JVC 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20 JVC 2000

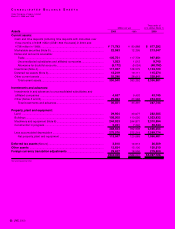

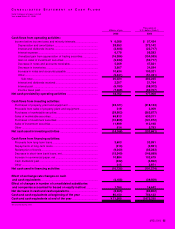

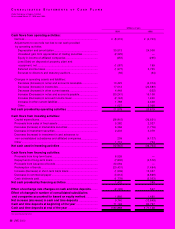

As a result, free cash flows totaled ¥4,594 million (US$43.3

million). Cash and cash equivalents at end of the year de-

creased 10.7% to ¥71,585 million (US$675.3 million) com-

pared with cash and cash equivalents at beginning of the year.

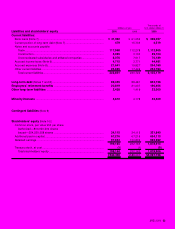

Financial Position Total assets decreased ¥47,642

million (US$449.5 million) to ¥540,359 million (US$5,097.7

million) as a result of efforts to reduce assets to improve asset

efficiency.

Total current assets declined ¥32,812 million (US$309.5

million), owing to a reduction in inventories and a decrease in

notes and accounts receivable. Total current liabilities de-

creased ¥17,893 million (US$168.8 million) as debt was re-

paid. As a result, working capital fell ¥14,919 million

(US$140.7 million) to ¥127,709 million (US$1,204.8 million)

compared with the previous fiscal year. The current ratio de-

creased from 1.59 to 1.57.

Interest-bearing debt decreased ¥33,370 million

(US$314.8 million) to ¥131,896 million (US$1,244.3 million).

Stockholders’ equity fell ¥32,998 million (US$311.3 million)

to ¥199,164 million (US$1,878.9 million) on account of a re-

duction in consolidated retained earnings in accordance with

the application of tax-effect accounting and the net loss

recorded during the term. Stockholders’ equity as a percent-

age of total assets was 36.9% compared with 39.5% in the

previous fiscal year. Stockholders’ equity per share was

¥783.41 (US$7.39).

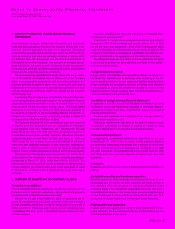

Forward-Looking Statements When included in

this annual report, the words “will,” “should,” “expects,”

“intends,” “anticipates,” “estimates,”and similar expressions,

among others, identify forward-looking statements. Such

statements are inherently subject to a variety of risks and

uncertainties that could cause actual results to differ materially

from those set forth in such statements. These forward-

looking statements are made only as of the date of this

annual report. The Company expressly disclaims any

obligations or undertaking to release any update or revision to

any forward-looking statement contained herein to reflect any

change in the Company’s expectations with regard thereto or

any change in events, conditions or circumstances on which

any statement is based.

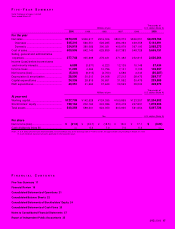

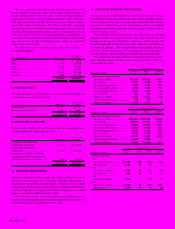

Stockholders’ Equity/Total Assets (Billions of yen)

562

604

624

588

540

1996

1997

1998

1999

2000

Capital Expenditures/Depreciation & Amortization (Billions of yen)

36.7

30.5

28.8

28.6

24.3

24.0

27.2

31.6

28.5

30.5 1996

1997

1998

1999

2000

248

250

243

232

199

Stockholders’ Equity

Capital Expenditures Depreciation & Amortization