JVC 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC 2000 25

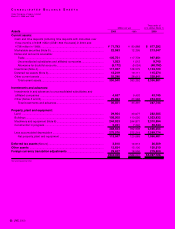

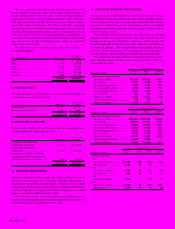

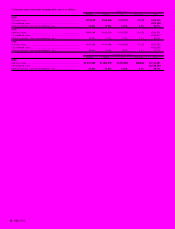

Thousands of

Millions of yen U.S. dollars (Note 1)

2000 2000

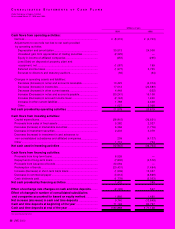

Cash flows from operating activities:

Income before income taxes and minority interests............................. ¥6,088 $ 57,434)

Depreciation and amortization......................................................... 28,953 273,142

Interest and dividends income......................................................... (2,408) (22,717)

Interest expense.............................................................................. 6,178 58,283

Unrealized gain from appreciation of trading securities.................... (16,386) (154,585)

Gain on sales of investment securities............................................. (6,330) (59,717)

Decrease in notes and accounts receivable.................................... 5,069 47,821

Decrease in inventories ................................................................... 3,667 34,594

Increase in notes and accounts payable ......................................... 10,634 100,321

Other............................................................................................... (5,441) (51,331)

Sub-total..................................................................................... 30,024 283,245

Interest and dividends received ....................................................... 2,307 21,764

Interest paid .................................................................................... (6,180) (58,302)

Income taxes paid........................................................................... (7,389) (69,707)

Net cash provided by operating activities ........................................ 18,762 177,000

Cash flows from investing activities:

Purchases of property, plant and equipment ....................................... (23,121) (218,123)

Proceeds from sales of property, plant and equipment........................ 319 3,009

Purchases of marketable securities ..................................................... (59,983) (565,877)

Sales of marketable securities ............................................................. 66,813 630,311

Purchases of investment securities...................................................... (10,809) (101,972)

Sales of investment securities.............................................................. 11,999 113,198

Other................................................................................................... 614 5,793

Net cash used in investing activities ................................................. (14,168) (133,661)

Cash flows from financing activities:

Proceeds from long-term loans ........................................................... 3,603 33,991

Repayments of long-term loans........................................................... (316) (2,981)

Redemption of bonds.......................................................................... (9,040) (85,283)

Decrease in short-term bank loans, net............................................... (15,549) (146,689)

Increase in commercial paper, net ....................................................... 10,884 102,679

Cash dividends paid ............................................................................ (632) (5,962)

Other................................................................................................... 315 2,971

Net cash used in financing activities ................................................ (10,735) (101,274)

Effect of exchange rate changes on cash

and cash equivalents .......................................................................... (4,188) (39,509)

Effect of changes in number of consolidated subsidiaries

and companies accounted for based on equity method................ 1,764 16,642

Net decrease in cash and cash equivalents...................................... (8,565) (80,802)

Cash and cash equivalents at beginning of the year ...................... 80,150 756,132

Cash and cash equivalents at end of the year ................................. ¥71,585 $ 675,330

See accompanying notes.

CONSOLIDATED STATEMENT OF CASH FLOWS

Victor Company of Japan, Limited

Year ended March 31, 2000