Enom 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-18

applied prospectively. Early adoption is permitted. We are currently evaluating the impact of this amended guidance on

our consolidated financial statements.

In November 2015, the FASB issued ASU No. 2015-17, Income Taxes (Topic 740): Balance Sheet Classification

of Deferred Taxes. This amended guidance requires an entity to present deferred tax assets and liabilities as noncurrent in

the statement of financial position. The amended guidance is effective for the Company commencing in the first quarter

of fiscal 2018. Early adoption is permitted. We expect the adoption of this update will result in a reclassification of

deferred tax amounts on the consolidated balance sheets.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). This update will require lease assets

and lease liabilities to be recognized on the balance sheet and disclosure of key information about leasing arrangements.

This guidance is effective for the Company commencing in the first quarter of fiscal 2019 and must be adopted using a

modified retrospective transition, and provides for certain practical expedients. Early adoption is permitted. We are

currently evaluating the impact of this standard on our consolidated financial statements.

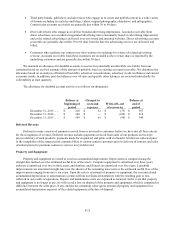

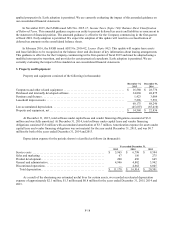

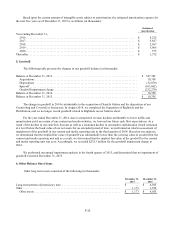

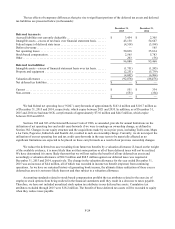

3. Property and Equipment

Property and equipment consisted of the following (in thousands):

December 31,

December 31,

2015

2014

Computers and other related equipment ...........................................

$

16,588

$

28,776

Purchased and internally developed software .......................................

34,868

48,875

Furniture and fixtures ..........................................................

1,423

3,004

Leasehold improvements .......................................................

7,296

7,591

60,175

88,246

Less accumulated depreciation ...................................................

(45,607)

(65,410)

Property and equipment, net .....................................................

$

14,568

$

22,836

At December 31, 2015, total software under capital lease and vendor financing obligations consisted of $3.8

million and was fully amortized. At December 31, 2014, total software under capital lease and vendor financing

obligations consisted $3.8 million with accumulated amortization of $3.7 million. Amortization expense for assets under

capital lease and vendor financing obligations was not material for the year ended December 31, 2015, and was $0.7

million for both of the years ended December 31, 2014 and 2013.

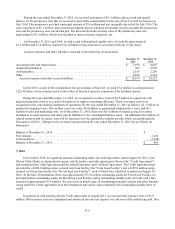

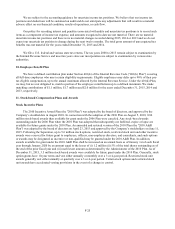

Depreciation expense for the periods shown is classified as follows (in thousands):

Year ended December 31,

2015

2014

2013

Service costs ...................................................

$

5,965

$

6,798

$

9,594

Sales and marketing .............................................

67

156

275

Product development .............................................

200

496

645

General and administrative ........................................

4,946

4,802

3,942

Discontinued operations ..........................................

—

4,662

6,045

Total depreciation .............................................

$

11,178

$

16,914

$

20,501

As a result of the shortening our estimated useful lives for certain assets, we recorded accelerated depreciation

expense of approximately $2.1 million, $1.3 million and $0.8 million for the years ended December 31, 2015, 2014 and

2013.