Enom 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-29

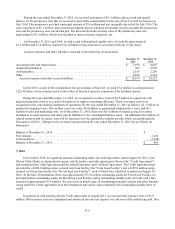

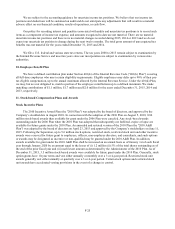

12. Stockholders’ Equity

Reverse Stock Split

On August 1, 2014, we completed the Separation of Rightside from Demand Media, Inc. The Separation was

structured as a pro rata tax-free dividend involving the distribution of all outstanding shares of Rightside common stock

to holders of Demand Media common stock as of the record date (the “Distribution”). Immediately following the

Distribution, we enacted a 1-for-5 reverse stock split with respect to all of our outstanding shares of common stock,

which is reflected retrospectively throughout the consolidated financial statements.

Stock Repurchases

Under our February 8, 2012 stock repurchase plan, as amended, we are authorized to repurchase up to $50.0

million of our common stock from time to time. Since April 2013, we have not repurchased any shares of common stock.

Approximately $19.2 million remains available under the repurchase plan at December 31, 2015. The timing and actual

number of shares repurchased will depend on various factors including price, corporate and regulatory requirements,

debt covenant requirements, alternative investment opportunities and other market conditions.

Shares repurchased by us are accounted for when the transaction is settled. As of December 31, 2015, there were

no unsettled share repurchases. The par value of shares repurchased and retired is deducted from common stock and any

excess over par value is deducted from additional paid in capital. Direct costs incurred to repurchase the shares are

included in the total cost of the shares.

Voting Rights

Each share of common stock has the right to one vote per share.

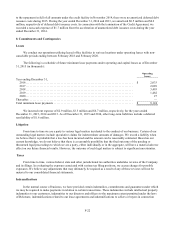

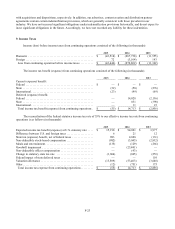

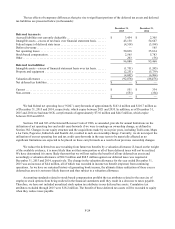

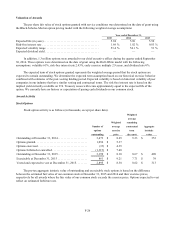

13. Fair Value of Financial Instruments

Fair value represents the exchange price that would be received for an asset or paid to transfer a liability (an exit

price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market

participants on the measurement date. We measure our financial assets and liabilities in three levels, based on the

markets in which the assets and liabilities are traded and the reliability of the assumptions used to determine fair value.

x Level 1—valuations for assets and liabilities traded in active exchange markets, or interest in open-end

mutual funds that allow a company to sell its ownership interest back at net asset value on a daily basis.

Valuations are obtained from readily available pricing sources for market transactions involving identical

assets, liabilities or funds.

x Level 2—valuations for assets and liabilities traded in less active dealer, or broker markets, such as quoted

prices for similar assets or liabilities or quoted prices in markets that are not active. Level 2 includes U.S.

Treasury, U.S. government and agency debt securities, and certain corporate obligations. Valuations are

usually obtained from third-party pricing services for identical or comparable assets or liabilities.

x Level 3—valuations for assets and liabilities that are derived from other valuation methodologies, such as

option pricing models, discounted cash flow models and similar techniques, and not based on market

exchange, dealer, or broker traded transactions. Level 3 valuations incorporate certain assumptions and

projections in determining the fair value assigned to such assets or liabilities.

In determining fair value, we utilize valuation techniques that maximize the use of observable inputs and minimize

the use of unobservable inputs to the extent possible and consider counterparty credit risk in our assessment of fair value.

The carrying amounts of our financial instruments, which include cash and cash equivalents, accounts receivable,

restricted cash and accounts payable approximate fair value because of their short maturities.