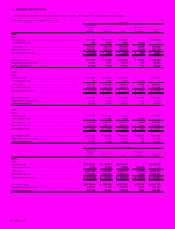

JVC 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 JVC 2000

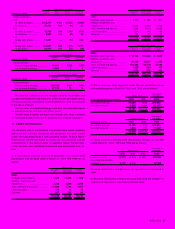

The 1.5% unsecured convertible bonds are redeemable prior to their

stated maturity, in whole or in part, at the option of the Company at

prices ranging from 107% to 100% of the principal amount,

respectively. The price at which shares of common stock shall be is-

sued upon conversion is ¥2,867 ($27.05) per share, subject to adjust-

ment under certain circumstance. The 0.35% and 0.55% unsecured

convertible bonds are redeemable prior to their stated maturity, in whole

or in part, at the option of the Company at prices ranging from 102% to

100% and 103% to 100% of the principal amount, respectively. For

both issues, the price at which shares of common stock shall be issued

upon conversion is ¥1,487 ($14.03) per share, subject to adjustment

under certain circumstance.

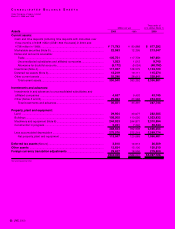

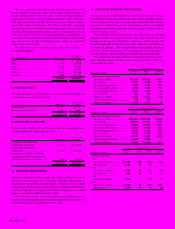

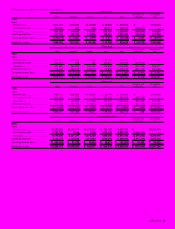

The aggregate annual maturities of long-term debt at March 31,

2000 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2001 ................................................... ¥ 479 $ 4,519

2002 ................................................... 11,187 105,538

2003 ................................................... 26,149 246,689

2004 ................................................... 7,274 68,622

2005 ................................................... 12,970 122,358

Thereafter............................................ 44,31,855 300,519

........................................................... ¥89,914 $848,245

8. PLEDGED ASSETS

The following assets were pledged as collateral for long-term debt and

accrued expenses at March 31, 2000:

Thousands of

Millions of yen U.S. dollars

Investments......................................... ¥ 8 $ 75

Machinery and equipment ................... 221 2,085

........................................................... ¥229 $2,160

9. CONTINGENT LIABILITIES

The contingent liabilities of the Company and its consolidated sub-

sidiaries at March 31, 2000 were as follows:

Thousands of

Millions of yen U.S. dollars

As endorser of export bills

discounted with banks........................ ¥ 6,119 $ 57,726

As guarantor for loans to

employees.......................................... 17,209 162,350

As guarantor for loan to affiliated

company and lease obligations of

affiliated company and others............. 1,125 10,613

........................................................... ¥24,453 $230,689

10. STOCKHOLDERS’ EQUITY

Under the Commercial Code of Japan (the “Code”), at least 50% of the

issue price of new shares, with a minimum of the par value thereof, is

required to be designated as stated capital. The portion which is to be

designated as stated capital is determined by resolution of the Board of

Directors. Proceeds in excess of the amounts designated as stated

capital are credited to additional paid-in capital.

The maximum amount that the Company can distribute as divi-

dends is calculated based on the unconsolidated financial statements

of the Company and in accordance with the Code.

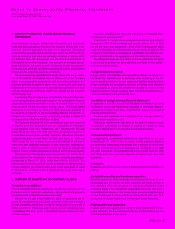

11. DERIVATIVE FINANCIAL INSTRUMENTS

The Company and its consolidated subsidiaries uses derivative financial

instruments in the normal course of their business to manage the expo-

sure to fluctuations in foreign exchange rates and interest rates. The pri-

mary classes of derivatives used by the Company and its consolidated

subsidiaries are forward exchange contracts, option contracts and in-

terest rate swap contracts.

These derivative financial transactions are utilized solely for hedging

purposes under the internal control rules and executed by the

Company’s accounting department and those authorized by the

Director responsible for accounting matters under the supervision by

the Board of Directors. The Company does not anticipate any credit

loss from nonperformance by the counterparties to the forward ex-

change contracts, option contracts and interest rate swap contracts.

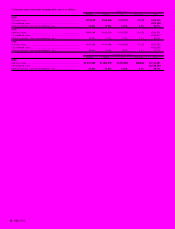

The outstanding contract amounts of derivative financial transac-

tions, their book values and their market values at March 31, 2000 are

summarized as follows:

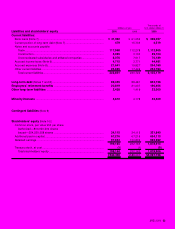

Millions of yen

Contract Market Unrealized

March 31, 2000 amount value gain (loss)

Forward exchange contracts:

To sell U.S. dollars...................... ¥51,691 ¥51,430 ¥261

To sell Euros ............................... 14,828 13,909 919

To sell Sterling pounds................ 3,883 3,718 165

To sell Canadian dollars .............. 2,500 2,399 101

To sell Singapore dollars............. 2,400 2,347 53

To sell Others.............................. 596 562 34

To buy U.S. dollars ..................... 15,342 15,037 (305)

To buy Singapore dollars ............ 312 312 0

To buy Thai bahts ....................... 1,570 1,604 34

Thousands of U.S. dollars

Contract Market Unrealized

March 31, 2000 amount value gain (loss)

Forward exchange contracts:

To sell U.S. dollars...................... $487,651 $485,189 $2,462

To sell Euros ............................... 139,887 131,217 8,670

To sell Sterling pounds................ 36,632 35,075 1,557

To sell Canadian dollars .............. 23,585 22,632 953

To sell Singapore dollars............. 22,642 22,142 500

To sell Others.............................. 5,623 5,302 321

To buy U.S. dollars ..................... 144,735 141,858 (2,877)

To buy Singapore dollars ............ 2,943 2,943 0

To buy Thai bahts ....................... 14,811 15,132 321

Millions of yen

Contract Book Market Unrealized

March 31, 2000 amount value value gain (loss)

Option contracts:

Call:

To sell U.S. dollars............ ¥12,965 ¥49 ¥132 ¥ (83)

To sell Euros..................... 2,153 16 10 6

Put:

To sell U.S. dollars............ 3,749 20 111 (91)

To sell Euros..................... 985 11 9 2

Call:

To buy U.S. dollars ........... 1,260 —11 11

Put:

To buy U.S. dollars ........... 12,938 74 203 129

To buy Euros .................... 2,153 27 25 (2)