EasyJet 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 easyJet plc Annual report and accounts 2013

Strategic report

Chief Executive’s review continued

LOOKING FORWARD

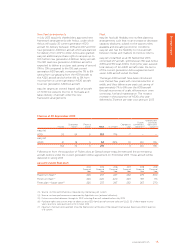

Hedging positions

easyJet operates under a clear set of treasury policies agreed by the Board. The aim of easyJet’s hedging

policy is to reduce short-term earnings volatility. Therefore, easyJet hedges forward, on a rolling basis,

between 65% and 85% of the next 12 months anticipated fuel and currency requirements and between

45% and 65% of the following 12 months anticipated requirements.

Details of current hedging arrangements are set out below:

Percentage of anticipated requirement hedged

Fuel

requirement

US dollar

requirement

Euro

surplus

Six months to 31 March 2014 76% 82% 76%

Average rate $991 m/t $1.57 €1.19

Full year ending 30 September 2014 72% 79% 73%

Average rate $982 m/t $1.57 €1.20

Full year ending 30 September 2015 56% 58% 54%

Average rate $950 m/t $1.56 €1.17

Sensitivities

• A $10 movement per metric tonne impacts the

FY’14 fuel bill by $4.8 million.

• A one cent movement in £/$ impacts the FY’14

profit before tax by £1.2 million.

• A one cent movement in £/€ impacts the FY’14

profit before tax by £1.4 million.

Outlook

easyJet expects to grow capacity, measured in

seats flown, by around 3.5% in the first half of the

year and by 5% for the full year. Forward bookings

for the first half of the 2014 financial year are in line

with the prior year. The first quarter will be impacted

by the tough comparison with the prior year due to

strong post-Olympics demand in the UK in October

2012 and by a number of European governments

imposing travel restrictions to Egypt. The situation in

Egypt will reduce first half revenue per seat growth

at constant currency by 0.7 percentage points, and

the movement of Easter into the second half of the

year will reduce first half revenue per seat growth

at constant currency by a further 1.5 percentage

points. easyJet therefore expects revenue per seat

at constant currency for the first half of the financial

year to be very slightly up on the prior year.

easyJet expects cost per seat (excluding fuel and

currency) to increase by around 2% for the first half

of the year and by 2% for the full year. The cost per

seat increase will principally be driven by charges at

regulated airports and the increased maintenance

costs associated with the fleet ageing in the

transition to the new generation of Airbus aircraft

arriving in the fleet.

The levels of disruption are expected to be higher

than the same period last year as the impact of ATC

strikes and issues such as the power outage at

Gatwick have already led to a year-on-year increase

of 152 cancelled flights in the month of October.

It is estimated that at current exchange rates

and with fuel remaining within its $950 m/t to

$1,050 m/t trading range, easyJet’s unit fuel bill

for the 2014 financial year will be up to £20 million

adverse in the 6 months to 31 March 2014 and

up to £50 million adverse in the 12 months to

30 September 2014. Using current rates and

hedging positions, it is estimated that year-on-year

exchange rate movements (including those

related to fuel) will have an adverse impact of

up to £10 million in the 6 months to 31 March 2014

and be broadly neutral over the 12 months to

30 September 2014.

easyJet will continue to deliver its strategy of

offering its customers low fares to great

destinations with friendly service so that it can

continue to win in a more competitive market. This

means easyJet is well placed to continue to deliver

sustainable returns and growth for shareholders.

Carolyn McCall OBE

Chief Executive