Lululemon 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

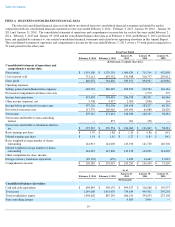

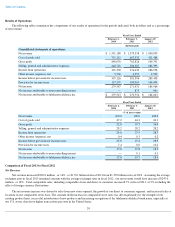

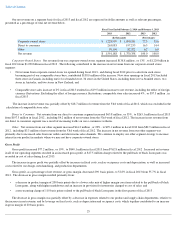

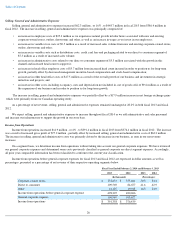

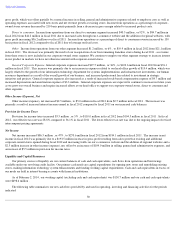

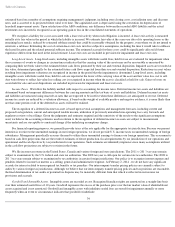

Our net revenue on a segment basis for fiscal 2012 and fiscal 2011 are expressed in dollar amounts as well as relevant percentages,

presented as a percentage of total net revenue below.

Corporate-Owned Stores. Net revenue from our corporate-owned stores segment increased $273.3 million , or 33% , to $1,090.2 million

in fiscal 2012 from $816.9 million in fiscal 2011 . The following contributed to the increase in net revenue from our corporate-owned stores

segment:

Direct to Consumer. Net revenue from our direct to consumer segment increased $90.9 million , or 86% , to $197.3 million in fiscal 2012

from $106.3 million in fiscal 2011 , including $4.2 million of net revenue from the 53rd week of fiscal 2012 . The increase in net revenue from

our direct to consumer segment was a result of increasing traffic, conversion rates and average order value on our e-commerce website, as well

as making our products available in new markets outside of North America.

Other. Net revenue from our other segment increased $5.3 million , or 7% , to $82.9 million in fiscal 2012 from $77.6 million in fiscal

2011 . The increase in net revenue from our other segment was primarily due to increased sales from our outlets and showrooms sales channels.

The increase was partially offset by decreased net revenue from wholesale. In addition, we reacquired our four remaining franchise stores during

fiscal 2011 , therefore revenue from these stores is now included in our corporate-owned stores segment. We continue to employ our other

segment strategy to increase interest in our product in markets where we may not have corporate-owned stores.

Gross Profit

Gross profit increased $193.5 million , or 34% , to $762.8 million in fiscal 2012 from $569.4 million in fiscal 2011 . Increased net revenue

in most of our operating segments resulted in an increased gross profit.

The increase in gross profit was partially offset by increases in fixed costs, such as occupancy costs and depreciation, as well as increased

costs related to our design, merchandising, and production departments.

Gross profit, as a percentage of net revenue, or gross margin, decreased 120 basis points, to 55.7% in fiscal 2012 from 56.9% in fiscal

2011 . The decrease in gross margin resulted primarily from:

The decrease in gross margin was partially offset by:

28

Fiscal Year Ended February 3, 2013 and January 29, 2012

2012

2011

2012

2011

(In thousands)

(Percentages)

Corporate-owned stores

$

1,090,181

$

816,925

79.6

81.6

Direct to consumer

197,255

106,313

14.4

10.6

Other

82,922

77,601

6.0

7.8

Net revenue

$

1,370,358

$

1,000,839

100.0

100.0

• Comparable store sales increase of 16% in fiscal 2012 resulted in a $118.3 million increase to net revenue, including the effect of

foreign currency fluctuations. Excluding the effect of foreign currency fluctuations, comparable store sales increased 16% , or $119.3

million , in fiscal 2012 ;

•

Net revenue from corporate

-owned stores we opened during fiscal 2012 , and during fiscal 2011 prior to sales from such stores

becoming part of our comparable stores base, contributed $136.3 million of the increase. New store openings in fiscal 2012 included

four stores in Canada, including three ivivva branded stores, 27 stores in the United States, five in Australia, and one in New Zealand;

and

•

Net revenue of

$18.7 million from the 53rd week of fiscal 2012

, which was excluded in the calculation of comparable store sales.

• an increase in product costs of 200 basis points due to increased labor and raw materials costs related to increased product innovation,

function and garment complexity, as well as an increase in markdowns and discounts due to a more balanced inventory position in

fiscal 2012 compared to fiscal 2011 ;

• an increase in expenses related to our product and supply chain departments, relative to the increase in net revenue, which had a

deleveraging effect on gross margin of 30 basis points.

• a decrease in air freight of 60 basis points due to lower air freight usage than in fiscal 2011

; and