Enom 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-28

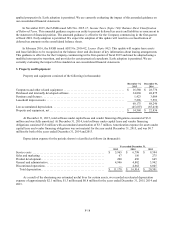

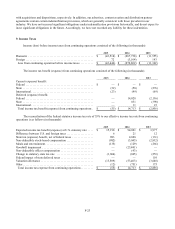

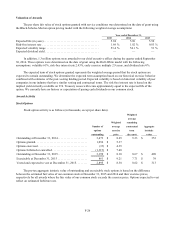

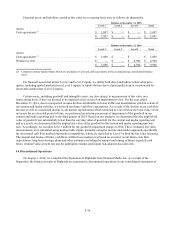

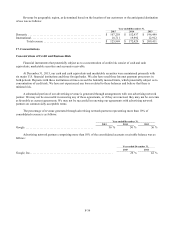

Stock-based Compensation Expense

Stock-based compensation expense related to all employee and non-employee stock-based awards was as follows

(in thousands):

Year ended December 31,

2015

2014

2013

Service costs ...................................................

$

1,084

$

1,422

$

2,420

Sales and marketing .............................................

588

683

3,823

Product development .............................................

1,836

4,745

3,835

General and administrative ........................................

4,054

12,016

12,525

Discontinued operations ..........................................

—

2,949

4,781

Total stock-based compensation .................................

7,562

21,815

27,384

Income tax benefit related to stock-based compensation included in net

income (loss) ...................................................

—

(706)

(782)

$

7,562

$

21,109

$

26,602

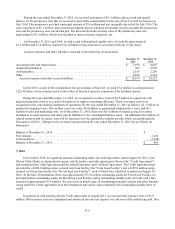

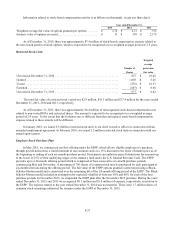

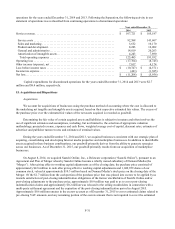

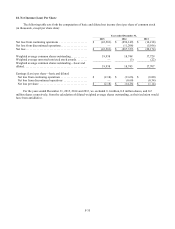

There was no income tax benefit related to stock-based compensation included in net income (loss) for the year-

ended December 31, 2015 as the Company generated current year taxable losses without stock-based compensation.

During the years ended December 31, 2015, 2014 and 2013, $0.4 million, $1.0 million and $2.0 million

respectively, of stock-based compensation expense related to stock options was capitalized, primarily as part of

internally developed software projects.

Stock-based compensation expense for accelerations and modifications was immaterial for the year ended

December 31, 2015. During the year ended December 31, 2014, we accelerated the vesting of certain outstanding equity

instruments for three employees, resulting in the recognition of $3.5 million of expense.

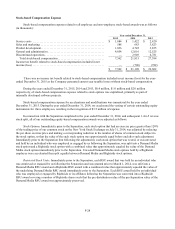

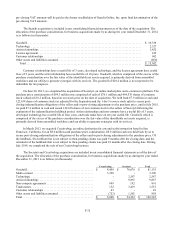

In connection with the Separation completed in the year ended December 31, 2014, and subsequent 1-for-5 reverse

stock split, all of our outstanding equity-based compensation awards were adjusted as follows:

Stock Options. Immediately prior to the Separation, each stock option that had an exercise price greater than 120%

of the trading price of our common stock on the New York Stock Exchange on July 31, 2014, was adjusted by reducing

the per share exercise price and making a corresponding reduction in the number of shares of common stock subject to

the stock option, so that the value of the such stock option was approximately equal before and after such adjustment.

Immediately prior to the Separation (but following the adjustment), each stock option that was vested, or was unvested

and held by an individual who was employed or engaged by us following the Separation, was split into a Demand Media

stock option and a Rightside stock option with a combined value that approximately equaled the value of the Demand

Media stock option immediately prior to the Separation. Unvested Demand Media stock options held by a Rightside

employee were accelerated then split equally between Demand Media and Rightside stock options.

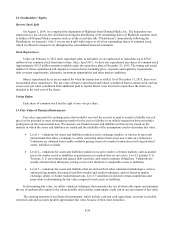

Restricted Stock Units. Immediately prior to the Separation, each RSU award that was held by an individual who

was employed or engaged by us following the Separation and was granted prior to March 1, 2014, was split into a

Demand Media RSU award and a Rightside RSU award with a combined value that approximately equaled the value of

the underlying Demand Media RSU award immediately prior to the Separation. Each RSU award held by an individual

who was employed or engaged by Rightside or its affiliates following the Separation was converted into a Rightside

RSU award covering a number of Rightside shares such that the pre-distribution value of the pre-Separation value of the

Demand Media RSU award was approximately preserved.