Enom 2015 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2015 Enom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-23

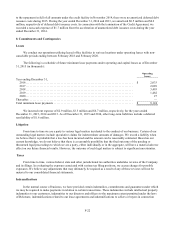

with acquisitions and dispositions, respectively. In addition, our advertiser, content creation and distribution partner

agreements contain certain indemnification provisions, which are generally consistent with those prevalent in our

industry. We have not incurred significant obligations under indemnification provisions historically, and do not expect to

incur significant obligations in the future. Accordingly, we have not recorded any liability for these indemnities.

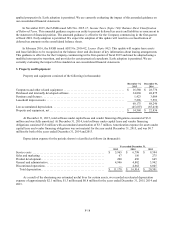

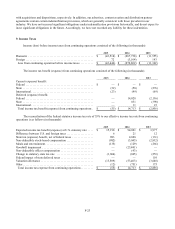

9. Income Taxes

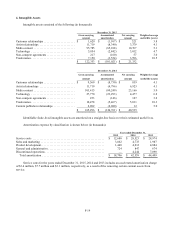

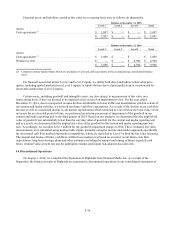

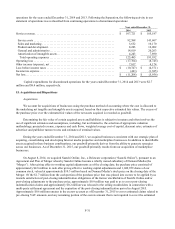

Income (loss) before income taxes from continuing operations consisted of the following (in thousands):

2015

2014

2013

Domestic ..............................................

$

(43,518)

$

(267,758)

$

(11,555)

Foreign ................................................

72

(3,104)

193

Loss from continuing operation before income taxes..........

$

(43,446)

$

(270,862)

$

(11,362)

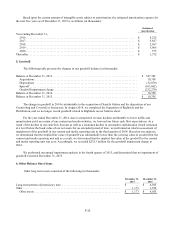

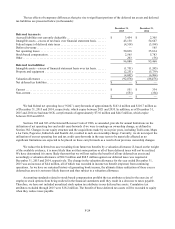

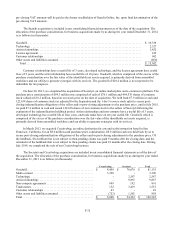

The income tax benefit (expense) from continuing operations consisted of the following (in thousands):

2015

2014

2013

Current (expense) benefit:

Federal ................................................

$

—

$

—

$

—

State ..................................................

(32)

(58)

(276)

International ............................................

(23)

(99)

(69)

Deferred (expense) benefit:

Federal ................................................

—

14,028

(2,136)

State ..................................................

—

831

(398)

International ............................................

—

11

23

Total income tax benefit (expense) from continuing operations .

$

(55)

$

14,713

$

(2,856)

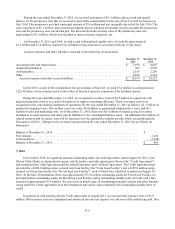

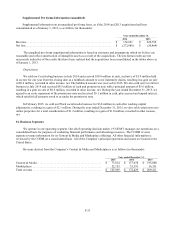

The reconciliation of the federal statutory income tax rate of 35% to our effective income tax rate from continuing

operations is as follows (in thousands):

2015

2014

2013

Expected income tax benefit (expense) at U.S. statutory rate ....

$

15,198

$

94,801

$

3,977

Difference between U.S. and foreign taxes ...................

6

21

12

State tax (expense) benefit, net of federal taxes ...............

983

4,828

(131)

Non-deductible stock-based compensation ...................

(982)

(3,845)

(2,832)

Meals and entertainment ..................................

(135)

(129)

(266)

Goodwill impairment ....................................

—

(25,841)

—

Non-deductible officer compensation .......................

—

(43)

—

Change in statutory state tax rate ..........................

(1,604)

(865)

(253)

Federal impact of state deferred taxes .......................

—

—

110

Valuation allowance .....................................

(13,509)

(53,463)

(3,648)

Other ..................................................

(12)

(751)

175

Total income tax expense from continuing operations .........

$

(55)

$

14,713

$

(2,856)