Enom 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-20

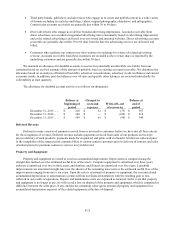

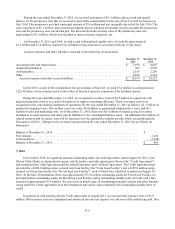

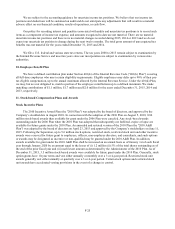

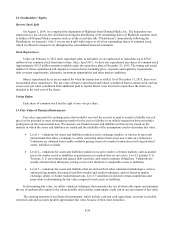

Based upon the current amount of intangible assets subject to amortization, the estimated amortization expense for

the next five years as of December 31, 2015 is as follows (in thousands):

Estimated

Amortization

Year ending December 31,

2016 .............................................................................

$

9,225

2017 .............................................................................

$

5,827

2018 .............................................................................

$

2,967

2019 .............................................................................

$

1,006

2020 .............................................................................

$

575

Thereafter ...........................................................................

$

1,732

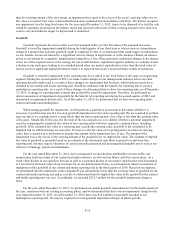

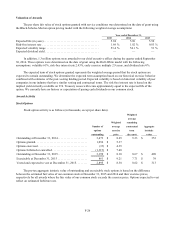

5. Goodwill

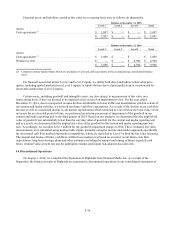

The following table presents the changes in our goodwill balance (in thousands):

Balance at December 31, 2013 ............................................................

$

347,382

Acquisitions ........................................................................

10,358

Dispositions ........................................................................

(12,070)

Spin-off ............................................................................

(103,042)

Goodwill impairment charge ...........................................................

(232,270)

Balance at December 31, 2014 ............................................................

10,358

Balance at December 31, 2015 ............................................................

$

10,358

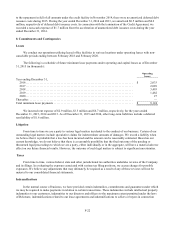

The change in goodwill in 2014 is attributable to the acquisition of Saatchi Online and the disposition of our

Creativebug and CoveritLive businesses. In August 2014, we completed the Separation of Rightside and the

Distribution, and we no longer record goodwill related to Rightside on our balance sheet.

For the year ended December 31, 2014, due to unexpected revenue declines attributable to lower traffic and

monetization yield on certain of our content and media websites, we lowered our future cash flow expectations. As a

result of the decline in our cash flow forecast as well as a sustained decline in our market capitalization which remained

at a level below the book value of our net assets for an extended period of time, we performed an interim assessment of

impairment of the goodwill in our content and media reporting unit in the third quarter of 2014. Based on our analyses,

we determined that the implied fair value of goodwill was substantially lower than the carrying value of goodwill for the

content and media reporting unit and as a result, we determined that the implied fair value of the goodwill in the content

and media reporting unit was zero. Accordingly, we recorded $232.3 million for the goodwill impairment charge in

2014.

We performed our annual impairment analysis in the fourth quarter of 2015, and determined that no impairment of

goodwill existed at December 31, 2015.

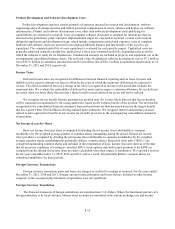

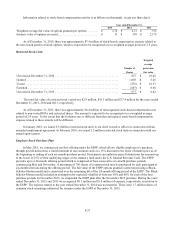

6. Other Balance Sheet Items

Other long term assets consisted of the following (in thousands):

December 31,

December 31,

2015

2014

Long-term portion of promissory note ..........................................

$

—

$

4,505

Other .....................................................................

1,173

1,550

Other assets .............................................................

$

1,173

$

6,055