

Except as provided by this Section 5 and Section 8, the Performance Shares shall vest and become Vested

Performance Shares as provided in the Grant Notice and certified by the Board.

5.2 Effect of Leave of Absence.

Unless otherwise required by law, in the event that the Participant has taken in excess of

thirty (30) days in a leave or leaves of absence during the period beginning on the Grant Date and ending on the Performance Share Vesting

Date, the Performance Share Vesting Date will be deferred for a period of time equal to the duration