Enom 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-34

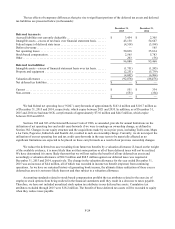

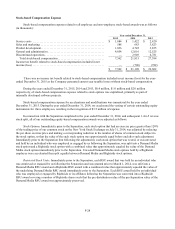

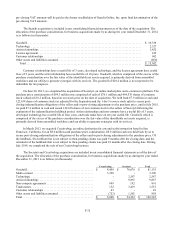

Revenue by geographic region, as determined based on the location of our customers or the anticipated destination

of use was as follows:

Year ended December 31,

2015

2014

2013

Domestic ....................................................

$

107,258

$

152,437

$

196,499

International ..................................................

18,711

19,992

12,912

Total revenue .........................................

$

125,969

$

172,429

$

209,411

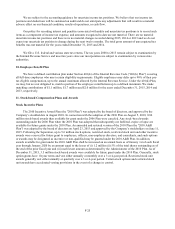

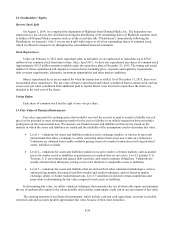

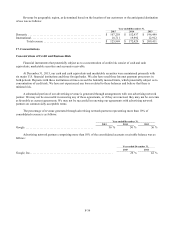

17. Concentrations

Concentrations of Credit and Business Risk

Financial instruments that potentially subject us to a concentration of credit risk consist of cash and cash

equivalents, marketable securities and accounts receivable.

At December 31, 2015, our cash and cash equivalents and marketable securities were maintained primarily with

six major U.S. financial institutions and three foreign banks. We also have used three Internet payment processors in

both periods. Deposits with these institutions at times exceed the federally insured limits, which potentially subject us to

concentration of credit risk. We have not experienced any losses related to these balances and believe that there is

minimal risk.

A substantial portion of our advertising revenue is generated through arrangements with one advertising network

partner. We may not be successful in renewing any of these agreements, or if they are renewed, they may not be on terms

as favorable as current agreements. We may not be successful in renewing our agreements with advertising network

partners on commercially acceptable terms.

The percentage of revenue generated through advertising network partners representing more than 10% of

consolidated revenue is as follows:

Year ended December 31,

2015

2014

2013

Google ................................................

36

%

50

%

56

%

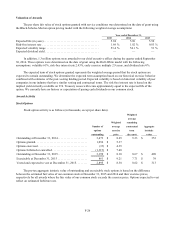

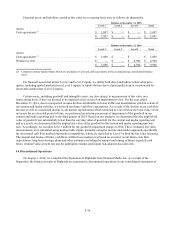

Advertising network partners comprising more than 10% of the consolidated accounts receivable balance was as

follows:

Year ended December 31,

2015

2014

Google, Inc. ..........................................................

26

%

42

%