Enom 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

based compensation expense, and $0.4 million in consulting costs, partially offset by an increase of $0.9 million in

depreciation expense.

Severance Costs

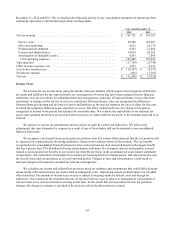

In the year ended December 31, 2015, we implemented a number of initiatives to improve operating efficiency,

including targeted reductions in force in areas where our business model shifted during the year. For the year ended

December 31, 2015, we incurred $2.2 million in severance costs primarily related to certain workforce reduction actions

that occurred during the year. These severance costs were recognized in the consolidated statements of operations for the

year ended December 31, 2015 as follows: $1.1 million in product development costs, $0.6 million in service costs, $0.4

million in general and administrative costs, and $0.1 million in sales and marketing costs. Severance costs include

severance pay, the provision of certain extended employee benefits, and employer taxes. As of December 31, 2015, there

was $0.5 million of accrued severance costs included in accrued expenses and other current liabilities in the consolidated

balance sheet. We will incur additional severance costs currently estimated to be $0.2 million over the applicable

retention periods, which extend through the first quarter of 2016.

Amortization of Intangibles

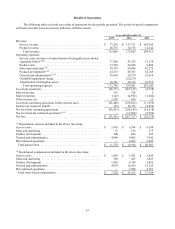

Amortization expense for the year ended December 31, 2015 decreased by $19.6 million, or 51%, to $18.7 million

compared to $38.3 million for the year ended December 31, 2014. The decrease is primarily due to the removal of

certain content units from our media properties in the fourth quarter of 2014 and the disposition of certain intangible

assets in connection with the sales of our Pluck business in the first quarter of 2015 and our Creativebug and CoveritLive

businesses in the third quarter of 2014, offset by an increase in amortization expense from intangible assets acquired

from the Saatchi Art acquisition in the third quarter of 2014.

Amortization expense for the year ended December 31, 2014 increased by $1.8 million, or 5%, to $38.3 million

compared to $36.5 million for the year ended December 31, 2013. The increase is primarily due to additional

amortization expense from intangible assets acquired from the Society6 acquisition in 2013, as well as an increase in

accelerated amortization expense due to our content remediation efforts initiated in the fourth quarter of 2014, partially

offset by lower amortization expense of media content due to our removal of certain content units in the fourth quarter of

2013, and reduced amortization due to the disposition of certain intangible assets in connection with certain business

disposals.

Goodwill Impairment Charge

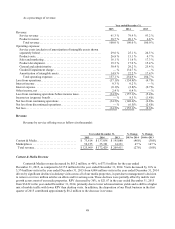

We performed our annual impairment analysis in the fourth quarter of the year ended December 31, 2015, and

based on the results of the annual impairment test there was no goodwill impairment charge for the year ended

December 31, 2015.

For the year ended December 31, 2014, due to unexpected revenue declines attributable to lower traffic and

monetization yield on certain of our content and media websites, we lowered our future cash flow expectations. As a

result of the decline in our cash flow forecast as well as a sustained decline in our market capitalization which remained

at a level below the book value of our net assets for an extended period of time, we performed an interim assessment of

impairment of the goodwill in our content and media reporting unit in the third quarter of 2014. Based on our analyses,

we determined that the implied fair value of goodwill was substantially lower than the carrying value of goodwill for the

content and media reporting unit and that the implied fair value of the goodwill in the content and media reporting unit

was zero. Accordingly, we recorded a $232.3 million goodwill impairment charge in the year ended December 31, 2014.

Interest Income (Expense), Net

Net interest income was approximately $0.2 million for the year ended December 31, 2015, primarily related to

interest income paid to us on the promissory note we received as part of the consideration for our sale of CoveritLive in

July 2014.