EasyJet 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

www.easyJet.com

Strategic report

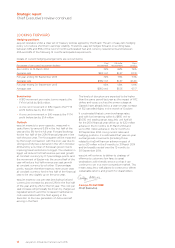

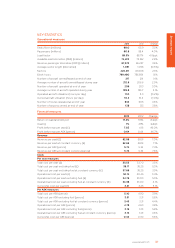

SHAREHOLDER RETURNS

The aviation market is a highly capital intensive

industry and it is important for airlines to give careful

consideration to their financing and balance sheet

positions to balance risk, growth, access to funding

and shareholder returns. A strong balance sheet

allows easyJet to withstand external shocks such as

an extended closure of airspace, significant fuel price

increases or a sustained period of low yields, whilst

being in a position to drive growth and returns

forshareholders.

easyJet has a policy of returning excess capital to

shareholders and it first announced a dividend policy

in November 2010. The policy was to pay out 20%

of profit after tax to shareholders and in respect of

the 2011 financial year, this resulted in a payment to

shareholders of £46 million (10.5 pence per share).

As a result of the strong performance of the business

throughout the 2011 financial year, easyJet also paid

a special dividend to shareholders of £150 million

(34.9 pence per share).

In November 2012, easyJet increased the payout

ratio in respect of the ordinary dividend from one fifth

to one third of profit after tax which resulted in an

ordinary dividend of £85 million (21.5 pence per share)

paid to shareholders.

Following another year of strong financial performance

in the 2013 financial year easyJet has proposed an

ordinary dividend of £133 million (33.5 pence per share)

and a special dividend of £175 million (44.1 pence per

share). This is a result of the strong balance sheet

position, the low level of gearing and the highest profit

after tax in the Company’s history.

Following the payment of these dividends, easyJet will

have returned £589 million to shareholders since its

maiden dividend in 2011.

44.1 pence

per share

proposed special dividend

(2012: nil)