Enom 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-12

x Third party brands, publishers, and advertisers who engage us to create and publish content in a wide variety

of formats including text articles and blogs, videos, original photography, slideshows, and infographics.

Content sales accounts receivable are generally due within 30 to 60 days;

x Direct advertisers who engage us to deliver branded advertising impressions. Accounts receivable from

direct advertisers are recorded at negotiated advertising rates (customarily based on advertising impressions)

and as the related advertising is delivered over our owned and operated websites. Direct advertising accounts

receivable are generally due within 30 to 60 days from the date the advertising services are delivered and

billed;

x Customers who syndicate our content over their websites in exchange for a share of related advertising

revenue. Accounts receivable from these customers are recorded as the revenue share as reported by the

underlying customers and are generally due within 30 days.

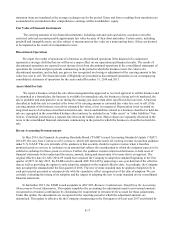

We maintain an allowance for doubtful accounts to reserve for potentially uncollectible receivables from our

customers based on our best estimate of the amount of probable losses in existing accounts receivable. We determine the

allowance based on an analysis of historical bad debts, advertiser concentrations, advertiser credit-worthiness and current

economic trends. In addition, past due balances over 60 days and specific other balances are reviewed individually for

collectability at least quarterly.

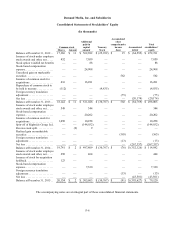

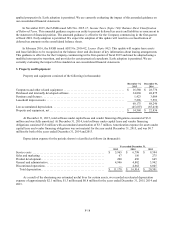

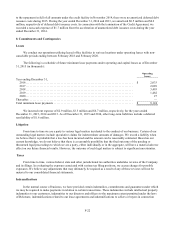

The allowance for doubtful account activity is as follows (in thousands):

Balance at

Charged to

Balance at

beginning of

costs and

Write-offs, net

end of

period

expenses

of recoveries

period

December 31, 2015 ....

$

218

$

52

$

(73)

$

197

December 31, 2014 ....

$

340

$

—

$

(122)

$

218

December 31, 2013 ....

$

369

$

61

$

(90)

$

340

Deferred Revenue

Deferred revenue consists of amounts received from or invoiced to customers before we have met all four criteria

for the recognition of revenue. Deferred revenue includes payments received from sales of our products on Society6

prior to delivery of such products; payments made for original art and prints sold via Saatchi Art that are collected prior

to the completion of the return period; amounts billed to custom content customers prior to delivery of content; and sales

of subscriptions for premium content or services not yet delivered.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the

straight-line method over the estimated useful lives of the assets. Computer equipment is amortized over three years,

software is amortized over two to three years, and furniture and fixtures are amortized over five years. Leasehold

improvements are amortized straight-line over the shorter of the remaining lease term or the estimated useful lives of the

improvements ranging from one to ten years. Upon the sale or retirement of property or equipment, the cost and related

accumulated depreciation or amortization is removed from our financial statements with the resulting gain or loss

reflected in our results of operations. Repairs and maintenance costs are expensed as incurred. In the event that property

and equipment is no longer in use, we will record a loss on disposal of the property and equipment, which is computed as

difference between the sales price, if any, and the net remaining value (gross amount of property and equipment less

accumulated depreciation expense) of the related equipment at the date of disposal.