EasyJet 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com 81

Governance

What are the terms of appointment of the

Non-Executive Directors?

The Chairman, Deputy Chairman and Non-Executive

Directors’ terms of appointment are recorded in

letters of appointment, which are usually renewed

every three years. The required notice from the

Company is three months in all cases. The

Non-Executive Directors are not entitled to any

compensation on loss of office.

OUR ANNUAL REPORT ON

REMUNERATION

Who is on our Remuneration Committee?

The members of the Committee are: Charles

Gurassa (Chairman), David Bennett, Professor Rigas

Doganis and Andy Martin. The responsibilities of the

Committee are set out in the Corporate Governance

section of the Annual Report on page 66.

The CEO attends meetings by invitation and assists

the Committee in its deliberations as appropriate.

The Committee also received assistance from the

Group People Director and the Group Head of

Reward. The Group Company Secretary acts as

secretary to the Committee. No Executive Directors

are involved in deciding their own remuneration.

The Remuneration Committee is advised by New

Bridge Street (“NBS”), a trading name of Aon plc.

NBS was appointed by the Company in 2004. NBS

provided advice keeping the Committee up to date

on developments in executive pay and on the

operation of easyJet’s incentive plans. The total fees

paid to NBS in respect of service to the Committee

during the year were £143,000. NBS is a signatory

to the Remuneration Consultants’ Code of Conduct.

Aon plc also assisted easyJet with operating an

employee engagement survey. The Committee has

reviewed the operating processes in place at NBS

and is satisfied that the advice it receives is

independent and objective.

How will the Remuneration Policy be applied

for the 2014 financial year?

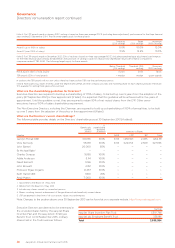

What are the Executive Directors’ current salaries?

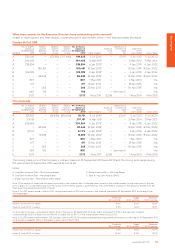

The Executive Directors’ salaries for the 2014

financial year are as follows:

1 January 20141

salary

1 October 2012

salary Change

CEO £681,600 £665,000 2.5%

CFO £420,250 £410,000 2.5%

1 To ensure consistency across the Group, salary increases are

effective from 1 January from 2014 onwards. This is now the

policy on an on-going basis.

How will annual performance be rewarded for

performance in the 2014 financial year?

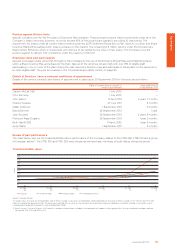

The annual bonus for the 2014 financial year will

operate on the same basis as for 2013 financial year

and will be consistent with the policy detailed in the

Remuneration policy section of this report in terms

of the maximum bonus opportunity, deferral and

clawback provisions. The measures have been

selected to reflect a range of financial and

operational goals that support the key strategic

objectives of the Company.

The performance measures and weightings will

be as follows:

As a percentage of

maximum bonus

opportunity

Measure CEO CFO

Profit before tax 70% 60%

On-time performance 10% 10%

Customer satisfaction targets 10% 10%

Operating costs (excluding fuel)

per seat at constant currency 10% 10%

Departmental objectives – 10%

The proposed target levels for 2014 have been set

to be challenging relative to the 2014 business plan.

The targets themselves, as they relate to the 2014

financial year, are deemed to be commercially

sensitive. However, retrospective disclosure of

the targets and performance against them will

be provided in next year’s remuneration report to

the extent that they do not remain commercially

sensitive at that time. The safety of our customers

and people underpins all of the operational activities

of the Group and the bonus plan includes an

underpin that enables the Remuneration Committee

to scale back the bonus earned in the event that

there is a safety event that occurs that it considers

warrants the use of such discretion.