Lululemon 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Company's operations and negatively impact earnings. Further, the Company may not be able to obtain adequate insurance to protect it from

these types of litigation matters or extraordinary business losses.

In addition to the legal matters described above, the Company is, from time to time, involved in routine legal matters incidental to its

business. The company believes the ultimate resolution of any such current proceeding will not have a material adverse effect on its continued

financial position, results of operations or cash flows.

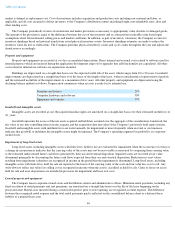

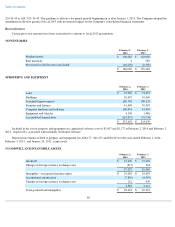

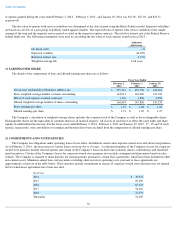

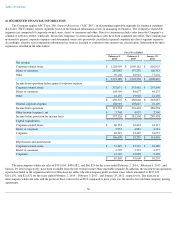

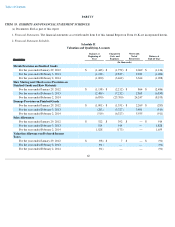

13 RELATED PARTY BALANCES AND TRANSACTIONS

The Company entered into the following transactions with related parties:

The Company's principal stockholder owns a retail space that the Company leases for one of its corporate-owned stores. Consulting fees

were paid to a relative of our principal stockholder.

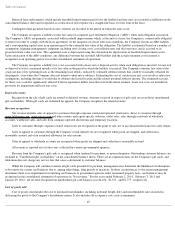

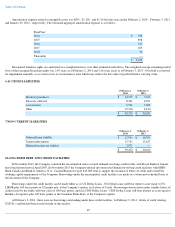

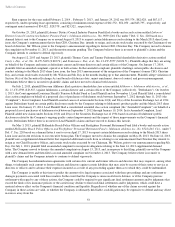

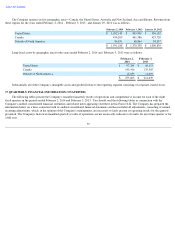

14 SUPPLEMENTAL CASH FLOW INFORMATION

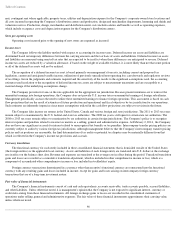

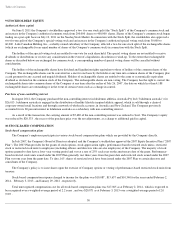

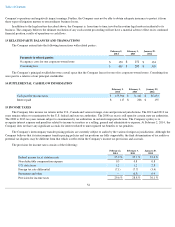

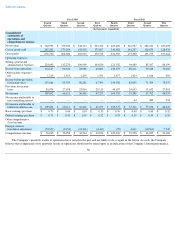

15 INCOME TAXES

The Company files income tax returns in the U.S., Canada and various foreign, state and provincial jurisdictions. The 2012 and 2013 tax

years remain subject to examination by the U.S. federal and state tax authorities. The 2008 tax year is still open for certain state tax authorities.

The 2008 to 2013 tax years remain subject to examination by tax authorities in certain foreign jurisdictions. The Company's policy is to

recognize interest expense and penalties related to income tax matters as a selling, general and administrative expense. At February 2, 2014 , the

Company does not have any significant accruals for interest related to unrecognized tax benefits or tax penalties.

The Company's intercompany transfer pricing policies are currently subject to audits by the various foreign tax jurisdictions. Although the

Company believes that its intercompany transfer pricing policies and tax positions are fully supportable, the final determination of tax audits or

potential tax disputes may be different from that which is reflected in the Company's income tax provisions and accruals.

The provision for income taxes consists of the following:

54

February 2,

2014

February 3,

2013

January 29,

2012

Payments to related parties

Occupancy costs for one corporate-owned store

$

150

$

151

$

134

Consulting fees

$

409

$

295

$

305

February 2,

2014

February 3,

2013

January 29,

2012

Cash paid for income taxes

$

155,394

$

71,342

$

85,633

Interest paid

$

117

$

206

$

155

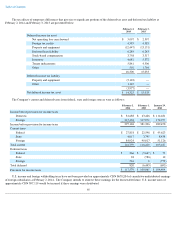

February 2,

2014

February 3,

2013

January 29,

2012

Federal income tax at statutory rate

35.0

%

35.0

%

35.0

%

Non-deductible compensation expense

0.5

0.8

0.8

U.S. state taxes

1.2

1.2

2.8

Foreign tax rate differential

(7.1

)

(7.7

)

(3.4

)

Permanent and other

—

(

0.5

)

0.9

Provision for income taxes

29.6

%

28.8

%

36.1

%