Lululemon 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Lululemon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

rent, contingent rent where applicable, property taxes, utilities and depreciation expense for the Company's corporate-owned store locations and

all costs incurred in operating the Company's distribution centers and production, design and merchandise departments, hemming and shrink and

valuation reserves. Production, design, merchandise and distribution center costs include salaries and benefits as well as operating expenses,

which include occupancy costs and depreciation expense for the Company's distribution centers.

Store pre

-opening costs

Operating costs incurred prior to the opening of new stores are expensed as incurred.

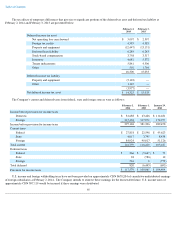

Income taxes

The Company follows the liability method with respect to accounting for income taxes. Deferred income tax assets and liabilities are

determined based on temporary differences between the carrying amounts and the tax basis of assets and liabilities. Deferred income tax assets

and liabilities are measured using enacted tax rates that are expected to be in effect when these differences are anticipated to reverse. Deferred

income tax assets are reduced by a valuation allowance, if based on the weight of available evidence, it is more likely than not that some portion

or all of the deferred tax assets will not be realized.

The recognition of a deferred income tax asset is based primarily on management's forecasts, including current and proposed tax

legislation, current and anticipated taxable income, utilization of previously unrealized non-operating loss carryforwards and regulatory reviews

of tax filings. Given the judgments and estimates required and the sensitivity of the results to the significant assumptions used, the accounting

estimates used in relation to the recognition of deferred income tax assets are subject to measurement uncertainty and are susceptible to a

material change if the underlying assumptions change.

The Company provides for taxes at the rate applicable for the appropriate tax jurisdiction. Because present intentions are to reinvest the

unremitted earnings into foreign operations, the Company does not provide U.S. income taxes on unremitted earnings of foreign subsidiaries.

Management periodically assesses the need to utilize these unremitted earnings to finance foreign operations. This assessment is based on cash

flow projections that are the result of estimates of future production and operational and fiscal objectives by tax jurisdiction for our operations.

Such estimates are inherently imprecise since many assumptions utilized in the cash flow projections are subject to revision in the future.

The Company files income tax returns in the United States, Canada and various foreign and state jurisdictions. The 2011 to 2013 tax years

remain subject to examination by the U.S. federal and state tax authorities. The 2008 tax year is still open for certain state tax authorities. The

2008 to 2013 tax years remain subject to examination by tax authorities in certain foreign jurisdictions. The Company's policy is to recognize

interest expense and penalties related to income tax matters as a selling, general and administrative expense. At February 2, 2014 , the Company

does not have any significant accruals for interest related to unrecognized tax benefits or tax penalties. Intercompany transfer pricing policies are

currently subject to audits by various foreign tax jurisdictions. Although management believes that the Company's intercompany transfer pricing

policies and tax positions are reasonable, the final determination of tax audits or potential tax disputes may be materially different from that

which is reflected in the Company's income tax provisions and accruals.

Currency translation

The functional currency for each entity included in these consolidated financial statements that is domiciled outside of the United States

(the foreign entities) is the applicable local currency. Assets and liabilities of each foreign entity are translated into U.S. dollars at the exchange

rate in effect on the balance sheet date. Revenue and expenses are translated at the average rate in effect during the period. Unrealized translation

gains and losses are recorded as a cumulative translation adjustment, which is included in other comprehensive income or loss, which is a

component of accumulated other comprehensive income or loss included in stockholders' equity.

Foreign currency transactions denominated in a currency other than an entity's functional currency are remeasured into the functional

currency with any resulting gains and losses included in income, except for gains and losses arising on intercompany foreign currency

transactions that are of a long-term investment nature.

Fair value of financial instruments

The Company's financial instruments consist of cash and cash equivalents, accounts receivable, trade accounts payable, accrued liabilities,

and other liabilities. Unless otherwise noted, it is management's opinion that the Company is not exposed to significant interest, currency or

credit risks arising from these financial instruments. All foreign exchange gains or losses are recorded in the consolidated statements of

operations under selling, general and administrative expenses. The fair value of these financial instruments approximates their carrying value,

unless otherwise noted.

46