Lululemon 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our focus on building foundation will also extend to our other categories, including our men’s and ivivva business, where we see potential for

future expansion. We believe our strong cash flow generation, solid balance sheet and healthy liquidity provide us with the financial flexibility to

execute the initiatives which will continue to lead our profitable growth.

Operating Segment Overview

lululemon is a designer and retailer of technical athletic apparel operating primarily in North America and Australia. Our yoga-inspired

apparel is marketed under the lululemon athletica and ivivva athletica brand names. We offer a comprehensive line of apparel and accessories

including pants, shorts, tops and jackets designed for athletic pursuits such as yoga, running and general fitness, and dance-inspired apparel for

female youth. As of February 2, 2014 , our branded apparel was principally sold through 254 corporate-owned stores that are located in the

United States, Canada, Australia and New Zealand and via our e-commerce websites through our direct to consumer sales channel. We believe

our vertical retail strategy allows us to interact more directly with and gain insights from our customers while providing us with greater control

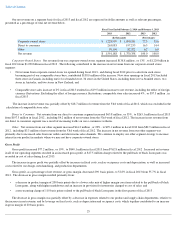

of our brand. In fiscal 2013 , 66% of our net revenue was derived from sales of our products in the United States, 29% of our net revenue was

derived from sales of our products in Canada and 5% of our net revenue was derived from sales of our products outside of North America. In

fiscal 2012 , 61% of our net revenue was derived from sales of our products in the United States, 34% of our net revenue was derived from sales

of our products in Canada and 5% of our net revenue was derived from sales of our products outside of North America. In fiscal 2011 , 53% of

our net revenue was derived from sales of our products in the United States, 43% of our net revenue was derived from sales of our products in

Canada and 4% of our net revenue was derived from sales of our products outside of North America.

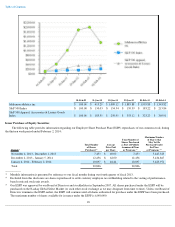

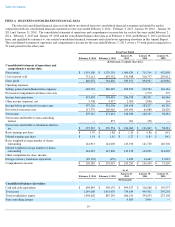

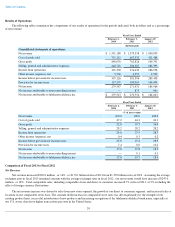

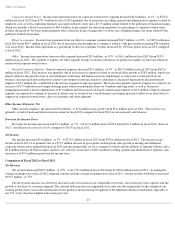

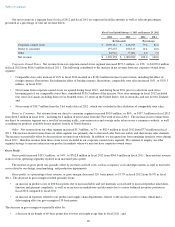

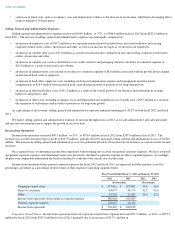

Our net revenue increased from $1.4 billion in fiscal 2012 to $1.6 billion in fiscal 2013 , representing an annual growth rate of 16% . Our

increase in net revenue from fiscal 2012 to fiscal 2013 resulted from the addition of 43 net new retail locations, and comparable store sales

growth of 2% in fiscal 2013 , excluding the impact of the 53rd week in fiscal 2012. Our total comparable sales, which includes comparable store

sales and direct to consumer, were 7% in fiscal 2013, excluding the impact of the 53rd week in fiscal 2012. Our ability to open new stores and

grow sales in existing stores has been driven by increasing demand for our technical athletic apparel and a growing recognition of the lululemon

athletica brand. We believe our superior products, strategic store locations, inviting store environment and distinctive corporate culture are

responsible for our strong financial performance.

We have three reportable segments: corporate-owned stores, direct to consumer and other. We report our segments based on the financial

information we use in managing our businesses. While we receive financial information for each corporate-owned store, we have aggregated all

of the corporate-owned stores into one reportable segment due to the similarities in the economic and other characteristics of these stores.

As of February 2, 2014 , we sold our products through 254 corporate-owned stores located in the United States, Canada, Australia, and

New Zealand. We plan to increase our net revenue in North America and Australia by opening additional corporate

-owned stores in new and

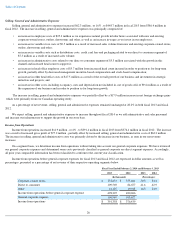

existing markets. Corporate-owned stores accounted for 77.3% of total net revenue in fiscal 2013 , 79.6% of total net revenue in fiscal 2012 and

81.6% of total net revenue in fiscal 2011 .

As of February 2, 2014 , our direct to consumer segment included our lululemon and ivivva e-commerce websites. E-commerce sales are

taken directly from retail customers through www.lululemon.com and www.ivivva.com and other country and region specific websites. Our

direct to consumer segment is an increasingly substantial part of our growth strategy, and now represents 16.5% of our net revenue compared to

14.4% in fiscal 2012 and 10.6% in fiscal 2011 .

In addition to deriving revenue from sales through our corporate-owned stores and direct to consumer, we also derive other net revenue,

which includes outlet, wholesale, and warehouse sales and as well as sales through a number of company-operated showrooms and temporary

locations. Outlets as well as warehouse sales, which are typically held one or more times a year, are both to sell slow moving inventory or

inventory from prior seasons to retail customers at discounted prices. Wholesale customers include select premium yoga studios, health clubs

and fitness centers. Our showrooms are typically small locations that we open from time to time when we enter new markets and feature a

limited selection of our product offering during select hours. Our temporary locations are typically opened for the holiday season in markets in

which we may not already have a presence. We reacquired our four remaining franchise stores during fiscal 2011, and as such, franchise sales,

which included inventory sales and royalties, are no longer a part of our other net revenue. Other net revenue accounted for 6.2%

of total revenue

in fiscal 2013 compared to 6.0% in fiscal 2012 and 7.8% of total net revenue in fiscal 2011 .

We believe that our athletic apparel has and will continue to appeal to consumers outside of North America who value its technical

attributes as well as its function and style. In 2004, we opened our first store in Australia which was operated under a franchise license. In fiscal

2009 we made a 13% equity investment in lululemon athletica australia Pty, our franchise operator. During fiscal 2010 we increased our

investment to 80% which provided us with control over lululemon athletica australia Pty. During fiscal 2012 we purchased the remaining non-

controlling interest in lululemon athletica australia Pty. In fiscal 2008, we

21