Enom 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.40

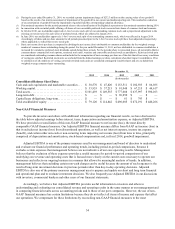

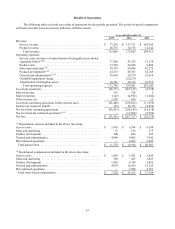

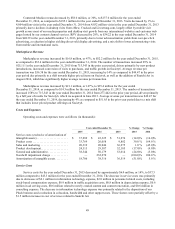

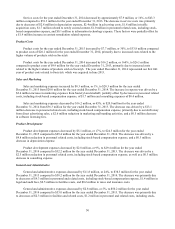

Sales and Marketing

Sales and marketing expenses consist primarily of sales and marketing personnel costs, sales support, public

relations, advertising, marketing and general promotional expenditures. Fluctuations in our sales and marketing expenses

are generally the result of our efforts to drive growth in our product and service offerings. We currently anticipate that

our sales and marketing expenses will increase in the near term as a percentage of revenue as we grow our marketing

activities across all our platforms, especially our studioD and Marketplaces offerings.

Product Development

Product development expenses consist primarily of expenses incurred in our software engineering, product

development and web design activities and related personnel costs. Fluctuations in our product development expenses

are generally the result of hiring personnel to support and develop our platforms, including the costs to improve our

owned and operated online properties and related mobile applications, as well as the costs to develop future product and

service offerings. We currently anticipate that our product development expenses will remain relatively flat in the near

term as a percentage of revenue.

General and Administrative

General and administrative expenses consist primarily of personnel costs from our executive, legal, finance,

human resources and information technology organizations and facilities related expenditures, as well as third-party

professional fees and insurance. Professional fees are largely comprised of outside legal, audit and information

technology consulting. We currently anticipate that general and administrative expenses will decrease in the near term as

a percentage of revenue due to managed reduction of expenses.

Amortization of Intangible Assets

We capitalize certain costs (i) allocated to the purchase price of certain identifiable intangible assets acquired in

connection with business combinations and (ii) incurred to develop media content that is determined to have a probable

economic benefit. We amortize these costs on a straight-line basis over the related expected useful lives of these assets.

We determine the appropriate useful life of intangible assets by performing an analysis of expected cash flows based on

our historical experience of intangible assets of similar quality and value. In the event of content remediation in future

periods, additional accelerated amortization expense may be incurred in the periods such actions occur. We expect

amortization expense related to business combinations to decrease in the near term due to fewer acquisitions as

compared to prior years. Amortization as a percentage of revenue will depend upon a variety of factors, such as the

amounts and mix of our investments in content and identifiable intangible assets acquired in business combinations.

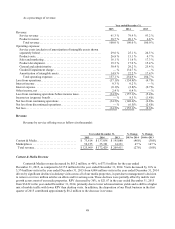

Goodwill

We test goodwill for impairment in the fourth quarter of each year unless there are interim indicators that suggest

that it is more likely than not that goodwill may be impaired. Goodwill is tested at the reporting unit level and as of

December 31, 2015 we determined that we have two reporting units: content and media and marketplaces. We did not

record any goodwill impairment charges for the year ended December 31, 2015. We may be required to record

impairment charges on our remaining goodwill in future periods. For the year ended December 31, 2014, due to

unexpected revenue declines attributed to lower traffic and monetization yields on certain of our content and media

websites, we lowered our future cash flow expectations. As a result, we performed an interim assessment of impairment

of the goodwill in our content and media reporting unit in the third quarter of 2014 and recorded a $232.3 million

goodwill impairment charge in 2014.

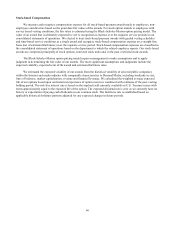

Stock-based Compensation

Included in operating expenses are expenses associated with stock-based compensation, which are allocated and

included in service costs, sales and marketing, product development and general and administrative expenses. Stock-

based compensation expense is largely comprised of costs associated with stock options, restricted stock units and