JVC 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

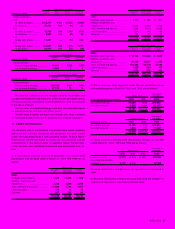

JVC 2000 27

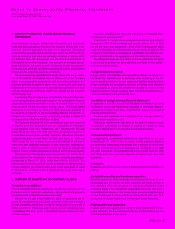

1. BASIS OF PRESENTING CONSOLIDATED FINANCIAL

STATEMENTS

Victor Company of Japan, Limited (the “Company”) and its consoli-

dated domestic subsidiaries maintain their accounts and records in ac-

cordance with the provisions set forth in the Japanese Commercial

Code and the Securities and Exchange Law and in conformity with ac-

counting principles and practices generally accepted in Japan, which

are different from the accounting and disclosure requirements of

International Accounting Standards. The accounts of overseas consoli-

dated subsidiaries are based on their accounting records maintained in

conformity with generally accepted accounting principles and practices

prevailing in the respective countries of domicile.

The accompanying consolidated financial statements are a transla-

tion of the audited consolidated financial statements of the Company

which were prepared in accordance with accounting principles and

practices generally accepted in Japan from the accounts and records

maintained by the Company and its consolidated subsidiaries and were

filed with the Ministry of Finance (“MOF”) as required by the Securities

and Exchange Law.

In preparing the accompanying consolidated financial statements,

certain reclassifications have been made in the consolidated financial

statements issued domestically in order to present them in a form

which is more familiar to readers outside Japan. The consolidated

statements of cash flows for 1999 and 1998 have been prepared for

the purpose of inclusion in the consolidated financial statements, al-

though such statements were not customarily prepared in Japan and

not required to be filed with MOF prior to 2000.

The Company prepared the 2000 consolidated cash flow statement

as required by and in accordance with the “Standards for Preparation

of Consolidated Cash Flow Statements, etc.” effective from the year

ended March 31, 2000. The 1999 and 1998 consolidated statements

of cash flows have not been restated. Significant differences in the con-

solidated statement of cash flows for 2000 and those for 1999 and

1998 include the use of pretax income in 2000 instead of net loss in

1999 and 1998, additional disclosure in cash flows from operating ac-

tivities in 2000 of interest expense, income tax expense, interest and

dividend income, interest and dividend received and income taxes paid.

The translation of the Japanese yen amounts into U.S. dollars are in-

cluded solely for the convenience of the reader, using the prevailing ex-

change rate at March 31, 2000, which was ¥106 to U.S.$1.00. The

convenience translations should not be construed as representations

that the Japanese yen amounts have been, could have been, or could

in the future be, converted into U.S. dollars at this or any other rate of

exchange.

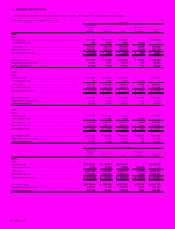

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of consolidation

The consolidated financial statements include the accounts of the

Company and its significant subsidiaries. All significant intercompany

transactions and accounts have been eliminated.

Effective for the year ended March 31, 2000, all companies are re-

quired to consolidate all significant investees which are controlled

through substantial ownership of majority voting rights or existence of

certain conditions. Previously, only majority-owned companies were

consolidated. The prior years’ consolidated financial statements have

not been restated.

The effect of applying this rule to the Company’s consolidated finan-

cial statements was immaterial.

Investments in certain unconsolidated subsidiaries and affiliated

companies (20% to 50% owned and certain others 15% to 20%

owned) are, with minor exceptions, stated at their underlying net equity

value after elimination of unrealized intercompany profits and losses. The

Company’s investments in its remaining subsidiaries and affiliated com-

panies are immaterial in the aggregate, and are stated at cost or less.

The differences between acquisition cost and underlying net equity

at the time of acquisition are generally being amortized on the straight-

line method over five years.

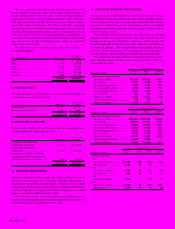

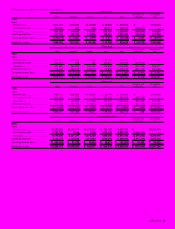

Foreign currency translation

Current assets and liabilities denominated in foreign currencies are

translated into Japanese yen at exchange rates prevailing at the bal-

ance sheet dates, and non-current assets and liabilities denominated in

foreign currencies are translated at historical exchange rates. Resulting

exchange gains or losses are credited or charged to income for the

respective periods. Foreign currency items with forward exchange con-

tracts are translated at the contracted rates.

Translation of foreign currency financial statements

In accordance with the Accounting Standards for Foreign Currency

Translations, assets and liabilities are translated at exchange rates pre-

vailing at the balance sheet dates. Stockholders’ equity is translated at

historical exchange rates.

Revenue and expenses are translated at the average exchange

rates during the respective years.

Differences resulting from translation of the balance sheet of foreign

consolidated subsidiaries are debited or credited to “foreign currency

translation adjustments” in the accompanying balance sheets.

Cash and cash equivalents

In preparing the consolidated statement of cash flows for the year

ended March 31, 2000, cash on hand, readily available deposits

and short-term highly liquid investments with maturities of not exceed-

ing three months at the time of purchase are considered to be cash

and cash equivalents. Consolidated statements of cash flows for 1999

and 1998 used cash and time deposits instead of cash and cash

equivalents.

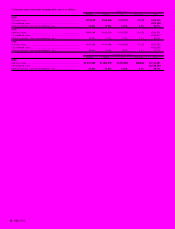

Inventories

Inventories are stated at cost, which is determined by the average cost

method.

Marketable securities and investment securities

Securities quoted on stock exchanges are stated at the lower of mov-

ing average cost or market. All other securities are stated at cost or

less, reflecting write-downs based on significant impairment of the

underlying equity, if not considered recoverable. Securities held by the

consolidated subsidiaries in the United States are accounted for based

on the Statement of Financial Accounting Standards No. 115,

Accounting for Certain Investments in Debts and Equity Securities.

Property, plant and equipment

Property, plant and equipment is stated at cost. Depreciation is com-

puted primarily by the declining-balance method based on the

estimated useful lives of the assets.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Victor Company of Japan, Limited

Years ended March 31, 2000, 1999 and 1998