Enom 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-22

to the repayment in full of all amounts under the credit facility in November 2014, there were no amortized deferred debt

issuance costs during 2015. During the year ended December 31, 2014 and 2013, we amortized $0.5 million and $0.2

million, respectively of deferred debt issuance costs. In connection with the termination of the Credit Agreement, we

recorded a non-cash expense of $1.7 million from the acceleration of unamortized debt issuance costs during the year

ended December 31, 2014.

8. Commitments and Contingencies

Leases

We conduct our operations utilizing leased office facilities in various locations under operating leases with non-

cancelable periods ending between February 2018 and February 2020.

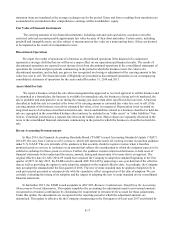

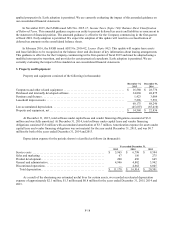

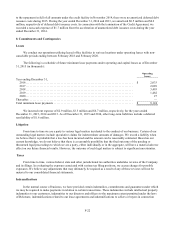

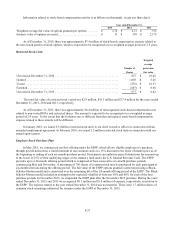

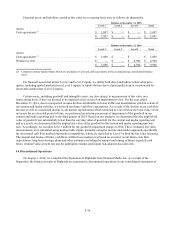

The following is a schedule of future minimum lease payments under operating and capital leases as of December

31, 2015 (in thousands):

Operating

leases

Year ending December 31,

2016 ............................................................................

$

2,033

2017 ............................................................................

2,089

2018 ............................................................................

3,493

2019 ............................................................................

1,482

2020 ............................................................................

27

Thereafter ..........................................................................

—

Total minimum lease payments ........................................................

$

9,124

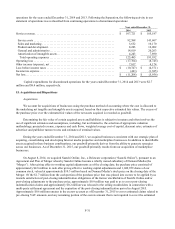

We incurred rent expense of $2.9 million, $3.5 million and $6.7 million, respectively, for the years ended

December 31, 2015, 2014 and 2013. As of December 31, 2015 and 2014, other long-term liabilities include a deferred

rent liability of $1.6 million.

Litigation

From time to time we are a party to various legal matters incidental to the conduct of our business. Certain of our

outstanding legal matters include speculative claims for indeterminate amounts of damages. We record a liability when

we believe that it is probable that a loss has been incurred and the amount can be reasonably estimated. Based on our

current knowledge, we do not believe that there is a reasonable possibility that the final outcome of the pending or

threatened legal proceedings to which we are a party, either individually or in the aggregate, will have a material adverse

effect on our future financial results. However, the outcome of such legal matters is subject to significant uncertainties.

Taxes

From time to time, various federal, state and other jurisdictional tax authorities undertake reviews of the Company

and its filings. In evaluating the exposure associated with various tax filing positions, we accrue charges for possible

exposures. We believe any adjustments that may ultimately be required as a result of any of these reviews will not be

material to our consolidated financial statements.

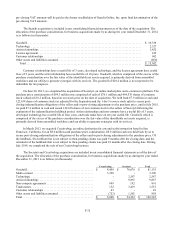

Indemnifications

In the normal course of business, we have provided certain indemnities, commitments and guarantees under which

we may be required to make payments in relation to certain transactions. These indemnities include intellectual property

indemnities to our customers, indemnities to our directors and officers to the maximum extent permitted under the laws

of Delaware, indemnifications related to our lease agreements and indemnifications to sellers or buyers in connection