JVC 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC 2000 31

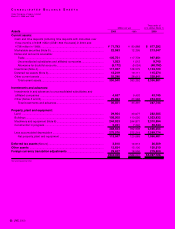

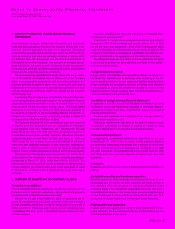

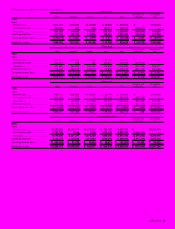

Thousands of U.S. dollars

Contract Book Market Unrealized

March 31, 2000 amount value value gain (loss)

Option contracts:

Call:

To sell U.S. dollars............ $122,311 $462 $1,245 $(783)

To sell Euros..................... 20,311 151 94 57

Put:

To sell U.S. dollars............ 35,368 189 1,047 (858)

To sell Euros..................... 9,292 104 85 19

Call:

To buy U.S. dollars ........... 11,887 —104 104

Put:

To buy U.S. dollars ........... 122,057 698 1,915 1,217

To buy Euros .................... 20,311 255 236 (19)

Millions of yen

Contract Market Unrealized

March 31, 2000 amount value gain (loss)

Swap contracts:

Receive fix/pay floating ............... ¥9,561 ¥(10) ¥(10)

Pay fix/receive floating ................ 5,000 2 2

Thousands of U.S. dollars

Contract Market Unrealized

March 31, 2000 amount value gain (loss)

Swap contracts:

Receive fix/pay floating ............... $90,198 $(94) $(94)

Pay fix/receive floating ................ 47,170 19 19

The forward contracts on the foreign currency receivable and

payables translated into Japanese yen at the forward exchange rate on

the accompanying consolidated financial statements were not included

in the above amounts.

The fair value of forward exchange contracts are estimated based

on market prices for contracts with similar terms.

The fair value of option contracts and interest rate swap contracts

are estimated based on the quotes obtained from financial institutions.

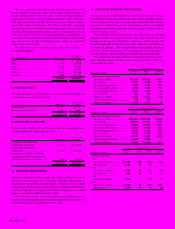

12. LEASE INFORMATION

The Company and its consolidated subsidiaries lease certain buildings

and structures, vehicles, machinery and equipment and other assets

under non-capitalized finance and operating leases. Finance leases

which do not transfer ownership to lessees are not capitalized and are

accounted for in the same manner as operating leases. Certain infor-

mation for such non-capitalized finance and operating leases is as fol-

lows.

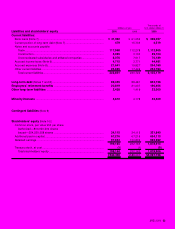

(1) A summary of assumed amounts of acquisition cost, accumulated

depreciation and net book value at March 31, 2000 and 1999 are as

follows:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2000:

Buildings and structures .................. ¥ 2,035 ¥1,226 ¥ 809

Vehicles, machinery and

equipment ...................................... 5,738 2,849 2,889

Tools, furniture and fixtures .............. 11,699 5,742 5,957

Leasehold rights .............................. 109 66 43

Software.......................................... 167 103 64

¥19,748 ¥9,986 ¥9,762

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

1999:

Buildings and structures .................. ¥ 1,335 ¥ 386 ¥ 949

Vehicles, machinery and

equipment ...................................... 6,455 3,293 3,162

Tools, furniture and fixtures .............. 11,395 5,412 5,983

Leasehold rights .............................. 234 142 92

Software.......................................... 153 74 79

¥19,572 ¥9,307 ¥10,265

Thousands of U.S. dollars

Acquisition Accumulated Net book

cost depreciation value

2000:

Buildings and structures .................. $ 19,198 $11,566 $ 7,632

Vehicles, machinery and

equipment ...................................... 54,132 26,877 27,255

Tools, furniture and fixtures .............. 110,368 54,170 56,198

Leasehold rights .............................. 1,028 623 405

Software ......................................... 1,576 972 604

$186,302 $94,208 $92,094

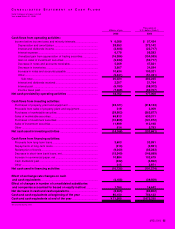

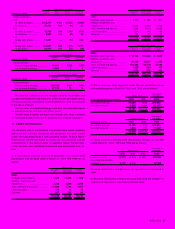

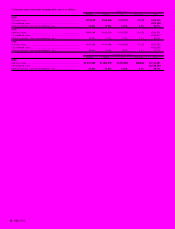

(2) Future minimum lease payments under the non-capitalized finance

and operating leases at March 31, 2000 and 1999 are as follows:

Thousands of

Millions of yen U.S. dollars

Non-capitalized finance leases 2000 1999 2000

Due within one year ..................... ¥3,694 ¥ 3,802 $34,849

Due after one year ....................... 6,068 6,463 557,245

¥9,762 ¥10,265 $92,094

Thousands of

Millions of yen U.S. dollars

Operating leases 2000 1999 2000

Due within one year ..................... ¥1,125 ¥ 670 $10,613

Due after one year ....................... 1,824 971 517,208

¥2,949 ¥1,641 $27,821

(3) Lease payments and assumed depreciation charges for the year

ended March 31, 2000, 1999 and 1998 are as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 1998 2000

Lease payments ............. ¥3,119 ¥3,276 ¥3,352 $29,425

Assumed depreciation

charges.......................... 3,119 3,276 —29,425

Assumed depreciation charges were not required to be disclosed in

1998.

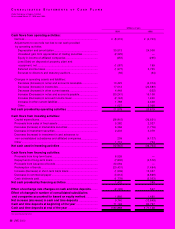

(4) Assumed depreciation charges are computed using the straight-line

method over lease terms assuming no residual value.