Enom 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.39

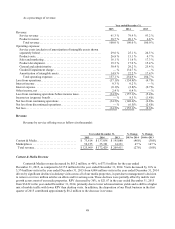

We also generate Content & Media service revenue from the sale or license of media content, including the

creation and distribution of content for third-party brands, advertisers and publishers through our studioD business.

Revenue from the sale or perpetual license of media content is recognized when the content has been delivered and the

contractual performance obligations have been fulfilled. Revenue from the non-perpetual license of media content is

recognized over the period of the license as content is delivered or when other related performance criteria are fulfilled.

In circumstances where we distribute our content on third-party properties and the customer acts as the primary obligor,

we recognize revenue on a net basis. In addition, we previously provided social media services and generated Content &

Media service revenue from recurring management support fees, overage fees in excess of standard usage terms, outside

consulting fees and initial set-up fees. As of February 2015, we no longer provide social media services.

Marketplaces

We generate service revenue from commissions we receive from facilitating the sale of original art by artists to

customers through Saatchi Art. We recognize service revenue arising from the sale of original art net of amounts paid to

the artist because we are not the primary obligor in the transaction, we do not have inventory risk, and we do not

establish the prices for the art sold. We also recognize this service revenue net of any sales allowances. Revenue is

recognized after the original art has been delivered and the return period has expired. Payments received in advance of

delivery and completion of the return period are included in deferred revenue in the accompanying consolidated balance

sheets. We periodically provide incentive offers to customers to encourage purchases, including percentage discounts off

current purchases, free shipping and other offers. Value-added taxes (“VAT”), sales tax and other taxes are not included

in Marketplaces service revenue because we are a pass-through conduit for collecting and remitting any such taxes.

Product Revenue

We recognize product revenue from sales of Society6 products upon delivery, net of estimated returns based on

historical experience. Product revenue for Society6 is recognized net of sales allowances and return allowances. We

recognize product revenue from the sale of prints through Saatchi Art when the prints are delivered and the return period

has expired. Payments received in advance of delivery and, with respect to the Saatchi Art prints, prior to completion of

the return period are included in deferred revenue in the accompanying consolidated balance sheets. Product revenue is

recorded at the gross amount due to the following factors: we are the primary obligor in a transaction, we have inventory

and credit risk, and we have latitude in establishing prices and selecting suppliers. We periodically provide incentive

offers to customers to encourage purchases, including percentage discounts off current purchases, free shipping and

other offers. VAT, sales tax and other taxes are not included in product revenue because we are a pass-through conduit

for collecting and remitting any such taxes.

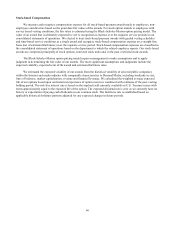

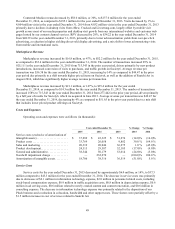

Service Costs

Service costs consist of payments relating to our Internet connection and co-location charges and other platform

operating expenses, including depreciation of the systems and hardware used to build and operate our content creation

and distribution platform; expenses related to creating, rewriting, or auditing certain content units; and personnel costs

related to in-house editorial, customer service and information technology. Service costs also include payments to our

customers pursuant to revenue-sharing arrangements where we are the primary obligor. In the near term, we expect

service costs to decrease as a percentage of revenue primarily as a result of lower personnel and information technology

expenses.

Product Costs

Product costs consist of outsourced product manufacturing costs, artist royalties, and personnel costs. In the near

term, we expect our product costs to remain relatively flat as a percentage of product revenue.

Shipping and Handling

Shipping and handling charged to customers are recorded in service revenue or product revenue, as applicable.

Associated costs are recorded in service costs or product costs.